Argentina’s Economic Shift: Lessons for the U.S. Under Trump?

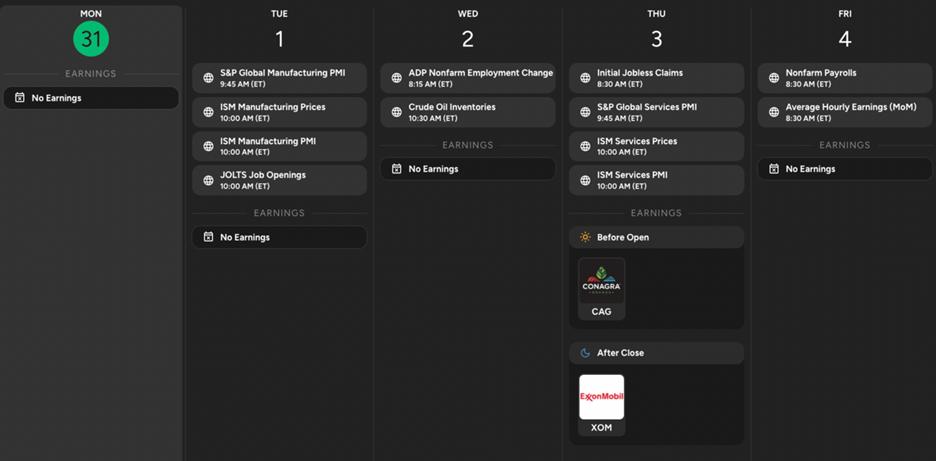

This Week’s earnings Calendar

In November 2023, Javier Milei was elected President of Argentina with a libertarian platform and a strong message of economic reform. His background as an economist shaped his promises to reduce government spending and deregulate various sectors of the economy.

Milei’s first year brought significant changes, including steep cuts to public spending and the elimination of entire government departments. His decisive actions included a memorable declaration of “afuera, afuera, afuera” as he streamlined the bureaucracy. Initially, these reforms triggered economic instability; however, Argentina soon began to recover, experiencing what is known as a J-curve effect—where short-term difficulties lead to rapid economic improvement. Inflation has stabilized, and the Argentine Stock market has surged by 98% over the last year.

This remarkable turnaround prompts an intriguing consideration: Could the U.S. be on a similar trajectory with D.O.G.E. and Trump at the helm? Elon Musk, along with Treasury Secretary Bessent, has characterized the U.S. economy as undergoing a “detox,” reflecting early challenges faced in Milei’s tenure. Similar to Milei’s approach, D.O.G.E. has focused on reducing government expenses and has discussed the potential dissolution of particular departments.

While the U.S. economy is significantly larger and inherently more complex than Argentina’s, parallels between the two situations are apparent. Milei’s reforms appear to have influenced aspects of D.O.G.E.’s economic strategies. If the U.S. is indeed following a J-curve model, the current economic uncertainty might pave the way for a more robust and resilient economy.

Adapting to change can be challenging, and industries often resist economic restructuring. Nevertheless, historical trends indicate that patience tends to reward those who navigate through turbulent times effectively.

My advice is straightforward: maintain a positive outlook and focus on the possibilities that change can bring.

**

Welcome to the WOLF Financial Newsletter.

Join over 13,000 informed investors who are focused on wealth-building and mastering advanced investment strategies through live discussions on Twitter Spaces. Subscribe below to engage with our community:

Subscribe

WOLF Financial has increased liquidity, user growth, and brand recognition across traditional finance and cryptocurrency through strategic marketing, advisory services, and partnerships. Learn more here.

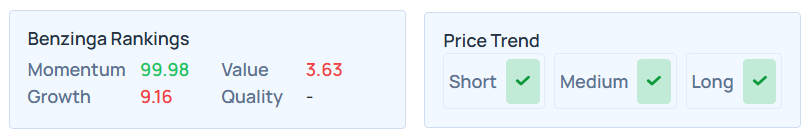

Momentum66.32

Growth–

Quality–

Value–

Market News and Data brought to you by Benzinga APIs