Dollar General and Dollar Tree Show Signs of Recovery

Dollar General DG and Dollar Tree DLTR are rebounding this year, driven by improved operational strategies. Despite trading far below their 52-week highs, both companies are set to release quarterly earnings reports on June 3 and June 4, respectively.

Turnaround Strategies for Dollar General and Dollar Tree

Dollar General’s “Back to Basics” strategy aims to enhance inventory management, remodel stores, and reduce theft. This initiative focuses on boosting operational efficiency and customer satisfaction.

Dollar Tree plans to sell its struggling Family Dollar unit to Brigade Capital for $1 billion, a fraction of its original $8 billion purchase price. This move is intended to cut declining profits and operational overhead linked to Family Dollar’s management.

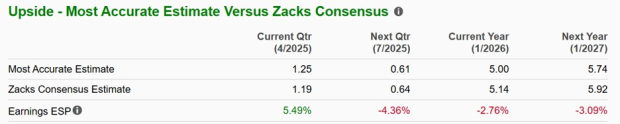

Dollar General and Dollar Tree Performance Snapshot

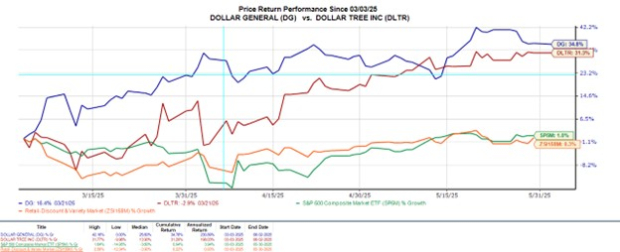

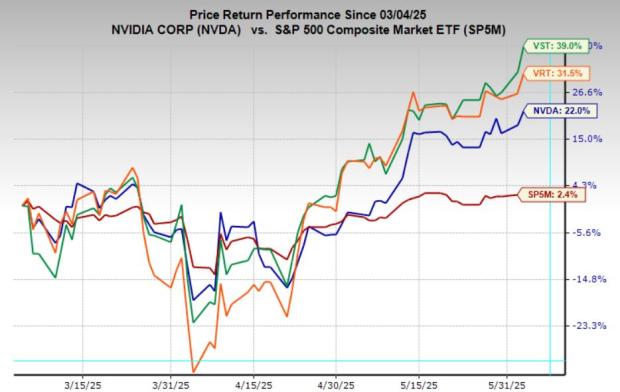

Dollar General remains 30% below its 52-week high of $141 per share, while Dollar Tree is 25% under its $121 high. Both companies have rebounded over 20% year-to-date and surged more than 30% in the last three months.

Image Source: Zacks Investment Research

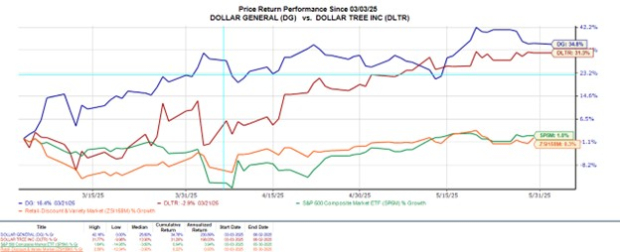

Expectations for Q1 Earnings

Zacks projects Dollar General’s Q1 sales will rise 4% year-over-year to $10.29 billion, though EPS is expected to decline to $1.47 from $1.65 a year ago. The Zacks ESP suggests a possible earnings surprise with an estimated EPS of $1.51.

Image Source: Zacks Investment Research

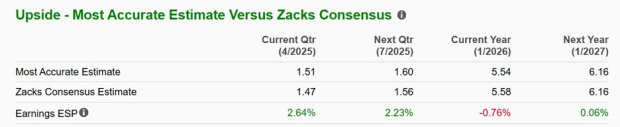

Conversely, Dollar Tree is expected to see a drop in Q1 sales to $4.54 billion from $7.63 billion last year. EPS is projected to fall 17% to $1.19 from $1.43. However, the most accurate estimate shows a potential earnings surprise with an anticipated EPS of $1.25.

Image Source: Zacks Investment Research

Valuation Comparison of DG and DLTR

Both Dollar General and Dollar Tree’s reasonable valuations have attracted investors, trading at 17X forward earnings. This offers a notable discount compared to the S&P 500 and the Zacks Retail-Discount Stores Industry average of 22X.

Moreover, both stocks are trading under an optimal level of less than 2X sales.

Image Source: Zacks Investment Research

Conclusion: Maintain Dollar General and Dollar Tree Holdings

With both Dollar General and Dollar Tree holding a Zacks Rank #3 (Hold), future upside potential will depend on demonstrating improved operational efficiency. Meeting or exceeding Q1 expectations and providing favorable outlooks will be crucial for both companies.