Software Stocks Face Major Sell-Off

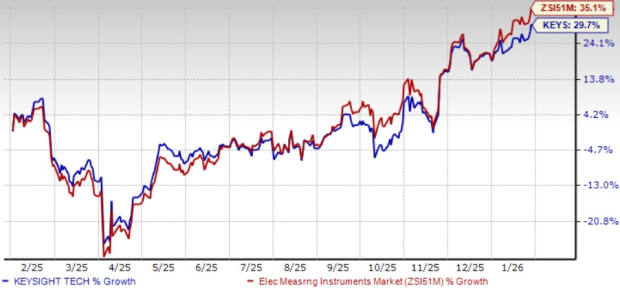

Software stocks have experienced a significant decline, particularly in late January 2026, with the iShares Expanded Tech-Software Sector ETF (NYSEMKT: IGV) falling 16% throughout the month and 7% in the last two days alone. Key players like Microsoft (NASDAQ: MSFT), Palantir (NASDAQ: PLTR), and ServiceNow (NYSE: NOW) have seen substantial drops, attributed mainly to investor concerns over potential AI disruptions that could challenge traditional enterprise software.

Despite solid growth numbers from many companies in the sector, valuation concerns have also emerged as major factors in the sell-off. ServiceNow has decreased by 50% from its late 2024 peak, yet still carries a price-to-earnings ratio of 70. In contrast, semiconductor stocks like Nvidia, which reported 62% revenue growth, trade at significantly lower valuations, raising questions about the sustainability of software sector valuations in the face of changing market dynamics.

As the market remains volatile, analysts suggest that investing in high-quality stocks with strong fundamentals, such as Microsoft, may offer better opportunities for resilience amid uncertainty. Investors are advised to remain cautious as fears surrounding AI continue to shape perceptions of the software industry.