Over the years, the stock market has triumphed over other asset classes, outpacing the annualized returns of oil, gold, certificates of deposit (CDs), and Treasury bonds. Nevertheless, the past decade has witnessed alternating bear and bull markets for the Dow Jones, S&P 500, and Nasdaq Composite. With the Dow and S&P 500 hitting record highs, and the Nasdaq Composite rallying nearly 60% from its 2022 bear market low, experts predict a rough 2024 for Wall Street.

Image source: Getty Images.

Investors are curious whether a time-tested valuation metric, which boasts a flawless track record spanning over 150 years, could shed light on the market’s trajectory.

Implications of the Shiller P/E Ratio

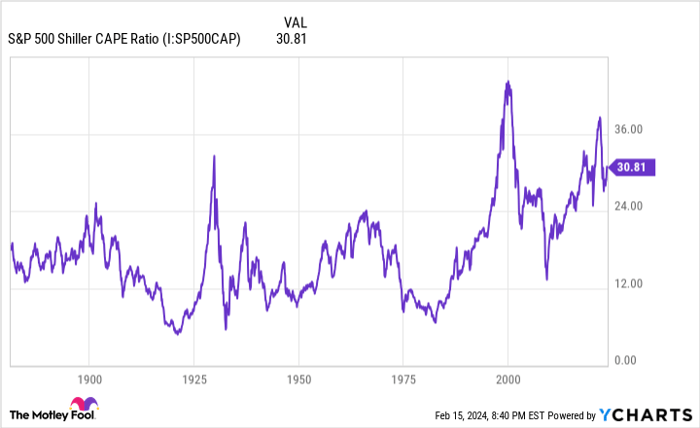

The Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted price-to-earnings ratio or CAPE ratio, is the valuation metric with a distinguished ability to forecast stock market movements. Unlike the traditional P/E ratio that can be skewed due to unforeseen events, the Shiller P/E ratio is based on average inflation-adjusted earnings from the prior 10 years. This allows for a smoother valuation picture of the S&P 500, cushioning the impact of unpredictable events.

Although the Shiller P/E ratio didn’t gain notoriety until the late 1990s, it has been back-tested to 1871. Over this period, the average reading for the S&P 500’s Shiller P/E ratio is 17.09. However, for the past 30 years, it has largely exceeded this mark, indicating investors’ willingness to accept higher valuations.

S&P 500 Shiller CAPE Ratio data by YCharts.

The Shiller P/E ratio has crossed above 30 only six times in the past 150 years, each instance preceding a significant downturn in the market. Notably, the Shiller P/E ratio is an indicator rather than a timing tool. It doesn’t guarantee an immediate downturn, as seen before the dot-com bubble burst when the ratio remained above 30 for over four years.

As of February 15, 2024, the Shiller P/E was at 33.85, indicating a consistent pattern of a 20% or more downturn in the S&P 500 when the ratio surpasses 30.

Image source: Getty Images.

Potential Upsides of Market Corrections and Bear Markets

While several predictive indicators point to a potential U.S. recession or a stock market correction/bear market, these events can have positive outcomes. Recessions, though unwelcome, are generally short-lived, with nine out of 12 U.S. recessions since World War II resolving in under a year. Similarly, on Wall Street, bull markets have consistently outlasted bear markets, clearing away any previous declines.

Though there’s no precise forecast for when stock market corrections or bear markets might occur, history has shown that every double-digit percentage decline in major stock indexes has eventually been followed by a bull market. Thus, investors may find solace in exercising patience and maintaining a long-term perspective.

It’s official. A new bull market

Stock Market Reaches Milestone: S&P 500 Up 20%

After a tumultuous period, the S&P 500 achieved a significant milestone, rising 20% from its closing low on October 12, 2022. The previous bear market recorded a 25.4% decline over 282 days, marking a remarkable turnaround for the index.

In a historical context, last June, researchers at Bespoke Investment Group released a data set analyzing every bear market in the S&P 500 since the Great Depression. Their research revealed that the average bear market lasted only 286 calendar days, while bull markets endured for an average of 1,011 calendar days. In fact, 13 of the 27 S&P 500 bull markets over the past 94 years have lasted longer than the lengthiest bear market. This data underscores the endurance and resilience of the American stock market.

Even with the Shiller P/E ratio possibly forecasting a 20% downturn in the S&P 500, long-term investors remain confident that equities will eventually rebound. This perspective positions any significant downturn in the stock market as an opportunity for patient investors with available funds.

Opportunities in the Market

When our analyst team has a stock tip, it’s worth paying attention. Over more than a decade, the newsletter, Motley Fool Stock Advisor, has nearly tripled the market.* They recently revealed the 10 best stocks for investors to consider right now, offering potential opportunities for those looking to invest $1,000 at this time.

Discover the 10 stocks and make informed decisions about your future investments.

*Stock Advisor returns as of February 12, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned, and has made its official disclosure policy publicly available.

The expressed views are those of the author and do not necessarily reflect those of Nasdaq, Inc.