In the year 2024, the ongoing evolution and progression of artificial intelligence (AI) remains a prevalent topic. The allure of AI is its unparalleled capacity to streamline and expedite production processes.

Businesses are leveraging artificial intelligence to enhance operational efficiency, save time, and reduce expenses. The immense scalability enabled by AI technology makes it one of the most revolutionary advancements in modern times.

Nvidia’s AI-powered chips have positioned the company firmly in the limelight. However, there are other more affordable options worth considering in this dynamic industry.

Here are three cost-effective stocks poised to catch the eyes of investors, contributing significantly to the AI revolution.

Exploring Dell & Hewlett-Packard’s Associations with Nvidia

Nvidia’s successful foray into AI technology owes much to its alliances with Dell Technologies and Hewlett Packard Enterprise. By harnessing Nvidia’s AI chips, Dell and Hewlett-Packard have revolutionized IT solutions and integrated systems, spanning servers, storage, data security, and management.

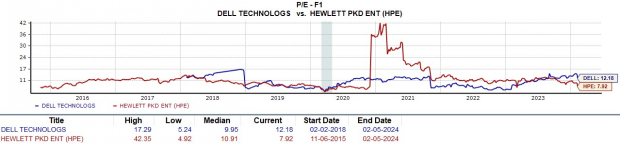

The AI renaissance within Dell and Hewlett-Packard secures their top and bottom lines, rendering them as two of the most compelling value stocks in the tech sector. Notably, both companies boast an “A” Zacks Style Scores grade for Value, with Dell’s stock trading at 12.1X forward earnings and Hewlett-Packard’s shares at just 7.9X.

Moreover, Dell has exceeded earnings expectations for seven consecutive quarters, while Hewlett-Packard has surpassed EPS estimates in its last four quarterly reports. Dell holds a Zacks Rank #1 (Strong Buy) and is due to report its fourth-quarter earnings for fiscal 2023 at the end of the month. Meanwhile, Hewlett-Packard, touted as a Zacks Rank #2 (Buy), is set to release Q1 results for FY24 in early March.

Image Source: Zacks Investment Research

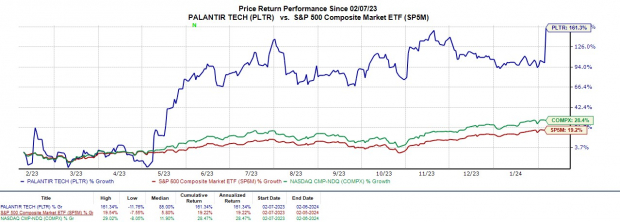

Palantir’s Soar Following AI-Driven Revenue Surge

Recently reporting its Q4 results, Palantir Technologies has captured the attention of investors due to its capabilities in AI. The stock soared by +30% in today’s trading session, reaching $21 per share, as heightened demand for its AI Platform (AIP) led to a 19% surge in Q4 sales to $608.35 million. This exceeded estimates by about 1%, causing pessimistic analysts and short-sellers to reassess their positions, resulting in a short squeeze. Notably, Palantir’s stock currently carries an “A” Zacks Style Scores grade for Growth.

Image Source: Zacks Investment Research

In essence, Palantir has substantiated the genuine demand for its AIP, driven by its machine learning capabilities or Large Language Model (LLM), an AI algorithm employing neural network techniques with an extensive number of parameters to process and comprehend human languages and text.

These LLMs play a pivotal role in developing Palantir’s software, aiding in counterterrorism investigations and operations. The commercial revenue of Palantir in the U.S. spiked by 40%, with the U.S. government serving as one of its prominent clients due to the company’s advancements in defense intelligence. Palantir reported Q4 net income of $93.4 million, more than tripling from $30.9 million a year ago. Earnings of $0.08 per share met the Zacks Consensus, doubling from $0.04 per share in the previous year’s quarter.

As of now, Palantir’s stock holds a Zacks Rank #3 (Hold), and an upward revision in annual earnings estimates is anticipated in the coming weeks, possibly leading to a buy rating.

Image Source: Zacks Investment Research

Final Thoughts

With Dell’s stock still priced under $100 and Hewlett-Packard and Palantir shares trading below $25, these three stocks present appealing and cost-effective opportunities in the realm of AI. They are poised to be potentially lucrative investments not only in 2024 but also as the AI revolution gains momentum.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.