The Case for Ares Capital

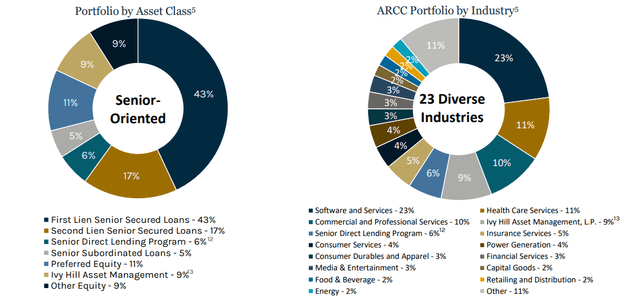

Ares Capital (NASDAQ:ARCC) is a business development company (BDC) that specializes in buying debt and equity of private middle market companies. Their portfolio stood at over $21.9 billion, mainly consisting of ~66% senior secured loans, making Ares Capital the largest BDC by market capitalization, currently valued at over $11.5 billion.

A Record-Breaking Performance

2023 has been a remarkable year for Ares Capital and BDCs in general, with the high interest rates leading to record total investment incomes. Ares Capital reported a record total investment income of $655 million for Q3, representing nearly 22% YOY growth. These robust performances translated into a record-breaking dividend for 2023 of $1.92, equating to an impressive 9.32% dividend yield.

The Fed is expected to cut rates in 2024, which poses potential challenges for Ares and other BDCs. However, the prospects for total investment income growth of ~6% in 2024, combined with a ~10% dividend yield, positions Ares Capital as a stable income producer in the face of changing economic conditions.

Total Investment Incomes & Portfolio

Ares Capital has witnessed record total investment incomes, primarily driven by the high-interest rate environment, with every quarter reporting over 20% YOY increases in total investment incomes. Their mainly floating rate portfolio has capitalized on the climbing interest rates, with an Annualized Net Realized Loss Rate of smaller than 0.0%.

The company’s shift towards non-cyclical and defensively positioned industries, coupled with a diversified portfolio, reflects the astute risk management by the experienced team at Ares. Their substantial allocation into mainly first and second lien secured loans has mitigated potential risks, positioning them favorably in the face of possible rate cuts.

The Impact of Federal Reserve Decisions

With the market anticipating interest rate cuts, the persistent inflation has created a more hawkish stance from the Fed. This delayed rate cut projection has exerted downward pressure on Ares Capital’s stock price. Nevertheless, if the Fed maintains higher rates for a more extended period, Ares has the potential to reap handsome benefits and alleviate the pricing pressure.

The delayed rate cut timeline presents an opportunity for Ares to continue capitalizing on record total investment incomes and fortifying their portfolio, adding to their overall stability as an income generator.

The Attractiveness of Ares Capital’s Dividend

The most captivating aspect of Ares Capital is the remarkable dividend yield that the company offers. With a dividend yield of 9.32%, Ares Capital has consistently outperformed the sector average, positioning it among the highest dividend yields in the market.

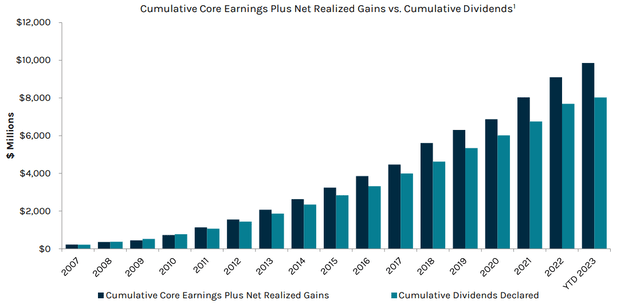

Ares Capital: A Diamond in the Rough for Investors

Ares Capital proves its mettle by withstanding the tides of financial uncertainty. Since their IPO, the company has demonstrated unwavering resilience, never once cutting their dividend except for a 16% reduction during the Great Financial Crisis – a testament to the unyielding strength of their financial stewardship. Over the last 14 years, Ares Capital has been a paragon of stability and growth, maintaining or increasing dividends without fail. This unshakeable commitment positions Ares Capital as a formidable force in the realm of dividend stocks.

The company’s annual dividend totals surged to a record $1.92 in 2023, with projections pointing to an even more robust figure of $1.95 in 2024. A harmonious blend of high yield, consistent performance, and anticipated growth heralds Ares Capital as a prime contender for investors seeking rewarding dividend stocks in 2024.

A Balanced Financial Fortitude

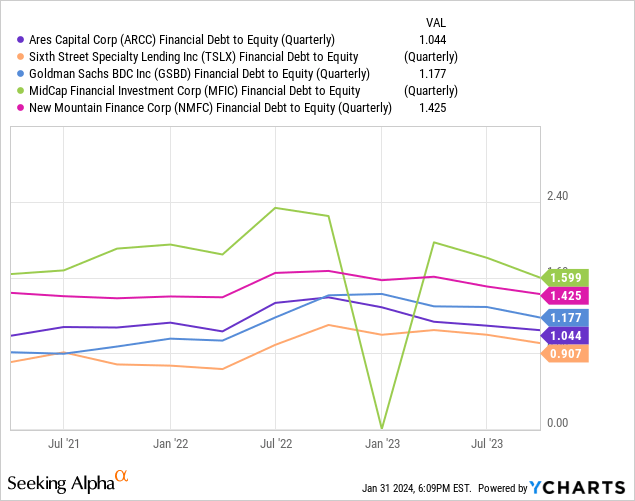

Despite achieving record investment incomes and substantial dividend increments, Ares Capital adeptly maintains equilibrium, supported by a robust balance sheet and ample liquidity. The Consolidated Appropriations Act of 2018 liberated BDCs from the onerous 1:1 debt-to-equity ratio, sanctioning them a 2:1 debt to equity ceiling. In a judicious display of prudence, Ares Capital refrains from overleveraging, with a debt-to-equity ratio of just 1.03x in Q3. Further bolstering its stability, the company commands an impressive $5.3 billion borrowing capacity, underpinned by BBB ratings and favorable outlooks from Fitch, Moody’s, and S&P Global. Ares Capital has consistently outstripped its interest expenses, sustaining a fixed charge coverage from earnings of over 3.2x since 2014, holding steady at 3.3x as of Q3.

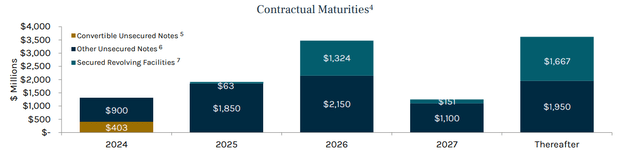

The deliberate staggering of maturity dates has conferred Ares Capital with flexibility and resilience during precarious market conditions. In Q3 of 2023, the company executed a strategic debt swap, converting a high-cost fixed debt obligation into a stretched-maturity floating rate obligation, shielding itself against potential interest rate declines and yielding long-term cost savings.

Despite a resplendent performance in 2023, Ares Capital endures the burden of market undervaluation, driven by apprehensions over the expected interest rate reduction in 2024. Notwithstanding the market’s contentment with the company’s growth, the short-term stock prices have been truncated by the anticipation of rate cuts, a predicament unjustly imposed. Trading at a P/E of 8.8x, Ares Capital languishes 24% below the sector average of 11.7x, paralleled by a PEG GAAP of 0.22x, 39.6% lower than the sector median of 0.36x. These statistics underscore the company’s potential for higher valuation, fueled by its current earnings and future growth projections. Coupled with a remarkable dividend yield of 9.32%, Ares Capital emerges as an unheralded gem amidst its peers. Garnering an A- Valuation grade from Seeking Alpha Quant further substantiates Ares Capital’s underappreciated status.

Navigating the Risks

Not immune to the overarching risks confronting all BDCs and loan-centered entities, Ares Capital grapples with the specter of diminishing interest rates. A substantial plunge in interest rates could erode the company’s total investment income from its predominantly floating rate portfolio, while concurrently assuaging some of its floating rate debt commitments. The velocity and severity of this interest rate descent will undoubtedly dictate market outcomes in 2024. Should the Federal Reserve implement a modest 0.5-0.75% cut by year-end, Ares Capital is poised to capitalize on the lingering high rates. However, a drastic and abrupt reduction exceeding 1% could precipitate a precipitous decline in total investment income. Thankfully, such a scenario appears improbable given the Fed’s cautious approach, attuned to the perils of precipitous rate cuts.

Convergently, there exists the inverse prospect – an environment where the Fed refrains from any rate reductions throughout 2024. Although unlikely, this conservative stance could foster a surge in non-accruals and loan defaults, imperiling BDCs and lending establishments. Should this transpire, Ares Capital’s asset composition, predominantly comprised of first and second lien secured loans, buttresses its position to reclaim collateral and offset potential losses.

Other palpable risks encompass heightened competition from major banks as the private credit industry burgeons, as well as intensifying rivalry from fellow BDCs. Dismissing the gravity of both threats, the regulatory scrutiny imposed on major banks has constrained their ability to establish credit syndicates, translating to a competitive advantage for Ares Capital. As the industry’s preeminent and foremost BDC, Ares Capital’s distinguished management and abundant resources confer it an enviable competitive edge.

Eminent Prospects Ahead

BDCs are poised for an eventful trajectory in 2024, as the unfolding narrative hinges on the Federal Reserve’s interest rate determinations. Endowed with astute financial management and a well-fortified portfolio, Ares Capital assumes a commanding stance within the industry. The company’s burgeoning operations, fortified by a prodigious dividend yield and unswerving consistency, position Ares Capital as a compelling “Buy” for investors in 2024. However, prudent investors must remain attuned to the caprices of FOMC deliberations and calibrate their risk tolerance accordingly.