Baker Hughes Gets Upgraded: What Investors Should Know

Fintel reports that on October 25, 2024, Argus Research has changed their stance on Baker Hughes (XTRA:68V) from Hold to Buy.

Analyst Predictions Indicate Significant Growth

As of October 22, 2024, the average one-year price target for Baker Hughes is 40,68 €/share. Predictions for the stock vary from a low of 33,35 € to a high of 51,05 €. This average target indicates a potential 18.85% increase from its most recent closing price of 34,23 € / share.

For insights on companies with the greatest price target upside, check our leaderboard.

Expected Revenue and Earnings

The projected annual revenue for Baker Hughes is 27,622MM, reflecting a small increase of 1.18%. Additionally, the anticipated annual non-GAAP EPS stands at 2.13.

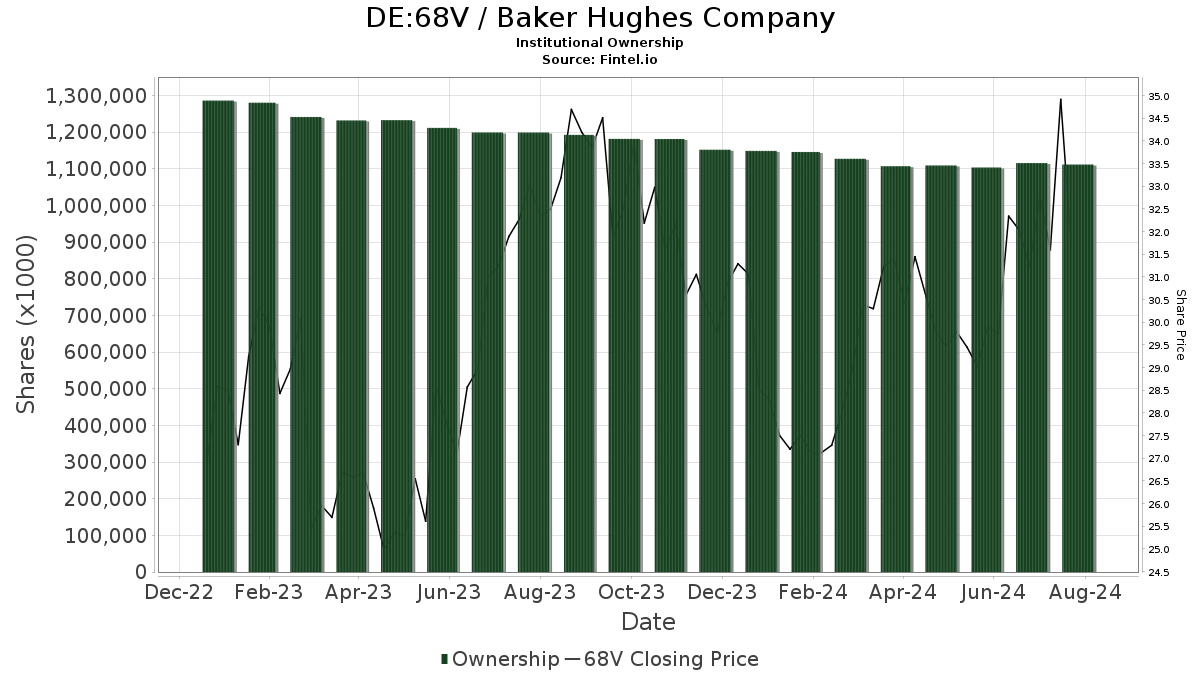

Fund Sentiments Around Baker Hughes

Currently, 1,682 funds or institutions hold positions in Baker Hughes, showing a decrease of 11 owners, or 0.65%, in the last quarter. On average, funds dedicated to 68V represent a portfolio weight of 0.34%, which is up by 9.88%. Over the past three months, total shares owned by institutions rose by 2.57% to reach 1,129,735K shares.

Institutional Shareholder Actions

JPMorgan Chase holds 55,015K shares, which accounts for 5.54% ownership in the company. They previously reported 49,542K shares, indicating a strong increase of 9.95%. However, they have reduced their portfolio allocation in 68V by 82.27% over the last quarter.

Dodge & Cox owns 46,059K shares, reflecting a 4.64% stake. Their earlier filing showed 46,165K shares, demonstrating a slight decrease of 0.23%, but they have increased their portfolio allocation in 68V by 8.37% recently.

Capital World Investors holds 37,592K shares, or 3.78% ownership. Their prior filing noted a decrease in holdings from 46,768K shares, marking a 24.41% drop and a portfolio allocation reduction of 16.86% in 68V.

DODGX – Dodge & Cox Stock Fund maintains 33,551K shares, representing 3.38% ownership, with no change in the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares now owns 31,582K shares, constituting a 3.18% share, up from 31,437K shares, reflecting an increase of 0.46% and a portfolio allocation rise of 2.56% over the last quarter.

Fintel is regarded as a leading investment research platform offering valuable insights for individual investors, financial advisors, and small hedge funds.

Our comprehensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, and much more. Plus, our exclusive stock picks utilize advanced, backtested quantitative models to enhance potential profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.