Comparative Analysis: Arista Networks vs. Cisco Systems in Networking

Arista Networks, Inc. (ANET) and Cisco Systems, Inc. (CSCO) are prominent players in the global networking industry. Arista is recognized for its extensive product lineup of data center and campus Ethernet switches and routers, providing solutions characterized by high capacity, low latency, port density, and energy efficiency.

Conversely, Cisco stands as the largest entity in the networking sector. The company holds a substantial market share in routers and switches, maintaining a leadership position in WLAN and Ethernet switching while rapidly expanding into network security. Cisco’s Next-Generation Network Routers facilitate the transport of data, voice, and video across IP networks.

Both Arista and Cisco boast diversified portfolios of cloud networking solutions tailored for data centers and cloud computing environments. This positions them well to accommodate the evolving needs of business enterprises. This article investigates the competitive dynamics between the two companies to determine which is better positioned for success.

The Case for Arista

Arista has established itself as a leader in 100-gigabit Ethernet switches and is gaining momentum in the 200-and-400-gig high-performance switching market. The company has reported robust demand from enterprise customers, driven by its unique multi-domain software approach. This approach revolves around its Extensible Operating System (EOS) and the CloudVision stack. Recent expansions in its cloud-native software product family include CloudEOS Edge, along with innovative cognitive Wi-Fi software that offers intelligent application identification, automated troubleshooting, and location services. This versatility across different use cases, such as WAN routing and campus and data center infrastructure, distinguishes Arista from its competitors.

Arista’s cloud networking solutions are recognized for their predictable performance and programmability. This enables seamless integration with third-party applications for network management, automation, and orchestration. The company has structured its portfolio around three core principles: best-in-class, proactive products featuring resilience, zero-touch automation, and insightful telemetry to support AI algorithms. Its software-driven, data-centric approach is expected to further enhance customers’ cloud architectures and improve the cloud experience they provide.

Despite its strengths, Arista faces challenges related to high operating costs. In the fourth quarter of 2024, total operating expenses rose approximately 20% to $431.3 million, influenced by increased headcount, new product development costs, and higher variable compensation. From 2013 to 2023, selling, general, and administrative, as well as R&D expenses, grew at a CAGR of 23.1%. Additionally, product redesigns and supply chain issues have negatively impacted profit margins. Although demand remains strong, supply bottlenecks for advanced products are complicating operations, leading the company to increase component orders and build inventory, thereby affecting working capital.

The Case for Cisco

Cisco is expanding its AI capabilities through the introduction of the Webex AI Agent and enhancements in its AI-infused security and collaboration platforms. Recent developments such as the Renewals Agent—an AI-driven solution created with Mistral—aim to digitize and simplify Network Change Management for customers. This strategic push to integrate AI across its offerings is intended to enhance customer experiences.

Moreover, Cisco is expanding its product lineup with an AI factory architecture developed alongside NVIDIA Corporation (NVDA). In February, the companies extended their partnership to create AI-ready data center network solutions. The Cisco Secure AI Factory, built on NVIDIA’s Spectrum-X Ethernet platform, seeks to provide advanced networking solutions. The introduction of 800-gig Nexus switches using Cisco’s 51.2 terabit Silicon One chip is likely to drive demand from AI-focused cloud customers.

However, Cisco faces pressure from competitors like Arista and Juniper Networks Inc. (JNPR) in the Ethernet switch market, forcing the company to offer discounts and attractive deals. As rivals enhance their product lines with faster, more efficient offerings, competitive pressures have intensified. While Cisco’s edge business remains robust, profitability may be jeopardized by declining new orders, which could impede revenue growth in the near term.

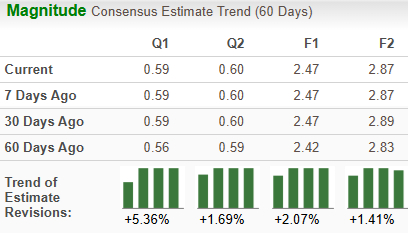

How Do Zacks Estimates Compare for ANET & CSCO?

According to Zacks, the consensus estimate for Arista’s 2025 sales suggests a year-over-year growth of 18%, with EPS growth forecasted at 8.8%. Notably, EPS estimates have been trending upward over the past 60 days.

Image Source: Zacks Investment Research

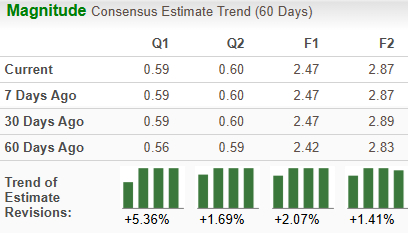

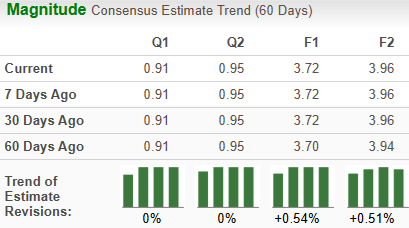

For Cisco, the 2025 sales consensus estimate indicates a modest year-over-year growth of 4.9%, while its EPS is projected to decline by 0.3%. Similar to Arista, Cisco has also seen its EPS estimates trend upward recently.

Image Source: Zacks Investment Research

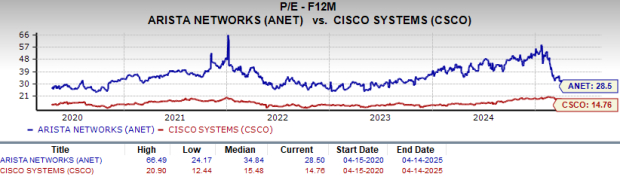

Price Performance & Valuation of ANET & CSCO

Over the past year, Arista has delivered a 12.1% increase, outperforming the industry growth of 7.3%. In contrast, Cisco’s stock has risen by 19.8% during the same timeframe.

Image Source: Zacks Investment Research

From a valuation perspective, Cisco appears more appealing with a forward price/earnings ratio of 14.76, significantly lower than Arista’s 28.5.

Image Source: Zacks Investment Research

Conclusion: ANET or CSCO?

Cisco vs. Arista: Which Stock is the Better Investment?

Arista Networks, Inc. (ANET) holds a Zacks Rank #3 (Hold), while Cisco Systems, Inc. (CSCO) boasts a Zacks Rank #2 (Buy). To view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks, you can click here.

Both companies expect sales and profits to rise in 2025, indicating positive growth ahead. Arista has consistently shown revenue and earnings per share (EPS) growth over the years. In contrast, Cisco has encountered more challenges recently. Given Cisco’s higher Zacks Rank, favorable price performance, and compelling valuation metrics, it appears to be the more attractive investment option right now.

Top 7 Stocks to Watch in the Coming Month

Recently released by analysts, a selection of seven high-potential stocks has been derived from the broader list of 220 Zacks Rank #1 Strong Buys. These stocks are seen as “Most Likely for Early Price Pops.”

This carefully curated list has outperformed the market over two times since 1988, achieving an average annual gain of +23.9%. Investors are encouraged to pay close attention to these seven stocks.

See the recommended stocks now >>

Interested in the latest recommendations from Zacks Investment Research? You can download the report on the 7 Best Stocks for the Next 30 Days today. Simply click here to obtain this free report.

For additional insights, explore our detailed stock analysis reports:

- Cisco Systems, Inc. (CSCO)

- Juniper Networks, Inc. (JNPR)

- NVIDIA Corporation (NVDA)

- Arista Networks, Inc. (ANET)

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.