“`html

Arista Networks Sees Growth Amidst Industry Challenges

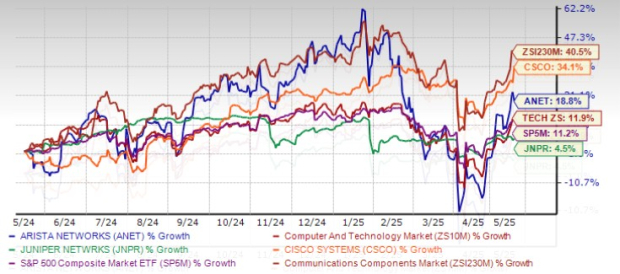

Arista Networks, Inc. (ANET) has increased by 18.8% over the past year. However, this growth lags behind the communication components industry, which grew by 40.5%. In comparison, ANET has also outperformed the S&P 500’s growth of 11.2% and the Zacks Computer & Technology sector’s growth of 11.9%.

Comparative One-Year Price Performance

Image Source: Zacks Investment Research

Compared to peers, Arista outperformed Juniper Networks, Inc. (JNPR), which gained 4.5%. However, it trailed behind Cisco Systems, Inc. (CSCO), which surged by 34.1% during the same period.

Growth Drivers: Portfolio Expansion and AI Focus

Arista is expanding its product portfolio to meet the rising demand for AI infrastructure. This growth is bolstered by a strong customer base, including various enterprises, thanks to its multi-domain software strategy. The innovative nature of its Extensible Operating System (EOS) and CloudVision stack underpins this strategy.

The introduction of Cluster Load Balancing enhances its network solutions by effectively managing large data flows. Additionally, Arista’s latest Etherlink AI Platforms support extremely high data rates of 800G/400G. As these platforms can accommodate both small AI clusters and large deployments with over 100,000 accelerators, they align with NVIDIA’s (NVDA) cutting-edge GPU strategies, which aim to greatly improve AI computing efficiency.

Arista expects to generate $750 million in AI revenues by 2025, fueled by demand for its solutions. In the first quarter, the company reported a net cash flow of $641.7 million from operations, significantly up from $513.8 million last year. This growth indicates solid financial efficiency and working capital management. As of March 31, 2025, Arista held $1.84 billion in cash and cash equivalents, along with $257.8 million in long-term liabilities. The current ratio stood at 3.93, well above the industry average of 1.48, reflecting its ability to meet short-term obligations and invest in growth opportunities.

Challenges Facing Arista Networks

Despite its strengths, geopolitical and trade uncertainties pose risks, particularly the potential reinstatement of tariffs between the U.S. and China. While a recent 90-day reduction in tariffs offers temporary relief, ongoing trade tensions may negatively impact Arista’s margins.

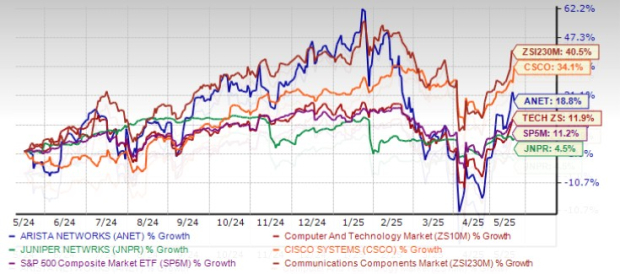

Moreover, intense competition from Cisco in the cloud networking sector and Juniper in network equipment further complicates its market position. To remain competitive, Arista must continue investing in product enhancements and technological advancements, which has raised its operating expenses. In Q1 2025, total operating expenses amounted to $417.3 million, up from $341.2 million in the previous year, with R&D costs increasing to $266.4 million from $208.4 million.

Image Source: Zacks Investment Research

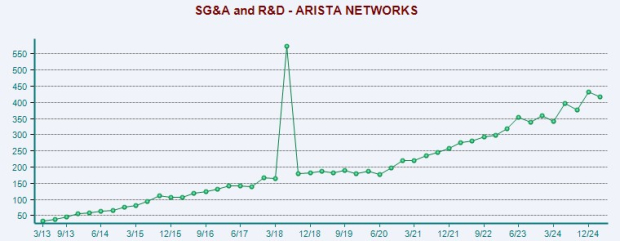

Positive Estimate Revisions for ANET

Currently, Arista is experiencing an upward trend in earnings estimate revisions. Estimates for 2025 have risen by 3.64% to $2.56, while those for 2026 have increased by 1.73% to $2.94. These positive revisions suggest growing investor confidence regarding the company’s future growth potential.

Image Source: Zacks Investment Research

Conclusion

Arista Networks is positioning itself as a pivotal player in AI infrastructure, focusing on enhancing its Etherlink portfolio. The company has a solid balance sheet and a promising outlook propelled by its involvement in NVIDIA’s GPU initiatives. Despite rising operating costs and competitive pressures, Arista is likely to capitalize on strong trends in AI, which could benefit investors in the long term.

Arista has delivered a trailing four-quarter average earnings surprise of 11.82%, and currently holds a Zacks Rank #2 (Buy).

5 Stocks Set to Double

Each was selected by a Zacks expert as the #1 stock expected to gain +100% or more in 2024. Previous recommendations have seen returns as high as +673.0%.

“`