Arkema S.A. ARKAY recently inaugurated its state-of-the-art Pebax elastomer unit at the Serquigny facility in France. The new unit, boasting cutting-edge industrial processes, is capable of producing both bio-circular Pebax Rnew and traditional Pebax elastomers.

This groundbreaking production of materials finds applications in various fields, including sports equipment like running shoes, soccer shoes, and ski boots, as well as in electrical devices and niche industries such as antistatic additives and medical tools.

Arkema has significantly increased its global manufacturing capacity for Pebax elastomers by 40% at the Serquigny plant to support the growth of its customers, especially in the sports and consumer goods markets.

This expansion presents a compelling opportunity for Arkema to meet the burgeoning demand in existing and new applications while simultaneously improving its operations. Notably, water usage at the facility will be reduced by approximately 25%.

Arkema’s premium solutions portfolio effectively caters to the ever-increasing demand for innovative and sustainable materials, leveraging its unique materials science expertise. The company offers cutting-edge technological solutions to tackle challenges in new energies, water access, recycling, urbanization, and mobility, ensuring seamless communication with all stakeholders.

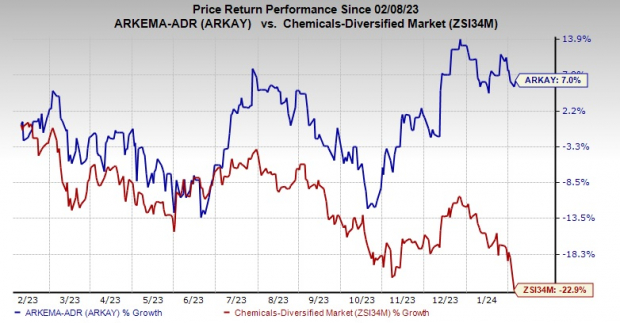

Shares of Arkema have surged 7% over the past year contrary to a 22.9% decline in its industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

As of now, Arkema carries a Zacks Rank #4 (Sell).

Other better-ranked stocks in the basic materials industry include Cameco Corporation CCJ, Carpenter Technology Corporation CRS, and Alpha Metallurgical Resources Inc. AMR.

Cameco, with a Zacks Rank #1 (Strong Buy), has a projected earnings growth rate of 188% for the current year. The Zacks Consensus Estimate for CCJ’s current-year earnings has been revised upward by 12.5% in the past 60 days. The stock has soared approximately 71.6% in a year. You can find the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology currently holds a Zacks Rank #1 and has surpassed the Zacks Consensus Estimate in three of the last four quarters while meeting it once, with an average earnings surprise of 12.2%. The company’s shares have surged 20% in the past year.

The Zacks Consensus Estimate for AMR’s current-year earnings has been enhanced by 69% in the past 60 days. It presently holds a Zacks Rank #1. AMR has delivered an average trailing four-quarter earnings surprise of approximately 9.6%. The company’s shares have ascended around 125.6% over the past year.

Zacks Names “Single Best Pick to Double”

Amid thousands of stocks, 5 Zacks experts have each selected their top choice capable of skyrocketing +100% or more in the coming months. From those 5, Director of Research Sheraz Mian has cherry-picked one with the most explosive upside of all.

This stock is attributed with a “watershed medical breakthrough” and is developing a bustling pipeline of projects that could make a significant difference for patients afflicted with liver, lung, and blood diseases. This timely investment opportunity is emerging from its bear market lows.

It has the potential to rival or surpass other recent Stocks Set to Double such as Boston Beer Company, which surged +143.0% in just over 9 months, and NVIDIA, which skyrocketed +175.9% in a single year.

Free: See Our Top Stock And 4 Runners Up

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Arkema SA (ARKAY) : Free Stock Analysis Report

Head over to Zacks.com to read this article

The expressions and assessments provided in this article represent those of the author and do not necessarily mirror the stance of Nasdaq, Inc.