ARM Holdings Faces Stock Decline Amid Strong Market Position

Arm Holdings plc (ARM) has experienced a notable downturn in its stock over the past three months, with shares dropping 30%, surpassing the industry average decline of 18%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Given the current weakness in ARM shares, investors may question whether it’s the right time to consider this stock. Let’s explore further.

Dominance in Mobile and AI Markets

Arm Holdings enjoys a strong presence in the semiconductor sector, particularly in mobile technology. The company’s low-power chip architecture has been essential in smartphones and tablets. Major players such as Apple (AAPL), Qualcomm (QCOM), and Samsung consistently rely on ARM’s designs, solidifying its role in mobile computing. As these tech giants expand their ecosystems, Arm’s technologies are expected to maintain steady, long-term demand.

Looking forward, Arm is poised to capitalize on rapid growth in artificial intelligence (AI) and the Internet of Things (IoT). Their energy-efficient chips are increasingly integrated into smart devices, autonomous technology, and cloud infrastructure. With the rise of AI workloads and IoT implementations, demand for scalable and power-efficient solutions has surged. Arm’s ongoing efforts to adapt its architecture for AI applications further elevate its growth potential as it aligns with companies like Apple and Qualcomm.

Robust Licensing Model and Financial Stability

One notable feature of Arm Holdings’ business model is its licensing and royalty approach. ARM licenses its chip designs to major tech companies while earning royalties for each chip sold. This structure allows for a steady revenue flow without hefty capital expenditures. Partnerships with key industry players help maintain relevance, ensuring ARM remains a preferred choice in sectors like automotive, data centers, and smart devices.

Following its IPO, Arm Holdings secured significant capital, strengthening its balance sheet. As of December 31, the company had $2.7 billion in cash and no debt. This strong cash reserve positions it well to fund research and development initiatives, consider strategic acquisitions, and broaden its market reach. Such financial flexibility enhances the company’s ability to navigate market fluctuations and invest in future growth opportunities.

Promising Fourth Quarter Guidance

Arm Holdings recently provided guidance for the fourth quarter of fiscal 2025, forecasting revenues between $1.175 billion and $1.275 billion, with the midpoint suggesting a 32% year-over-year increase. The projected adjusted EPS range of 48-56 cents indicates a 44% increase at the midpoint compared to the previous year’s 36 cents. While third-quarter fiscal 2025 results were solid, the strong guidance for Q4 reinforces the idea that AI-driven growth is taking shape in ARM’s financials.

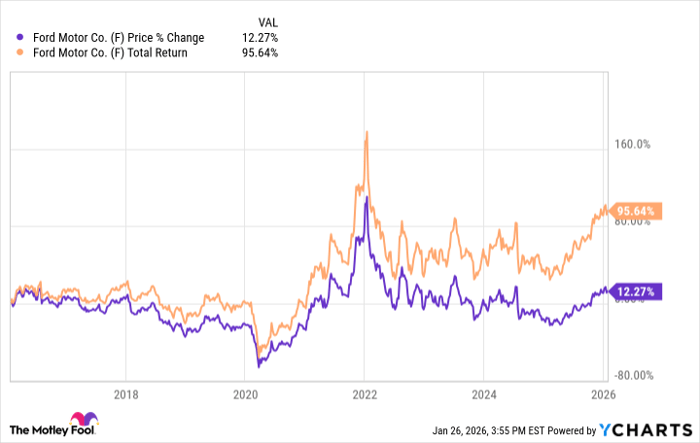

The Zacks Consensus Estimate for ARM’s fiscal 2025 earnings stands at $1.62, representing a 27.6% increase from the previous year. For fiscal 2026, earnings are expected to rise by 23.8% from prior-year figures.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Sales are projected to increase by 23.8% and 22.5% year over year in fiscal 2025 and 2026, respectively.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

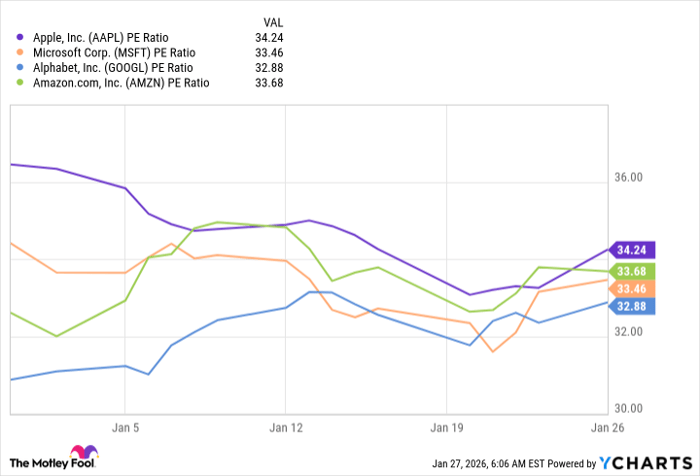

Current Valuation Concerns

Currently, ARM’s stock is considered expensive, trading at approximately 54.19 times forward 12-month earnings per share, significantly higher than the industry average of 23.83 times. Additionally, the trailing 12-month EV-to-EBITDA ratio for ARM stands at about 225.49 times, far exceeding the industry’s average of 16.79 times.

Advice for Potential Investors

Arm Holdings has established itself as a strong contender in the semiconductor space, driven by its leading architecture and involvement in AI and IoT markets. The favorable licensing model and solid financial post-IPO provide a robust foundation for future growth.

Nevertheless, careful timing is essential to maximize returns. Given ARM’s elevated valuation, there may be a potential for the stock to decline further. Investors may want to hold off until a more attractive entry point arises.

Currently, ARM holds a Zacks Rank #3 (Hold).