Arm Holdings Capitalizes on AI Surge: What Investors Need to Know

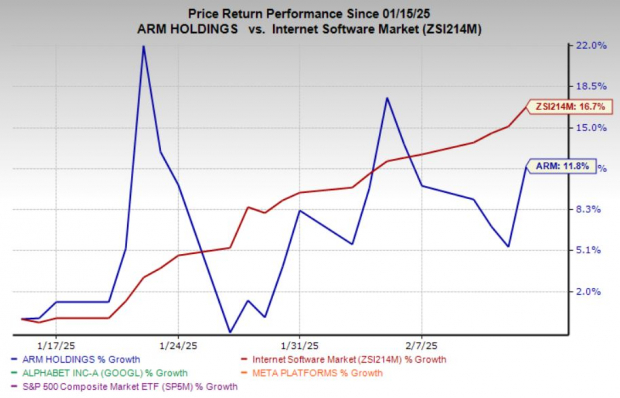

Arm Holdings plc (ARM) has seen a notable increase in its stock value, rising 12% in the past month. In contrast, the broader industry has experienced a more robust surge of 17%. This growth reflects the company’s strong positioning in the ever-evolving tech landscape.

The excitement surrounding advanced artificial intelligence (AI) software and its related hardware has played a significant role in driving ARM’s stock performance. Investors are also keeping a keen eye on economic conditions both globally and in the United States.

Image Source: Zacks Investment Research

Given ARM’s strong share performance, potential investors might be asking whether now is the ideal time to buy. Let’s take a closer look.

ARM’s Leadership in Mobile and AI Tech

Arm Holdings holds a key position in the semiconductor market, particularly for mobile devices. The company’s low-power architecture has been essential in smartphones and tablets for many years. Its technology is widely used by major manufacturers such as Apple (AAPL), Samsung, and Qualcomm (QCOM). This consistent demand underlines ARM’s competitive edge.

As the AI and Internet of Things (IoT) sectors expand, Arm Holdings is well-equipped to seize new opportunities. ARM’s chips are increasingly found in smart devices, autonomous systems, and data centers, meeting the rising demand for AI capabilities. The need for efficient, scalable, low-power solutions in these areas positions ARM favorably, especially with ongoing advancements in AI-focused applications.

The Advantages of ARM’s Licensing Strategy

One of the standout features of Arm Holdings’ business strategy is its licensing and royalty plan. By licensing its chip designs to leading tech firms, the company generates steady revenue without the burden of high capital costs. Strategic partnerships in areas like automotive and data centers help maintain its market relevance.

The recent IPO provided Arm Holdings with a considerable influx of capital, enhancing its financial stability. As of December 31, the company reported $2.7 billion in cash and no debt, positioning itself favorably for research, acquisitions, and further market expansion. This financial strength gives ARM a competitive advantage, allowing it to weather market volatility and pursue growth initiatives.

Market Volatility Post-IPO

Since the IPO, ARM’s stock has faced significant fluctuations. While the capital infusion has bolstered the company’s finances, market perception continues to impact its valuation. Global economic factors and the cyclical nature of the semiconductor sector inject an element of risk for short-term investors. Caution is advisable as the market adjusts to ARM’s public trading status.

Projected Earnings and Revenue Growth

The Zacks Consensus Estimate projects ARM’s fiscal 2025 earnings at $1.62, representing a 27.6% increase from the previous year. Expectations for fiscal 2026 suggest a further 23.5% growth compared to 2025.

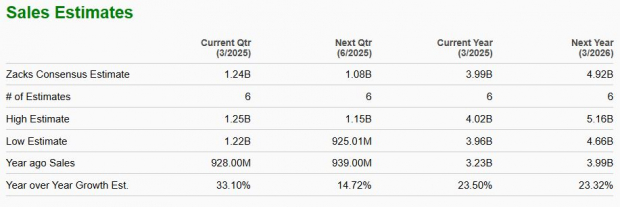

Image Source: Zacks Investment Research

Sales figures are also expected to climb, with anticipated year-over-year increases of 23.5% and 23.3% for fiscal 2025 and 2026, respectively.

Image Source: Zacks Investment Research

Overvaluation Concerns for ARM Stock

ARM stock currently trades at approximately 83.27 times forward 12-month earnings, notably higher than the industry average of 39.53 times. The trailing 12-month EV-to-EBITDA ratio for ARM sits at around 335.4 times, again surpassing the industry norm of 9.33 times.

Consider Waiting for a Better Buying Opportunity

Arm Holdings stands as a significant force in the semiconductor market, driven by its innovative architecture and involvement in AI and IoT sectors. Its robust licensing structure and solid financial position after its IPO provide a reliable foundation for future advancements.

Nonetheless, careful timing is crucial for potential investors looking to maximize returns. Given ARM’s elevated valuation, it may be wise to wait for a more favorable price point before making a purchase.

ARM currently holds a Zacks Rank #3 (Hold). You can explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Top Stock Picks for the Coming Month

Experts have identified 7 standout stocks among the current list of 220 Zacks Rank #1 Strong Buys, predicting they are “Most Likely for Early Price Pops.”

Since 1988, this curated list has consistently outperformed the market, averaging a +24.3% gain per year. Be sure to pay attention to these top picks.

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM) : Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.