AppLovin and Arm Holdings Target Growth in AI Market

AppLovin Corporation (APP) and Arm Holdings plc (ARM) are leveraging artificial intelligence (AI) to drive their business strategies. AppLovin focuses on AI-driven advertising and app monetization, while Arm Holdings specializes in advanced chip architectures for AI hardware. Both companies are at the forefront of the increasing demand for AI solutions in various sectors.

AppLovin’s AI-Driven Transformation

AppLovin is evolving into a top AI-powered advertising platform, shifting its focus to high-growth, high-margin segments. A notable step in this direction was its $900 million sale of its gaming unit to Tripledot Studios, which enables greater focus on its AXON 2.0 technology. This AI engine optimizes ad delivery and performance.

The integration of AI is central to AppLovin’s operations. The company is investing in automation and sophisticated algorithms to enhance advertiser efficiency. This allows it to serve over 10 million global businesses with data-driven ad solutions.

In its recent earnings report, AppLovin highlighted the positive impact of its AI-led advertising strategy. In Q1 2025, revenue increased by 40%, driven by strong demand and improved campaign performance. Adjusted EBITDA rose by 83%, and net income surged 144% year over year. Full-year 2024 revenue grew by 43%, validating its profitability through advanced technology.

Arm Holdings’ Strong Semiconductor Position

Arm Holdings remains a leading player in the semiconductor industry, known for its low-power chip architectures. Major companies like Apple (AAPL), Qualcomm (QCOM), and Samsung depend on Arm’s designs for smartphones and tablets.

With rapid advancements in AI and the Internet of Things (IoT), Arm is poised for growth. Its energy-efficient chips are essential for smart devices and cloud infrastructure, making it well-suited to meet increasing demands.

Arm’s licensing model is a key component of its business, generating steady revenue without large capital investments. However, ongoing tariff issues pose a risk, as 10–20% of its royalties come from the U.S. market. Increased tariffs could dampen demand for ARM’s products and reduce royalty revenues.

Fiscal Estimates for APP and ARM

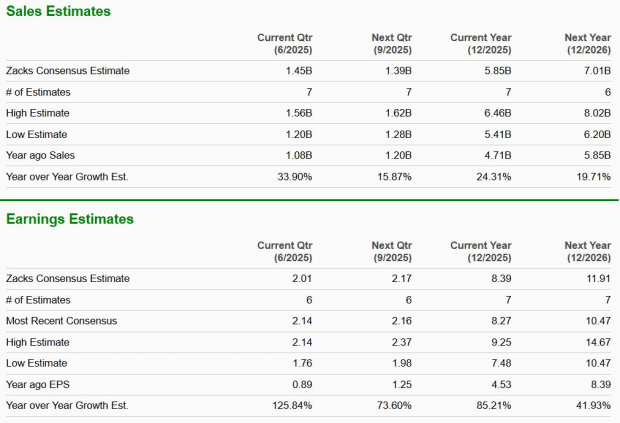

Zacks Consensus Estimates suggest that AppLovin is set for a 24% year-over-year sales increase and an 85% rise in earnings per share (EPS) for the current fiscal year, highlighting its operating leverage. Conversely, Arm is expected to see a more modest 17% sales growth and a 5.5% increase in EPS.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Valuation Insights Favor APP

Arm Holdings trades at a forward P/E of 70.45X, below its median of 103.99X, indicating a valuation discount despite high expectations for its AI and IoT prospects. AppLovin, with a forward P/E of 39.05X, is just above its median of 38.78X, suggesting a more stable valuation. Given APP’s stronger earnings growth potential, its valuation appears more appealing to investors.

AppLovin Emerges as the Favorable Option

While both companies are well-positioned in the AI landscape, AppLovin’s ability to convert innovation into profitability sets it apart. The focus on AI-driven advertising and impressive operational execution position it for ongoing growth. AppLovin’s valuation is more reasonable compared to its earnings potential, offering a favorable risk-reward profile. In contrast, Arm’s higher valuation and external risks may limit short-term gains.

APP currently holds a Zacks Rank #1 (Strong Buy), while ARM has a Zacks Rank #4 (Sell).

Conclusion

Investors looking for a tech-driven, AI-focused opportunity with potential for scalable returns should consider AppLovin.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.