“`html

Comparing Investment Opportunities: Arm Holdings vs. Byrna Technologies

Both Arm Holdings plc (ARM) and Byrna Technologies Inc. (BYRN) are companies that attract growth-oriented investors through their commitment to disruptive technologies.

Arm Holdings is a major player in semiconductor design, fueling advancements in AI and computing across various sectors. Byrna, on the other hand, specializes in non-lethal personal defense solutions, establishing a niche in both civilian and law enforcement markets. Despite their different sectors, both firms aim to revolutionize legacy systems with their high-impact technologies.

As innovation redefines the investment landscape, investors might wonder: Which of these tech disruptors presents a more promising opportunity today?

The Case for Arm Holdings

Arm Holdings has cultivated a strong foundation in mobile technology and AI, reflecting its innovation-centric approach. The company boasts a dominant position in the semiconductor industry, notably within mobile devices. Its low-power architecture has been essential for smartphones and tablets for many years. As mobile computing continues to expand, Arm remains a key supplier to major manufacturers such as Apple (AAPL), Samsung, and Qualcomm (QCOM). This consistent demand underlines Arm’s resilience, fueled by its ongoing commitment to innovation.

With the rise of AI and the Internet of Things (IoT), Arm Holdings is poised to capitalize on these technological advancements. ARM-powered chips are being integrated into smart devices, autonomous systems, and data centers, aligning with AI’s computational requirements. The increasing need for efficient, scalable, and low-power processing solutions positions ARM’s architecture as critical. The company’s effort to tailor its designs for AI operations enhances its growth prospects, highlighting its innovative strategy.

Arm Holdings employs a licensing and royalty-based business model, which is central to its innovation strategy. By licensing chip designs to technology giants and earning royalties on each chip sold, Arm generates a steady revenue stream with limited capital expenditure. Its partnerships with industry leaders ensure relevance, making it a preferred option in the automotive, data center, and smart device sectors—areas primed for innovation.

The recent IPO of Arm Holdings resulted in a significant influx of capital, bolstering its balance sheet. As of December 31, the company reported $2.7 billion in cash with no outstanding debt. This substantial cash reserve equips Arm to invest in research and development, pursue strategic acquisitions, and extend its market presence. Such financial flexibility enhances its competitive position, allowing it to withstand market fluctuations while investing in future innovation.

The Case for Byrna Technologies

Byrna continues to establish itself as an innovation leader in the non-lethal personal defense sector. Thanks to a creative and tech-savvy marketing strategy, the company enjoys high brand visibility supported by successful celebrity endorsements and extensive media coverage. In fiscal 2024, Byrna achieved over a 5X return on ad spend, culminating in $28.0 million in sales for the fourth quarter.

By integrating consumer education with product innovation, Byrna has normalized less-lethal solutions among the public and law enforcement. This brand strategy drove a remarkable 79% year-over-year sales growth in the fourth quarter. Additionally, net income rebounded dramatically, climbing from a loss of $0.8 million to a profit of $9.7 million—an impressive turnaround of $10.5 million.

Looking ahead, Byrna is pushing forward on multiple innovative fronts. The company is increasing production and plans to launch its next-generation Compact Launcher in mid-2025, designed for portability and user convenience. In the first fiscal quarter, production of the launcher platform surged by 33%, hitting 24,000 units per month to address growing demand.

Byrna is also enhancing its omnichannel strategy, opening more company-owned retail locations and expanding its reach into Latin America via strategic partnerships with law enforcement. Notably, Byrna partnered with the Secretaría de Trabajo y Previsión Social in Mexico to create a federally certified civilian training program for its devices, marking a significant regulatory achievement.

Furthermore, BYRN is streamlining operations by shifting ammunition production to domestic facilities, which improves supply chain management and boosts profit margins. These strategic efforts underscore Byrna’s dedication to technological innovation and long-term growth.

Comparative Analysis of Zacks Estimates for ARM & BYRN

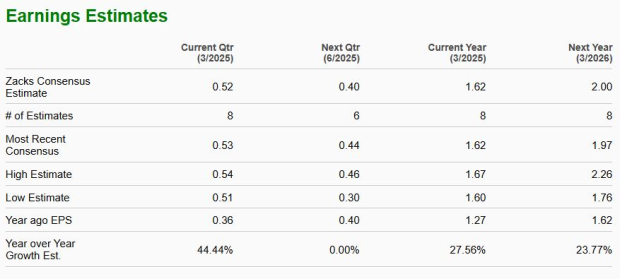

For ARM, the Zacks Consensus Estimate for fiscal 2025 suggests growth in sales and EPS by 24% and 28%, respectively. Analysts have reported no recent changes or revisions in estimates.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

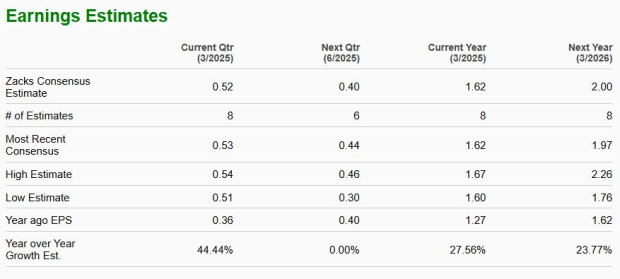

For BYRN, the Zacks Consensus Estimate points to year-over-year growth of 30% in sales and 13% in EPS for fiscal 2025, with upward revisions in estimates over the past month.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Valuation Comparison: ARM vs. BYRN

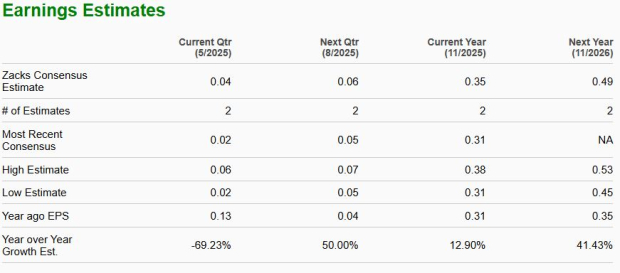

Currently, ARM trades at a forward earnings multiple of 49.31X, which is below its 12-month median of 127.41X. In contrast, BYRN’s forward earnings multiple is 54.26X, below its median of 96.9X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Final Verdict

Byrna is rated as a Buy, bolstered by rapid revenue growth, significant profitability improvements, rising EPS estimates, and aggressive expansion across products and regions. Its momentum and innovations in the non-lethal defense sector position it as an attractive growth opportunity. Meanwhile, Arm Holdings remains a global leader in its field, with a solid foundation for continued success.

“`

Investment Ratings: ARM Holds Steady While BYRN is a Strong Buy

In the realm of AI and mobile semiconductors, ARM Holdings PLC (ARM) currently receives a rating of Hold. While the company boasts solid fundamentals and a lower forward price-to-earnings (P/E) ratio compared to Byrna Technologies Inc. (BYRN), it has experienced stagnant analyst revisions and is navigating a more established growth trajectory. Investors may opt to wait for a more compelling earnings catalyst before increasing their ARM holdings.

Current Ratings and Market Position

As of now, BYRN enjoys a Zacks Rank of #2, indicating a Buy recommendation. In contrast, ARM holds a Zacks Rank of #3, signifying a Hold position. For those seeking insights into top investment options, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Potential Breakout Stock Identified by Zacks’ Research Chief

Recently, the Zacks research team unveiled five stocks with the highest potential to gain 100% or more in the near future. Among them, Director of Research Sheraz Mian has singled out one particular stock poised for significant appreciation.

This standout pick is a frontrunner among innovative financial companies. Boasting a rapidly expanding clientele of over 50 million and a diverse range of advanced solutions, this stock is strategically positioned for substantial growth. While past recommendations have not always succeeded, this stock has the potential to outshine earlier Zacks’ selections like Nano-X Imaging, which surged by +129.6% in just over nine months.

For an in-depth look at this promising pick, you can see our top stock and four runners-up.

If you’re interested in the latest recommendations from Zacks Investment Research, you can download our report entitled “7 Best Stocks for the Next 30 Days.” Click here to access this free report.

Additional analysis on leading companies is available:

- QUALCOMM Incorporated (QCOM): Free Stock Analysis report

- Apple Inc. (AAPL): Free Stock Analysis report

- ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis report

- Byrna Technologies Inc. (BYRN): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.