The New Price Horizon

ARS Pharmaceuticals (NasdaqGM:SPRY) has set sail on the seas of investment with a new one-year price target of $12.75 per share. This marks a remarkable ascent of 56.25% from the previous forecast logged on January 16, 2024. The revised target is an average derived from various analyst projections, ranging from a low of $6.06 to a soaring high of $19.95 per share. The current average price target showcases a robust 52.69% increase from the recent closing figure of $8.35 per share.

Tracking Fund Sentiment

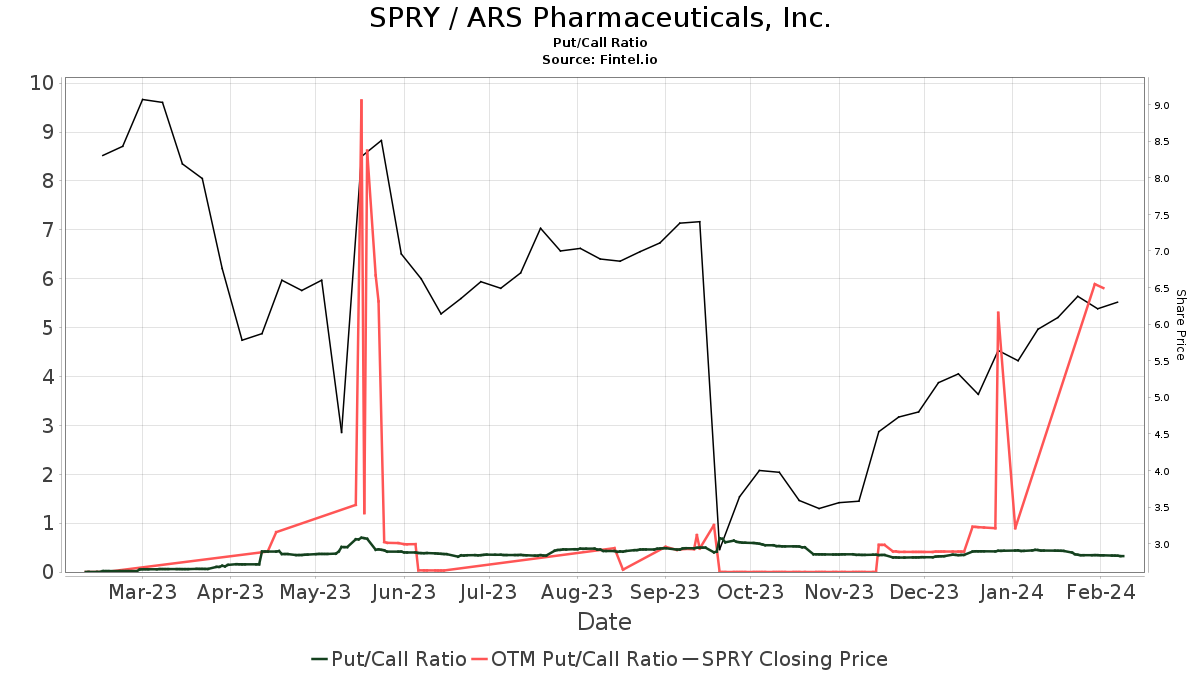

Welcome aboard the ARS Pharmaceuticals express, where 225 funds or institutions have disclosed their positions in the company. In the last quarter alone, 5 additional owners have joined the ride, reflecting a 2.27% rise. The average portfolio weight for all funds dedicated to SPRY has surged to 0.11%, marking a notable 13.13% increase. Institutions have upped their total shareholding by 0.71% over the past three months, now standing at 67,796K shares. With a put/call ratio of 0.34, the outlook remains bullish.

Shareholder Shuffle

In the bustling shareholder arena, Deerfield Management Company, L.P. retains its stake with 11,078K shares, constituting a solid 11.54% ownership slice. Ra Capital Management stands firm with 9,460K shares, representing 9.85% of the pie, while Orbimed Advisors holds 9,241K shares, accounting for 9.63% ownership. Franklin Resources has made bold moves, hiking its share count from 3,869K to 4,098K, a notable 5.61% increase, albeit slashing its portfolio allocation in SPRY by 68.16% over the quarter.

Sr One Capital Management maintains its position with 4,013K shares, securing a 4.18% ownership stake steadfastly.

Unveiling ARS Pharmaceuticals

ARS Pharmaceuticals, the newfound darling of post-COVID pharma, has been on a meteoric rise. Operating as a biotechnology company under the moniker Silverback Therapeutics, Inc., it embarks on groundbreaking discoveries and developments utilizing the innovative ImmunoTAC technology. This proprietary technology crafts potent therapeutic molecules for systemic patient administration, catering to a global clientele with its cutting-edge solutions.

If you seek comprehensive investing research, Fintel stands as a beacon for individual investors, traders, financial advisors, and modest hedge funds. Their rich database encompasses a vast array of fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading insights, options flow, unusual options trades, and much more. Augment your investment prowess with exclusive stock picks engineered by sophisticated, backtested quantitative models to enhance your profit prowess.

Jump aboard the ARS Pharmaceuticals bandwagon and discover the financial vistas that lie ahead. This tale originally premiered on Fintel, your trusty investment companion on the road to prosperity.

As you sail through these insights, remember that the views and opinions expressed herein solely belong to the author and may not necessarily align with those of Nasdaq, Inc.