Equity indexes climbed to new highs mid-month on the news of April’s favorable CPI print. For income investors looking to harness gains in equities but with an eye toward the ongoing complexity surrounding inflation and rates, investing in quality companies presents opportunities.

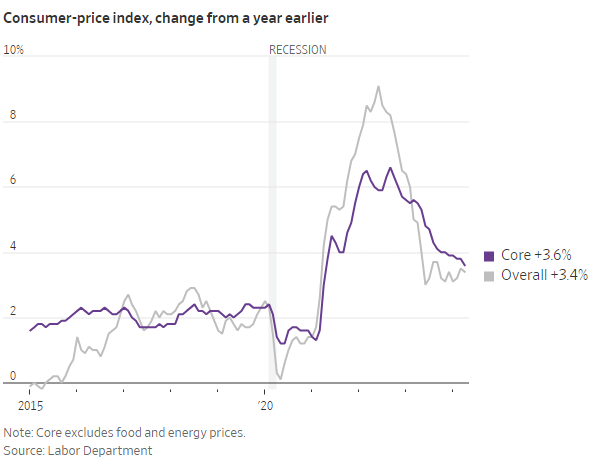

April’s consumer price index rose 3.4% year-over-year and 0.3% month-over-month. The monthly reading came in slightly lower than Dow Jones expectations of 0.4%, while the annual rise came in at expectations. Importantly, core CPI — which excludes food and energy — rose 3.6% on an annual basis. It’s the smallest rise since April 2021.

Image source: WSJ

“This is a very comforting report,” Erica Groshen, senior economic advisor at Cornell University School of Industrial and Labor Relations, told WSJ. “It is consistent with the view of a soft landing.”

Markets rallied on the news and hopes of favorable conditions for rate cuts later this year. The S&P 500® Index reached a new high, crossing 5,300 for the first time, while the Nasdaq Composite® Index soared 1.3%.

Harness Income Through Quality Equities With GQI

For equity investors looking to increase allocations or those seeking income potential, the Natixis Gateway Quality Income ETF (GQI) is a fund to consider. GQI seeks reliable cash flow from options premiums as well as dividends. It accomplishes this by investing in high-quality, established companies that exhibit high relative profitability, consistent earnings, and low leverage.

See also: “Quality is an All-Weather Investment Strategy”

GQI invests in large and mid-cap companies within the S&P 500. The equity exposures are then complemented by a laddered call option strategy on the S&P 500 Index. The options overlay half the portfolio. This allows the other half to participate in market upswings, balancing capital appreciation with income potential.

The income generated from options premiums helps mitigate volatility, providing a small buffer should equities decline. In a rising equity market, the premiums help to enhance the income but limit upside potential. Whichever way inflation and rates go from here, GQI provides an opportunity.

The fund provides risk-adjusted exposure to equities, making it a strong complement to existing equity allocations. Volatility mitigation also complements other minimum volatility strategies.

GQI works well within an income sleeve as an alternative to dividend-yield strategies. It also makes for a good addition to existing credit allocations because of its lack of interest rate risk. It makes it a strong diversifier to high-yield or other existing credit strategies within a portfolio.

GQI is actively managed and sub-advised by Gateway Investment Advisers. It’s fully transparent, with an expense ratio of 0.34%.

For more news, information, and analysis, visit the Portfolio Construction Channel.

Read more on ETFTrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.