Asbury Automotive Reports Strong Q4 2024 Earnings Driven by Robust Vehicle Sales

Asbury Automotive (ABG) announced its fourth-quarter 2024 adjusted earnings per share (EPS) at $7.26, exceeding the Zacks Consensus Estimate of $6.07 and showing an increase from last year’s $7.12. The surge in earnings was primarily fueled by higher sales and gross profits from both new and used vehicle segments. Revenue for the quarter reached $4.5 billion, up 18% compared to the same period last year, also surpassing the Zacks Consensus Estimate of $4.13 billion.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

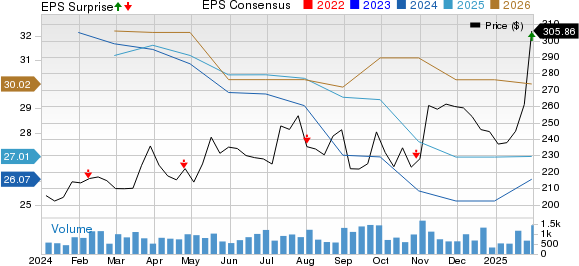

Price Performance Snapshot for Asbury Automotive

Price Consistency Indicators for Asbury Automotive Group, Inc.

Insight into Asbury’s Business Segments

In the fourth quarter, new vehicle revenue increased by 19% year over year, totaling $2.45 billion, exceeding the Zacks Consensus Estimate of $2.18 billion. This strong performance was supported by higher sales volumes and improved pricing. Retail units sold in this category amounted to 47,255, an 18% increase from last year, outpacing the consensus estimate of 42,938 units. Additionally, the average selling price (ASP) for new vehicles was $51,996, which was slightly higher than the estimated $50,599. The gross profit from new vehicle sales was $172.1 million, marking a 1% year-over-year increase, also surpassing expectations of $145 million.

In the used vehicle segment, retail revenues rose 14% to $1.1 billion, surpassing the Zacks Consensus Estimate of $957 million. Retail units sold totaled 35,328, a 15% increase, which exceeded the anticipated 33,574 units. The ASP for used vehicles was $31,106, slightly down year over year, but still beating estimates of $30,362. However, gross profit from this segment decreased by 2% to $51.2 million, although it still surpassed expectations of $49.1 million.

The wholesale used vehicle business saw revenues jump 55% to $160 million, beating the consensus estimate of $138 million, while gross profit rose 8% to $1.9 million, falling short of expectations at $3.28 million.

Meanwhile, the finance and insurance segment generated net revenues of $198.5 million, a 16% increase year over year, exceeding the Zacks estimate of $189 million. The gross profit in this category rose 13% year over year to $184.6 million, also surpassing the estimated $170 million.

Parts and service revenue increased 15% to $590.4 million but fell short of the Zacks consensus estimate of $599 million. The gross profit from this segment was $340 million, aligning with expectations and reflecting a 19% year-over-year growth.

Additional Financial Metrics

Selling, general, and administrative expenses as a percentage of gross profit rose to 63.6%, showing a year-over-year increase of 208 basis points.

As of December 31, 2024, Asbury reported cash and cash equivalents of $69.4 million, a rise from $45.7 million at the end of 2023. Long-term debt stood at $3.14 billion, down from $3.2 billion a year earlier.

During 2024, ABG repurchased 830,000 shares for $183 million, leaving $276 million remaining under its share repurchase authorization as of December 31, 2024.

Currently, Asbury holds a Zacks Rank #3 (Hold). Check out the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Major Automotive Company Earnings

General Motors (GM) revealed fourth-quarter 2024 adjusted earnings at $1.92 per share, beating the consensus of $1.85 and up from $1.24 a year ago. The company’s revenue reached $47.71 billion, surpassing estimates of $44 billion and increasing from $42.98 billion last year.

For 2025, GM projects adjusted EBIT between $13.7 billion and $15.7 billion, compared to $14.9 billion in 2024. The anticipated adjusted EPS for 2025 is between $11 and $12, up from $10.60 last year.

PACCAR (PCAR) announced earnings of $1.68 per share for the fourth quarter, beating estimates of $1.66 but down from $2.70 per share a year ago. Total revenues, including trucks and financial services, were $7.9 billion, down from $9 billion in the same quarter of 2023. Revenues from trucks, parts, and other sources accounted for $7.36 billion.

Looking ahead, PCAR expects 2025 capital expenditures and R&D expenses to range from $700-$800 million and $460-$500 million, respectively.

Tesla (TSLA) posted fourth-quarter 2024 earnings per share of 73 cents, slightly missing the consensus of 75 cents but increasing from 71 cents a year ago. Total revenues reached $25.71 billion, which fell short of the estimate of $27.5 billion yet grew from $25.17 billion in the previous year.

Tesla continues to focus on launching affordable vehicles production in the first half of this year and reiterated that the Cybercab will begin mass production in 2026. Additionally, energy storage deployments are projected to rise by at least 50% this year.

Zacks’ Research Team Highlights Potential Winners

Experts have identified five stocks with high potential for significant gains. Among these, Director of Research Sheraz Mian has pinpointed one standout stock.

This leading pick belongs to an innovative financial firm boasting a rapidly growing customer base of over 50 million and an array of advanced solutions, setting the stage for impressive growth in the near future. Although not every selection translates to success, this particular stock could outperform earlier Zacks picks, such as Nano-X Imaging, which gained +129.6% in just over nine months.

Free: Discover Our Top Stock and 4 Additional Runners Up.

Stay updated with Zacks Investment Research for the latest recommendations. You can download the report on the 7 Best Stocks for the Next 30 Days for free.

PACCAR Inc. (PCAR): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.