ASML Holding N.V. is projected to see a 30% increase in sales of its Extreme Ultraviolet (EUV) lithography equipment in 2025, spurred by chipmakers ramping up production for AI and high-performance computing. The company expects a year-over-year revenue growth of 23.8% for 2025, while the outlook for 2026 shows a potential decline of 0.9% due to external pressures such as tariff uncertainties and geopolitical tensions.

Despite strong long-term demand for advanced lithography tools, ASML has experienced adjustments in its backlog as clients reassess orders amid economic uncertainties. The Zacks Consensus Estimate for ASML’s earnings indicates a projected increase of 35.1% for 2025.

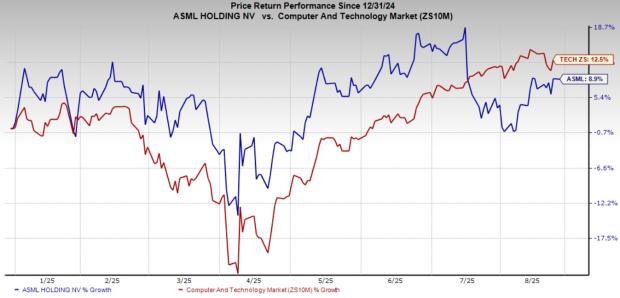

Year-to-date, ASML’s share price has risen 8.9%, although it trades at a forward price-to-sales ratio of 7.89, higher than the sector average of 6.66. Competitors like Applied Materials and Lam Research are also navigating challenges related to export restrictions affecting the semiconductor industry.