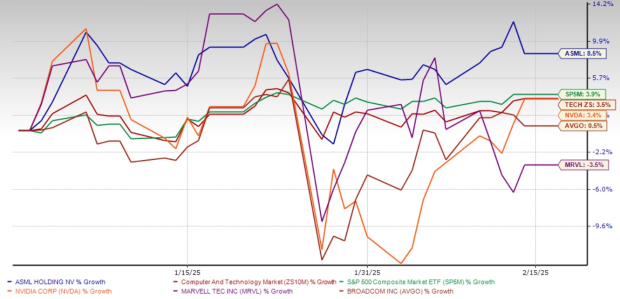

ASML Holding N.V. Defies Market Trends with Impressive Growth

ASML Holding N.V. has continued to thrive in 2025, recording an 8.5% increase year-to-date amidst broader market fluctuations. The performance has surpassed both the Zacks Computer and Technology sector and the S&P 500 index, showcasing robust investor confidence. Notably, ASML has also outpaced leading semiconductor firms like NVIDIA NVDA, Broadcom AVGO, and Marvell Technology MRVL.

Year-to-Date Price Return Overview

Image Source: Zacks Investment Research

ASML’s position as a leader in semiconductor manufacturing equipment remains intact. However, challenges such as export restrictions and high valuations suggest that holding onto the stock remains a prudent choice for now.

ASML’s Unmatched Technology Leadership

ASML enjoys a dominant position within the semiconductor manufacturing industry, particularly with its extreme ultraviolet (EUV) lithography technology, a crucial component in producing the latest chips.

This advanced technology enables the industry to advance towards smaller, more efficient nodes, like 3nm and below. While the hefty price tag of EUV machines limits customer access, ASML’s leadership guarantees its status as the preferred supplier for top semiconductor manufacturers, including Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, and Intel.

ASML is investing in future technologies, including High-NA EUV systems, essential for maintaining progress in smaller production nodes. Although the uptake of this technology has been slower than expected, it holds substantial long-term growth potential. ASML is strategically positioning itself to support the industry’s future, reinforcing a favorable investment outlook for long-term stakeholders.

ASML’s Strong Financial Performance Amidst Market Fluctuations

ASML recently reported impressive financial results for the fourth quarter of 2024, revealing a 24% increase in net sales to €9.26 billion, while net income rose by about 30% to €2.69 billion. Earnings per share also experienced growth of 30%, reaching €6.85, highlighting strong operational performance.

The gross margin expanded by 90 basis points year-over-year to 51.7%, which reflects effective cost management and enhanced efficiency in its advanced systems.

Looking ahead, ASML forecasts robust growth continuation, with revenue guidance for the first quarter and full year of 2025 expecting year-over-year increases of 46.5% and 15%, respectively. The gross margin forecasts also anticipate improvements of 150 basis points for the first quarter and 70 basis points for 2025.

Robust Order Backlog: A Strength for ASML

One of ASML’s significant advantages is its record backlog of €36 billion, which ensures visibility into future revenues. In the fourth quarter of 2025 alone, the company secured €7.1 billion in new orders, including €3 billion in EUV machines and €4.1 billion in deep ultraviolet (DUV) systems.

Despite a slowdown in semiconductor capital expenditures, demand driven by artificial intelligence for high-performance computing (HPC) chips, high-bandwidth memory (HBM), and advanced data center processors remains solid. As chipmakers push to enhance production at 2nm and below, ASML’s next-generation EUV systems will be vital in securing consistent revenue streams.

ASML Faces Near-Term Challenges

ASML’s main hurdle is rising geopolitical risks, especially concerning export restrictions on semiconductor equipment to China. Under pressure from the U.S., the Dutch government has instituted strict limits on ASML’s ability to sell its advanced lithography tools to Chinese clients, which could limit potential revenue from a significant market.

Notably, China accounted for approximately 41% of ASML’s lithography shipments in 2024, meaning further trade restrictions could further diminish sales prospects. With ongoing tensions between the U.S. and China, retaliatory measures might impact ASML’s supply chain or customer relationships. Despite ASML’s diversified global presence, these geopolitical uncertainties could create short-term fluctuations in stock prices.

Image Source: ASML Holding N.V.

Additionally, broader economical issues—such as inflation and a slow rebound in mobile and PC markets—are impacting ASML. The semiconductor industry, still recovering from pandemic-related demand fluctuations, highlights its cyclical nature.

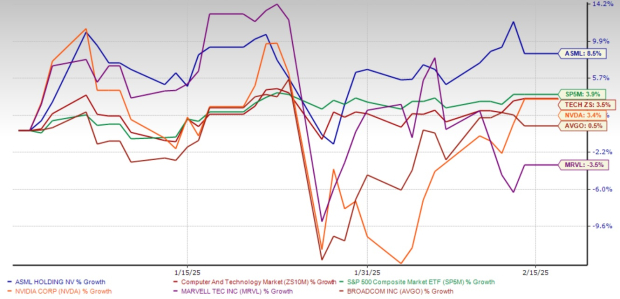

ASML’s Premium Valuation: A Point of Caution

Currently, ASML is trading at a premium compared to the Zacks Computer and Technology sector, with a forward 12-month price-to-earnings (P/E) ratio of 29.22, exceeding the sector’s average of 26.19. While this premium showcases ASML’s technological superiority and market position, it restricts the stock’s potential for immediate gains.

Forward 12-Month P/E Ratio Comparison

Image Source: Zacks Investment Research

Conclusion: Hold ASML Stock for the Time Being

Given ASML’s technological leadership, impressive financial results, and strong backlog, it represents a high-quality long-term investment. Nevertheless, potential geopolitical risks, a slower investment cycle, and a premium valuation imply that immediate growth may be constrained. Thus, it is advisable for investors to hold onto ASML shares for now, monitoring for potential market pullbacks or indications of increasing demand before expanding their positions.

Presently, ASML holds a Zacks Rank #3 (Hold). You can see the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to Access All of Zacks’ Buys and Sells

No joke.

Years ago, we surprised our members by offering 30-day access to all our stock picks for just $1, with no obligation to spend more.

Thousands took advantage of this offer, while many hesitated, thinking there was a catch. The reason? We aim to introduce you to our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which closed 256 positions with impressive double- and triple-digit gains in 2024 alone.

See Stocks Now >>

Want to stay updated with the latest recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days for free.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ASML Holding N.V. (ASML): Free Stock Analysis Report

Marvell Technology, Inc. (MRVL): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.