Battle of the Chip Giants: ASML vs. TSMC

The surge in artificial intelligence (AI) stocks has drawn many investors to this promising sector. However, with the rapid increase in some AI-related shares, assessing potential returns can be quite tricky.

In this landscape, it’s crucial to recognize the two enterprises that produce the hardware enabling AI technology: ASML (NASDAQ: ASML) and Taiwan Semiconductor (NYSE: TSM). Both companies have distinct yet complementary roles in manufacturing, but one is poised for higher returns than the other.

Understanding Company Profiles

ASML holds an advantage with its cutting-edge technology. It has maintained a monopoly on extreme ultraviolet (EUV) lithography, a critical process in crafting the world’s most advanced semiconductors.

While researchers in Japan are developing simpler and less costly alternatives to EUV lithography, ASML’s current market stronghold remains largely unchallenged. Until competitors like Nikon and Canon successfully enter this market, ASML’s dominance is unlikely to fade.

Conversely, TSMC relies on ASML for the essential equipment required to produce these advanced chips. The company takes chip designs from industry leaders such as Nvidia, AMD, and Qualcomm, fulfilling their production needs.

Despite facing competition from Samsung and Intel, TSMC holds an impressive position in the foundry market, accounting for 62% according to TrendForce. This substantial market share underscores its importance, despite growing political pressures for a diversification of production locations.

Financial Performance Analysis

Both ASML and TSMC are well-positioned to outperform the market due to their roles in AI semiconductor manufacturing. However, financial performance may reveal which company is more likely to deliver superior returns.

ASML reported revenues of 19 billion euros ($19.6 billion) in the first three quarters of 2024, reflecting a 6% decline from the previous year. This decrease is mainly attributed to reduced demand in China. Consequently, its net income dropped to 4.9 billion euros ($5.0 billion), down from 5.8 billion euros a year earlier.

In contrast, TSMC continues to thrive with $63 billion in revenue during the same period, a robust 32% increase year-over-year. Its expenses have kept pace with revenue, allowing its net income to soar by 33% to $26 billion compared to the prior year.

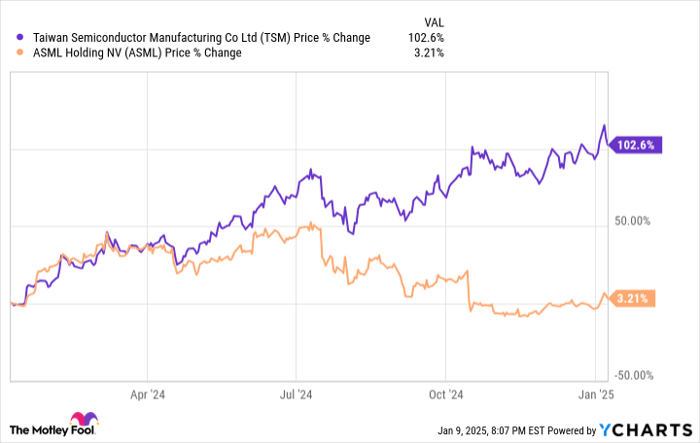

As a result, TSMC has significantly outperformed ASML in stock performance over the last year.

TSM data by YCharts

The contrasting financials are evident in their price-to-earnings (P/E) ratios, with ASML’s at 39 compared to TSMC’s 33. Historical valuations reveal that ASML’s average P/E ratio over the past five years is 43, indicating its current valuation as relatively inexpensive. Conversely, TSMC’s average P/E is 24, suggesting potential for pulling back during economic downturns.

Choosing Between ASML and TSMC

Considering valuation averages complicates the decision for investors, although TSMC might be the safer bet for higher returns.

Notably, TSMC’s dependence on ASML enhances ASML’s position of strength, even if ASML’s revenue decline raises concerns about its valuation.

While TSMC’s P/E ratio might indicate higher risk, it presents a relatively affordable choice for an AI stock. The ongoing AI boom supports TSMC’s rapid revenue and profit growth, thus justifying the premium valuation and enhancing prospects for future returns.

Is Taiwan Semiconductor Manufacturing a Good Investment Right Now?

Before investing in Taiwan Semiconductor Manufacturing, it’s worth noting that:

The Motley Fool Stock Advisor team has identified their top 10 stocks for investors, and Taiwan Semiconductor Manufacturing isn’t among them. The selected stocks could offer substantial returns in the coming years.

For instance, when Nvidia made the list on April 15, 2005, a $1,000 investment at that time would now be valued at $832,928!

Stock Advisor provides a concise roadmap to success, offering insights on portfolio building and regular updates from analysts, along with two new stock recommendations each month. This service has delivered returns that have quadrupled the S&P 500 performance since 2002.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

Will Healy holds positions in Advanced Micro Devices, Intel, and Qualcomm. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends a specific options strategy involving Intel. For more details, please review the Fool’s disclosure policy.

The views and opinions expressed herein represent the author’s views and do not necessarily reflect those of Nasdaq, Inc.