ASML’s Earnings Surprise Hits Semiconductor Stocks Hard

Market Reaction to ASML’s Unexpected Results

Semiconductor stocks took a significant hit following an unexpected earnings report from Dutch semiconductor leader ASML Holding (ASML). ASML’s financial results were made public on their website after a technical glitch, revealing that while the company surpassed Wall Street’s expectations, it issued weak guidance for future earnings. This was attributed to anticipated slowing demand for AI-related chips. As a result, ASML’s shares plummeted by 16%, with trading volume reaching five times the usual rate.

This downturn didn’t stop with ASML; its poor performance affected the broader semiconductor sector, causing the Semiconductor ETF (SMH) to drop over 5%. This raises the question: has the semiconductor boom come to an end, or is it an opportunity to buy the dip?

Nvidia’s Demand Remains Resilient

One useful analogy for the stock market comes from legendary hockey player Wayne Gretzky. He famously advised players to skate toward where the puck is going, not where it has been. Savvy investors adopt this same mindset, focusing on future trends rather than past performance.

While ASML plays a crucial role in the AI industry, Nvidia (NVDA) stands out as the premier investment choice in this space.

Demand Driven by Supply Issues

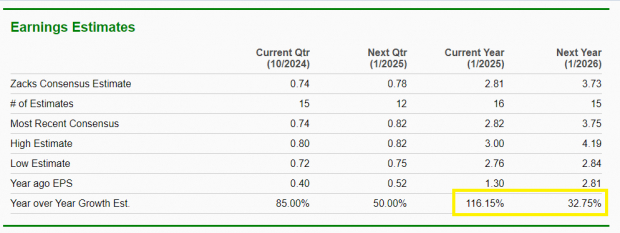

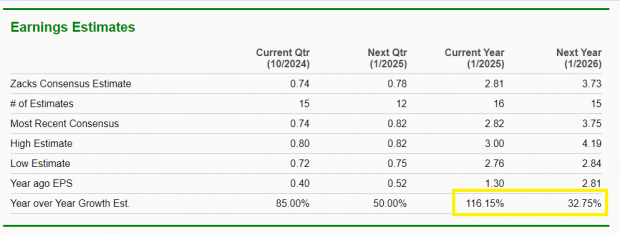

According to the latest Zacks Consensus Estimates, which compiles insights from around 3,000 analysts across more than 150 Wall Street firms, Nvidia’s demand shows no signs of slowing down. Estimates suggest that NVDA’s earnings could more than double by 2025 and rise approximately 33% in 2026.

Image Source: Zacks Investment Research

Moreover, Nvidia CEO Jensen Huang emphasized during a recent CNBC interview that demand for their new Blackwell chip is “insane.”

Positive Technical Indicators

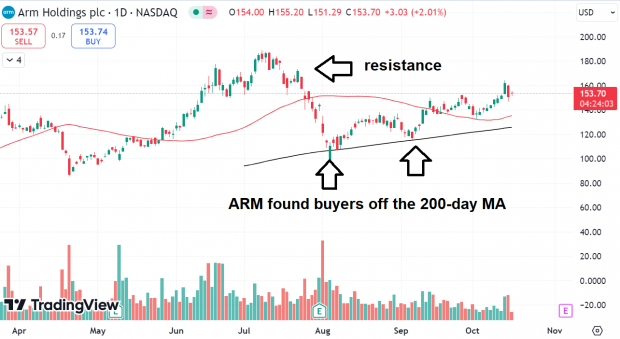

Stocks like Arm Holdings (ARM) and NVDA have seen upward trends but were expected to pull back somewhat. For instance, ARM surged over 25% in just a week after rebounding off its 200-day moving average. Such corrections are common after substantial increases and do not necessarily signal the end of a major upward trend.

Image Source: TradingView

Furthermore, ASML may not accurately represent the overall semiconductor market, given that its stock had been lagging even before its recent underwhelming earnings report.

Image Source: Zacks Investment Research

Bullish Options Activity

Significant investments flowed into the 2x Long NVDA ETF (NVDL) during the recent downturn, suggesting that informed investors remain confident in Nvidia’s future prospects.

Conclusion

The disappointing earnings report from ASML negatively impacted semiconductor stocks yesterday. However, the reactions in the market, combined with technical analyses and movements in the options market, indicate that this could be a prudent time to consider buying the dip.

Zacks Identifies Top Semiconductor Stock

A new top semiconductor stock has emerged, even as it stands just a fraction of the size of NVIDIA, which has soared over 800% since our recommendation. While NVIDIA continues to perform well, this new stock has considerable potential for growth.

This company is positioned for strong earnings growth and an expanding customer base, tapping into the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing industry is forecasted to grow from $452 billion in 2021 to $803 billion by 2028.

Click to see this stock for free now >>

Want more investment insights from Zacks Investment Research? Download “5 Stocks Set to Double” for free today.

Featured Stocks:

Intel Corporation (INTC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

ASML Holding N.V. (ASML) : Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

VanEck Semiconductor ETF (SMH): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.