AGNC Investment Corp. reported that as of March 31, 2025, it holds $70.5 billion in agency mortgage-backed securities (MBS) within a total investment portfolio of $78.9 billion. This commitment to agency MBS, backed by government guarantees, positions AGNC favorably despite recent financial volatility where market spreads to benchmark rates have widened.

AGNC’s liquidity remains strong, with $6 billion in cash and unencumbered Agency MBS. Comparatively, Annaly Capital Management (NLY) has a portfolio of $84.9 billion, $75 billion of which is in Agency MBS, while Starwood Property Trust (STWD) focuses on commercial real estate-backed investments, holding $1.02 billion in CMBS.

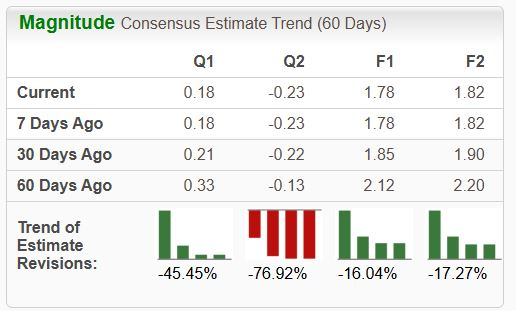

Over the past year, AGNC shares declined by 1.7%, slightly outperforming the industry’s 4.1% decline. The Zacks Consensus Estimate anticipates AGNC’s earnings to decline by 11.2% in 2025 and 3.9% in 2026.