Baidu Stock Experiences Significant Decline Amid Trade Tensions and Market Concerns

Baidu, Inc. BIDU Stock has dropped 17% over the past month, underperforming the Zacks Internet – Services industry’s 11.5% decline and the Zacks Computer and Technology sector’s 12.2% decrease. The stock’s substantial exposure to the volatile Chinese market has resulted in heavy losses as investor anxiety grows. Recently, China announced a 34% retaliatory tariff on all U.S. imports set to start on April 10, following a similar tariff hike imposed by Trump on Chinese goods. This escalation has intensified fears of a trade war and led to significant disruptions in the market.

Concerns are further compounded by the decline in Baidu’s primary online marketing revenue, which fell by 7% in the fourth quarter and is projected to decrease by 3% in 2024. Intense competition within China’s market adds to the challenges, even as Baidu makes strategic advancements, such as expanding its autonomous ride-hailing service to Dubai and introducing new AI models like ERNIE 4.5 and ERNIE X1.

Baidu’s decision to open source the ERNIE 4.5 series and offer ERNIE Bot for free seeks to increase adoption amidst a competitive AI landscape. The entrance of new competitors like DeepSeek indicates a need for Baidu to defend its market position with aggressive pricing strategies. Although management remains confident in ERNIE’s potential, this open-source approach highlights the necessity to stay relevant in an intensifying competitive environment.

BIDU Stock’s YTD Performance

Image Source: Zacks Investment Research

Assessment of Baidu Stock’s Technical Indicators

Baidu shares are currently trading below both the 50-day and 200-day moving averages, signaling a bearish market trend.

Image Source: Zacks Investment Research

This significant decline has investors questioning whether the downward trend has reached its limit. Is now an opportune moment to invest in this AI Stock?

Let’s explore the company’s prospects.

Growth in Baidu’s AI Cloud and Infrastructure

Baidu’s AI Cloud revenue soared 26% year over year in the fourth quarter of 2024, contributing to a 17% increase for the full year. Revenue from generative AI nearly tripled in 2024, indicating strong demand for the ERNIE model and a robust AI infrastructure. Baidu has cultivated a diverse customer base across multiple sectors, including Internet services, automotive, manufacturing, energy, and finance, while also seeing rapid adoption from mid-tier businesses. The Tianfeng MaaS platform enhances this value by providing high-quality models and fine-tuning tools, enabling seamless AI integration. With ongoing improvements in performance and costs, Baidu expects a surge in adoption, leading to sustained revenue growth and expanding non-GAAP operating margins through 2025.

Expanding the ERNIE Ecosystem

Baidu’s ERNIE large language model is quickly gaining traction, currently processing around 1.65 billion API calls daily as of December 2024. External API calls increased by 178% quarter over quarter. The ERNIE model demonstrates capabilities in instruction following and Retrieval-Augmented Generation technology, which significantly reduces errors. Notably, strong adoption has been seen in sectors such as education, e-commerce, entertainment, and recruitment.

Growth of Baidu’s Apollo Go Robotaxi Service

Baidu’s autonomous ride-hailing service, Apollo Go, provided over 1.1 million rides in the fourth quarter of 2024, reflecting a 36% increase from the previous year. By January 2025, the service recorded over 9 million total public rides. Apollo Go, which became the only service authorized for robotaxi testing in Hong Kong in November 2024, has begun fully driverless operations across China as of February 2025. The company pursues an asset-light expansion strategy through partnerships with local fleet operators and mobility service providers, positioning Apollo Go for substantial growth and higher ride volumes while enhancing operational efficiency.

Baidu’s Strong Financial Position

As of the end of 2024, Baidu maintains a solid net cash position of approximately RMB 170.5 billion and generated free cash flow of RMB 13.1 billion. The company is focusing on improving operational efficiency, highlighted by a reduction in personnel-related expenses and stable operating costs. Baidu continues to invest prudently in high-ROI areas, including AI, cloud services, and autonomous driving. In 2024, Baidu repurchased over $1 billion in shares, part of a broader $5 billion buyback program set to continue through December 2025, demonstrating confidence in its long-term prospects and commitment to shareholder value creation.

Baidu Stock Valuation Insights

Baidu is currently trading at a discount relative to its industry and historical metrics, with its forward 12-month price-to-sales (P/S) ratio below its five-year average. The stock holds a Value Score of A.

Price/Sales (F12M)

Image Source: Zacks Investment Research

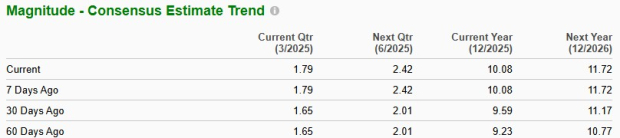

Analysts Adjust Earnings Estimates for BIDU

Analysts are increasingly optimistic about Baidu’s earnings potential. In the last 30 days, the Zacks Consensus Estimate for BIDU’s 2025 earnings per share has risen from $9.59 to $10.08, reflecting a favorable shift in market sentiment.

Discover the latest earnings estimates and surprises on Zacks earnings Calendar.

Baidu’s Investment Outlook Amid Rising Competition and Market Dynamics

In the competitive realms of cloud computing and artificial intelligence (AI), Baidu contends with formidable rivals such as Alibaba (BABA) and Tencent (TCEHY). Alibaba Cloud, known as Aliyun, dominates the Chinese market by offering a diverse array of enterprise services while heavily investing in AI through its DAMO Academy. This initiative emphasizes natural language processing, computer vision, and Internet of Things applications. Alibaba leverages its robust customer base, which stems from its expansive e-commerce, logistics, and finance platforms. Conversely, Tencent Cloud capitalizes on its strong presence in gaming, social media, and entertainment, utilizing the WeChat ecosystem to provide AI services including speech and image recognition. Tencent focuses its AI research on user behaviors, ad optimization, and content recommendations.

The landscape of Chinese AI is further complicated by the emergence of startups like Zhipu AI, which has garnered substantial backing from key players like Alibaba and Tencent. Zhipu AI is developing advanced AI models, adding to the mounting competitive pressures within the sector.

Baidu also vies for market share in the digital media space against companies such as ByteDance, the parent company of TikTok and Douyin. Recently, Baidu made headlines with its acquisition of JOYY’s China live-streaming platform, YY Live, for $2.1 billion, aiming to enhance its influence in the digital video market.

Assessing Baidu (BIDU) Stock Amid Market Challenges

Despite facing recent volatility sparked by geopolitical tensions, core revenue challenges, and intensified competition, Baidu represents an intriguing long-term investment opportunity at its current valuation. The stock’s recent 17% decline has been more pronounced than the average declines seen in its industry and sector. This drop may reflect an overreaction to short-term macroeconomic concerns, potentially creating an attractive entry point for proactive investors.

Baidu is advancing notably in AI, cloud computing, and autonomous driving sectors. Its AI Cloud revenue is witnessing significant growth, while the ERNIE ecosystem expands rapidly. Additionally, the Apollo Go project is scaling both within China and internationally. With strong financial foundations, a considerable cash reserve, proactive share buybacks, and a favorable valuation, BIDU presents a compelling narrative for growth.

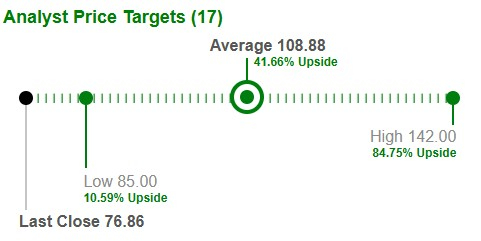

Analysts exhibit optimism regarding BIDU, with 10 out of 19 recommending it as a “Strong Buy.” The stock’s average price target of $108.88 suggests a potential upside of 41.7% from its most recent closing price.

Image Source: Zacks Investment Research

Furthermore, recent upward earnings revisions bolster the stock’s growth prospects. For long-term investors, this may be a promising moment to consider purchasing shares. Currently, BIDU has a Zacks Rank #1 (Strong Buy). To view a comprehensive list of today’s Zacks #1 Rank stocks, click here.

Top Picks for Significant Growth Potential

Five stocks have been meticulously selected by a Zacks expert as the #1 favorites expected to gain +100% or more in 2024. While not every selection can be a winner, earlier recommendations have surged by +143.0%, +175.9%, +498.3%, and an impressive +673.0%.

Most of the stocks featured in this report are under the radar of Wall Street, offering an excellent opportunity to enter early. Today, discover These 5 Potential Home Runs >>

Stay updated with the latest recommendations from Zacks Investment Research. Download the report: 7 Best Stocks for the Next 30 Days. Click here for your free report.

Baidu, Inc. (BIDU): Free Stock Analysis report

Tencent Holding Ltd. (TCEHY): Free Stock Analysis report

Alibaba Group Holding Limited (BABA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.