“`html

BigBear.ai Holdings, Inc. (BBAI) reported an adjusted EBITDA loss of $8.5 million for Q2 2025, influenced by disrupted Army contracts, despite a record cash balance of $391 million. The recent passage of the One Big Beautiful Bill (OB3) earmarks $170 billion for the Department of Homeland Security and $150 billion for defense technology, presenting opportunities for BigBear.ai in markets like border biometrics and AI autonomy.

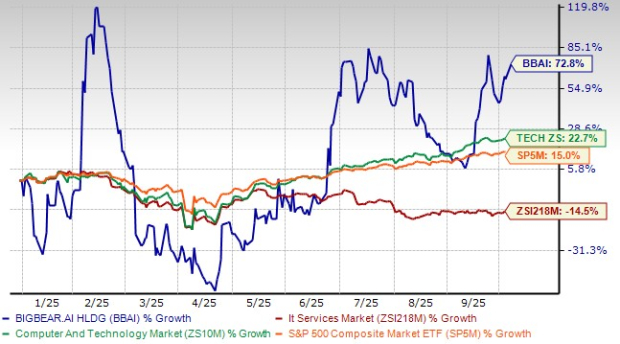

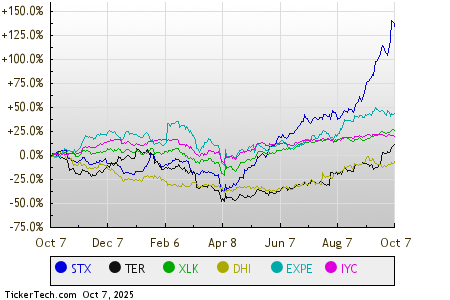

BigBear.ai aims to innovate beyond traditional defense AI to include “physical AI” and Internet of Things (IoT) integration, enhancing its core platforms such as veriScan and ConductorOS. Shares have increased by 72.8% year-to-date, leading in performance over the Zacks Computers – IT Services industry, with a forward price-to-sales ratio of 17.81, slightly above the industry average of 17.14. The loss per share estimate for 2025 has widened to $1.10 from 41 cents over the past 60 days.

“`