“`html

Bitfarms Ltd. (BITF) has experienced a surge of over 400% in its share price over the past six months, significantly outperforming the Technology Services industry (194.6% vs. 34.8%) in 2023. The strategic shift from Bitcoin (BTC) mining to high-performance computing (HPC) and artificial intelligence (AI) data centers has contributed to this rally, alongside a rising BTC price that recently hit $125,000, marking a year-to-date gain of 14.8%.

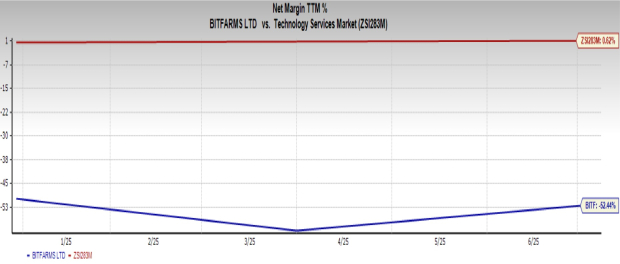

Bitfarms increased its convertible note offerings from $300 million to $500 million to expedite the development of its HPC/AI infrastructure projects. However, the company’s financials remain concerning, as it reported a net loss of $29 million in Q2 2023, compared to a $27 million loss in the same period last year. Bitfarms’ net profit margin stands at -52.44%, significantly lower than the industry average of 0.62%.

Experts advise caution for new investors considering BITF under $5, citing that the company’s fundamentals are not aligned with its rising share price trajectory. Currently, Bitfarms holds a Zacks Rank of #3 (Hold).

“`