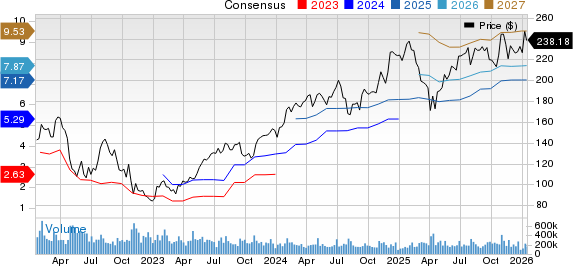

Broadcom Inc. (AVGO) is facing scrutiny for its current stock valuation, rated as overvalued with a Value Score of D. AVGO is trading at a forward 12-month price/sales ratio of 15.93X, significantly higher than the Zacks Computer and Technology sector’s average of 7.39X and pricier than competitors such as NVIDIA (NVDA) at 15.17X and Marvell Technology (MRVL) at 6.86X.

In fiscal 2025, Broadcom reported a 65% surge in AI revenues, reaching $20 billion, with expectations to double this to $8.2 billion in Q1 fiscal 2026. Strong demand for AI-specific products, particularly from major clients like Alphabet (GOOGL) and Meta Platforms, has contributed to a record order backlog of over $162 billion, including $73 billion in AI-related orders. However, the company also faces challenges, including soft gross margin guidance and intensified competition from NVIDIA and Marvell.

The Zacks Consensus Estimate for AVGO’s fiscal 2026 earnings is $9.93 per share, reflecting a 45.6% growth from fiscal 2025, while revenues are projected at $94.03 billion, a 47.2% increase. The company’s stock has appreciated 49.5% over the past 12 months, outperforming both its sector and key competitors.