Crocs Stock Down 30%: A Potential Investment Opportunity

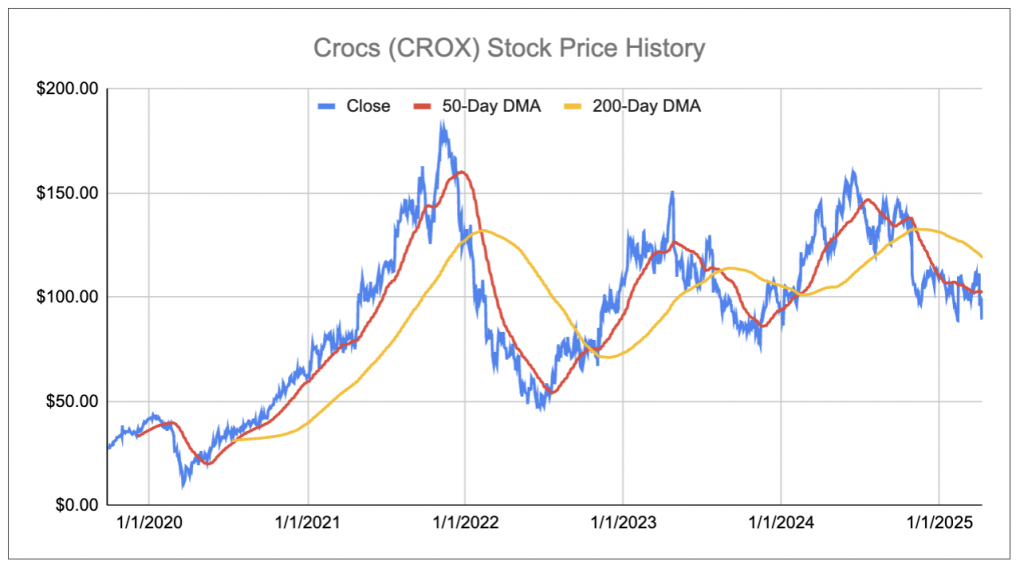

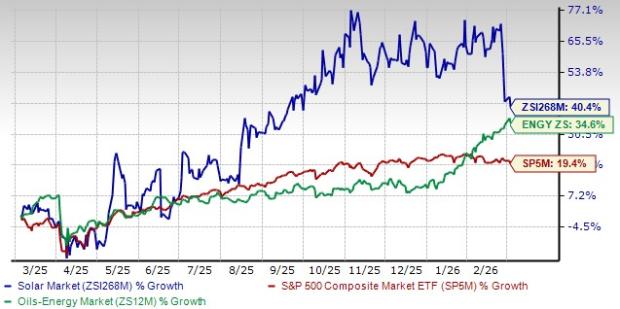

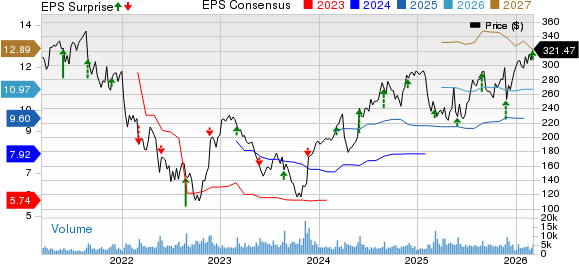

Crocs stock (NASDAQ: CROX) has declined over 30% in the past six months, presenting a notable value opportunity for investors. The stock’s downward trend began in mid-2024, culminating in a sharp decrease in late October when the company reported revenue declines from its acquired HeyDude brand. This drop is particularly alarming because Crocs incurred significant long-term debt to finance this acquisition. Furthermore, recent tariff announcements have led to a broad sell-off in consumer discretionary stocks, with Crocs particularly impacted due to its manufacturing operations in countries such as China and Mexico. If you’re looking for potential upside with reduced volatility compared to investing in a single stock, consider the High-Quality portfolio, which has outperformed the S&P 500, delivering returns exceeding 91% since its inception.

Trefis

Reasons Crocs is Valued Favorably

Despite these challenges, investors purchasing CROX now can benefit from:

- Strong cash generation with nearly a 25% free cash flow margin, alleviating debt concerns.

- Consistent growth, achieving approximately 23% annual growth over the past three years despite recent setbacks.

- A commitment to core brands while expanding its higher-margin direct-to-consumer operations globally.

- Enhanced resilience against tariff impacts compared to competitors like DECK and SHOO.

- An exceptionally undervalued stock, currently trading at a price-to-earnings ratio of just 6, a significant discount compared to peers DECK, NKE, and SHOO, which have higher multiple valuations despite lower cash flow margins.

CROX vs. Peers

Additional Insights for Consideration

From a technical analysis standpoint, CROX appears ready for a rebound. The stock has fluctuated in significant cycles over the past four years and now rests at a cyclical low. This price level has historically served as a launch pad for upward momentum, as seen in April 2021, November 2022 (post-consolidation), and again in November 2023.

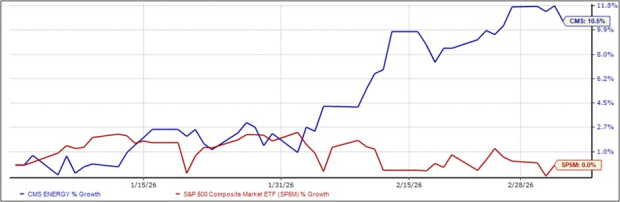

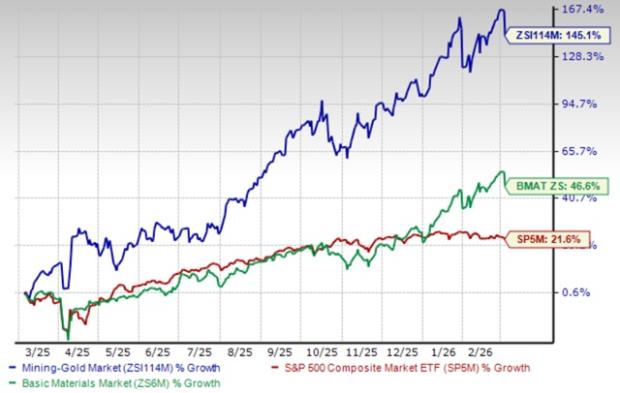

If the volatility of CROX stock concerns you, the Trefis High-Quality (HQ) Portfolio, comprising 30 stocks, has a history of consistently outperforming the S&P 500 over the last four years. This performance is attributed to the HQ Portfolio’s ability to provide superior returns with less risk compared to the benchmark index, noticeably reducing market fluctuations in the process.

Invest with Trefis to explore Market-Beating Portfolios

and discover the Trefis Price Estimates.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.