According to OilPrice.com, the price of West Texas Intermediate (WTI) crude is currently above $56 per barrel, a significant decline from approximately $70 per barrel a year ago. This price drop is impacting the upstream operations of Exxon Mobil Corporation (XOM), which relies heavily on these operations for earnings. Despite the challenges posed by low oil prices, ExxonMobil maintains a strong financial position with a debt-to-capitalization ratio of 13.6%, well below the industry average of 28.7%.

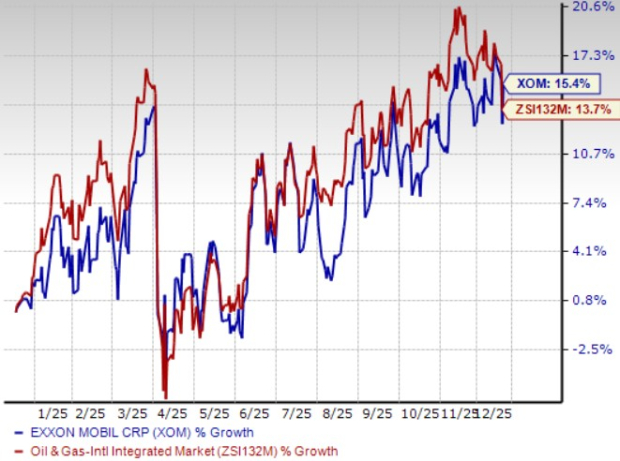

Other major players like Chevron Corporation (CVX) and EOG Resources Inc (EOG) are also facing similar pressures due to declining crude prices. However, CVX and EOG boast debt-to-capitalization ratios of 17.52% and 20.26%, respectively, allowing them to weather the market’s uncertainties effectively. Over the past year, XOM’s shares have increased by 15.4%, outperforming the 13.7% growth of its industry composite stocks.