**IBM’s Stock Performance and Growth Trends**

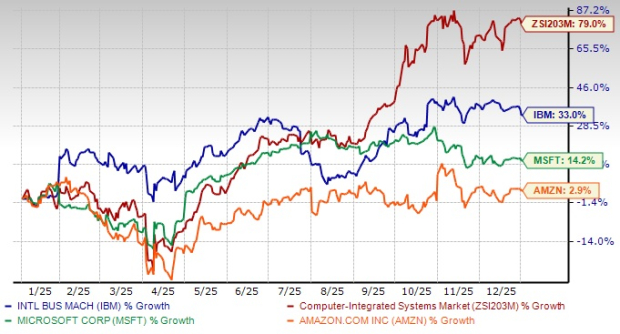

International Business Machines Corporation (IBM) has increased 33% over the past year, despite the industry’s growth of 79.1%. The surge is attributed to heightened demand for hybrid cloud and artificial intelligence (AI) products, significantly outpacing competitors like Microsoft, which gained 14.2%, and Amazon, at 2.9%.

The company anticipates ongoing growth due to strong demand for its hybrid cloud solutions and integration of AI technologies. Notably, IBM’s earnings estimates for 2025 and 2026 have risen by 15.4% to $12.24 and 16.3% to $13.07, respectively. Additionally, IBM has partnered with Cisco to develop a network of connected quantum computers by 2030.

From a valuation perspective, IBM’s shares currently trade at a price/sales ratio of 4.13, which is lower than the industry’s 4.86 but higher than its own historical mean of 3.63, suggesting a strategic investment opportunity.