“`html

International Business Machines Corporation (IBM) has reported significant profit growth in its Software segment, driven by product innovation and increasing adoption of hybrid cloud services. The Software segment encompasses Hybrid Cloud (formerly Red Hat), Automation, Data, and Transaction Processing businesses. This evolution has positioned IBM to effectively assist organizations in optimizing IT costs and enhancing operational efficiency through automation.

IBM’s hybrid cloud services have been gaining traction, with clients showing strong demand trends in automation and generative AI solutions like watsonx. The recent acquisition of HashiCorp has bolstered IBM’s capabilities in managing complex cloud environments, alongside previous buyouts of StreamSets and webMethods that enhance API management and AI data automation.

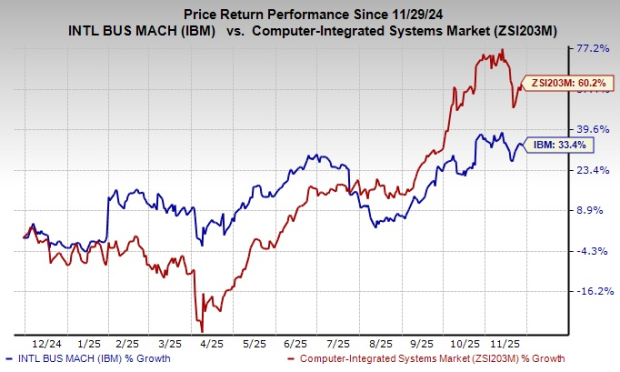

As of now, IBM’s share price has increased by 33.4% over the past year, compared to the industry growth of 60.2%. The company’s forward price-to-sales ratio stands at 4.05, below the industry average of 4.39. This financial data indicates IBM’s positioning as both a competitive player in the tech industry and a company that continues to evolve in response to market demands.

“`