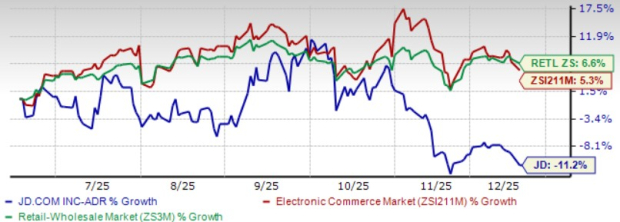

JD.com shares have dropped 11.2% over the past six months, significantly underperforming the Zacks Retail-Wholesale sector’s 6.6% return and the Zacks Internet-Commerce industry’s 5.3% growth. This decline is attributed to concerns over profitability pressures from new business investments, slowing growth in electronics after government subsidies ended, and ongoing losses from food delivery operations.

In the third quarter of 2025, JD reported an operating loss of RMB 15.7 billion in its food delivery segment as it transitioned to a hyperlocal logistics network. While annual active customers surpassed 700 million and revenues reached RMB 250.6 billion, with general merchandise growing 18.8% year over year, profit margin recovery remains uncertain due to ongoing competitive pressures from companies like PDD Holdings and Alibaba. The Zacks Consensus Estimate for JD’s fourth-quarter EPS is at 56 cents, representing a year-over-year decline of 45.10%.

Despite these challenges, JD’s valuation appears attractive, trading at a forward price-to-earnings ratio of 9.33x compared to the industry average of 23.69x. JD continues to show user growth and improved revenue mix, although it faces an uphill battle for margin recovery as it invests heavily in new business lines and logistic efficiencies.