The recent months have brought challenging times for shareholders of both JetBlue Airways (NASDAQ:JBLU) and Spirit Airlines (NYSE:SAVE). About a year ago, the two carriers were steering towards a merger, aiming for substantial cost reductions, anticipated to reach between $600 million and $700 million annually.

However, a recent court ruling striking down the merger has sent shockwaves through the aviation industry. This ruling was based on the concern that the combination would harm the most price-conscious consumers by effectively eliminating low fare travel options.

JetBlue Airways: A Promising Prospect

Despite the adversity faced by the aviation industry, JetBlue Airways presents a promising opportunity for value-oriented investors who are comfortable with a certain level of risk.

JetBlue Airways has seen its shares decline by an impressive 41.3% over the past year. This downturn can be attributed to both underlying business issues and the uncertainties stemming from the proposed Spirit Airlines merger.

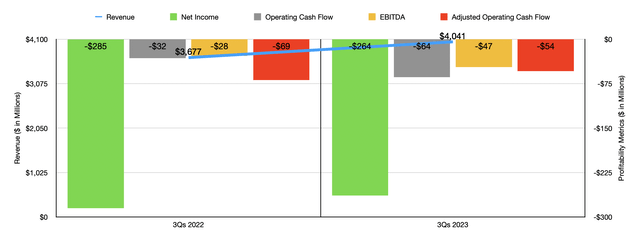

Although the situation presents both positive and negative facets, JetBlue Airways stands out as a potentially strong investment. While the potential merger with Spirit Airlines would have brought about synergies, the latter’s lack of profitability since 2019 and its significant debt presents a tangible downside to the proposition.

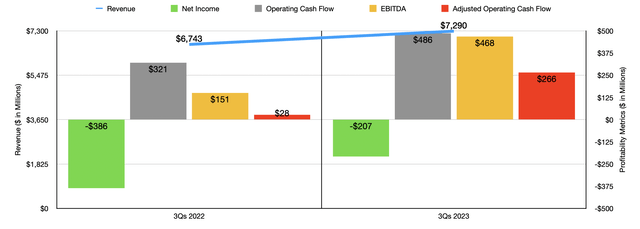

However, JetBlue Airways stands on much firmer ground. Despite reporting a loss of $207 million during the first nine months of 2023, the company boasts strong positive cash flow. Notably, its operating cash flow has increased to $486 million and its EBITDA has expanded to $468 million during the same period. These figures indicate a resilient and growing business, especially when compared to its industry peers.

While the company has faced an increase in certain costs, it has managed to offset them with a reduction in fuel expenses. This, coupled with a rise in revenue passengers, has significantly contributed to the growth in revenue from $6.74 billion to $7.29 billion.

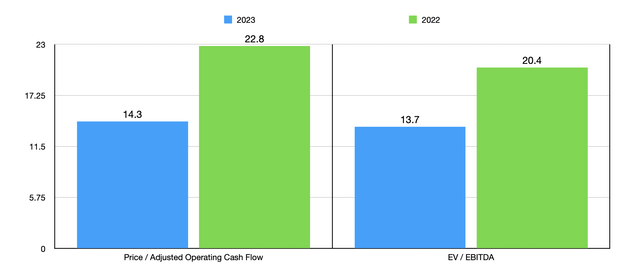

Valuing JetBlue Airways using EBITDA and operating cash flow metrics places its shares at an attractive valuation. With a price to operating cash flow multiple of 2.9 and an EV to EBITDA multiple of 6.2, the company presents an appealing investment.

In contrast, the company is more expensive than some of its competitors, with only four companies out of the five compared being cheaper on a price to operating cash flow basis.

JetBlue Airways: Navigating Earnings and Mergers

It’s never easy to predict how a company will perform in the stock market, and when it comes to evaluating the financial health of an airline, the task becomes akin to reading tea leaves. JetBlue Airways, a stalwart in the bustling airline industry, is gearing up to report its earnings, with investors holding their breath as they await the verdict. As the airline strives to soar to new heights, much discussion surrounding its potential merger with Spirit Airlines is gaining momentum. Let’s dive into the numbers and situational landscape to decipher what the future holds for the airline giant.

Financial Health Comparison

As a seasoned investor, crafting an in-depth appraisal of JetBlue Airways involves navigating through a maze of financial metrics. With an EV to EBITDA approach, it becomes apparent that three out of the five compared were inexpensively valued. Nevertheless, factors like leverage must be factored in. JetBlue Airways boasts a net leverage ratio of about 3.71, positioning it favorably against two out of five counterparts with heavier indebtedness relative to cash flows.

| Company | Price / Operating Cash Flow | EV / EBITDA | Net Debt / EBITDA |

| JetBlue Airways | 2.9 | 6.2 | 3.71 |

| Allegiant Travel Company (ALGT) | 2.9 | 5.8 | 3.05 |

| SkyWest Inc. (SKYW) | 3.1 | 8.4 | 5.49 |

| Controladora Vuela Compania de Aviacion (VLRS) | 1.3 | 4.9 | 10.61 |

| Sun Country Airlines Holdings (SNCY) | 4.2 | 5.8 | 2.58 |

| Air Canada (OTCQX:ACDVF) | 1.7 | 3.2 | 1.90 |

Earnings Outlook and Industry Prospects

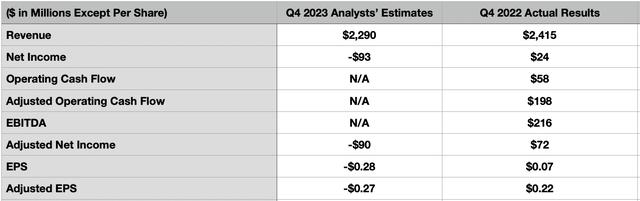

The impending announcement of JetBlue Airways’ earnings has investors on tenterhooks. With an anticipated revenue of approximately $2.29 billion, the midpoint guidance sits marginally lower at $2.21 billion, signaling a year-over-year decline from the $2.42 billion recorded in the final quarter of 2022. This downward trend extends to profitability, as earnings and adjusted earnings are poised to dip below the previous quarter’s figures.

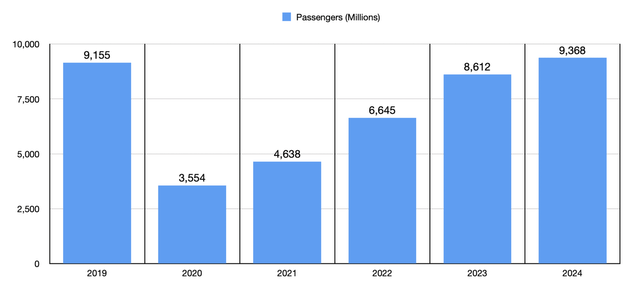

Nevertheless, amidst the palpable apprehension, the long-term industry outlook exudes promise. The projected global air traffic of 9.4 billion passengers in the current year, up from 8.6 billion in 2023, and surpassing the pre-pandemic peak of 9.2 billion in 2019, augurs well for sustained industry growth – a harbinger of potential upturns in revenue, profitability, and cash flow for JetBlue Airways.

Merging Horizons: Prospects and Pitfalls

The prospect of a union between JetBlue Airways and Spirit Airlines remains a subject of fervent speculation. Although the odds appear slim, recent developments, including an appeal filed by both companies against a merger judgement, hint at a glimmer of possibility. Uncertainty shrouds the duration and outcome of this appeal, but should the stars align, shareholders of both entities stand to reap handsome rewards.

Takeaway

As we await JetBlue Airways’ earnings reveal, the overarching outlook for the company and the industry is notably upbeat. While optimism shrouds JetBlue Airways, the cloud of uncertainty looms over Spirit Airlines due to its persistent bottom-line frailty. Regardless, JetBlue Airways remains enticing on the fundamentals, anchored by robust 2023 cash flows. If the merge materializes, synergies could potentially unlock substantial value for stakeholders of both entities. The road ahead is rife with opportunities, and JetBlue Airways is poised to seize them with unyielding vigor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.