Understanding Marvell Technology’s Stock: Analyst Recommendations and Insights

When making decisions about buying, selling, or holding a stock, many investors turn to analyst recommendations for guidance. Reports about changes in these ratings by sell-side analysts can affect a stock’s price. However, how significant are these recommendations when it comes to actual investment strategies?

To illustrate this point, let’s examine the current consensus among analysts regarding Marvell Technology (MRVL) before delving into the reliability of brokerage recommendations and how they can be utilized effectively.

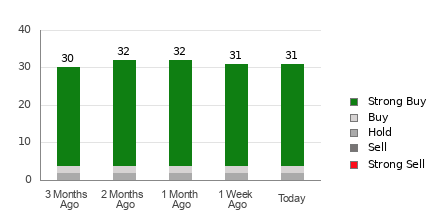

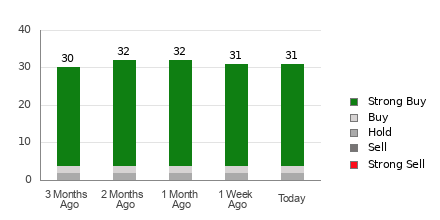

Current Analyst Recommendations for Marvell Technology

Marvell holds an average brokerage recommendation (ABR) of 1.19, rated on a scale from 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell). This ABR reflects the recommendations from 31 brokerage firms, with a rating of 1.19 corresponding to a position between Strong Buy and Buy. Notably, out of the 31 recommendations, 27 are Strong Buy and 2 are Buy, resulting in Strong Buy and Buy suggesting approximately 87.1% and 6.5% of all recommendations, respectively.

Check price target & stock forecast for Marvell here>>>

While the ABR suggests a positive investment outlook for Marvell, relying solely on this metric may not yield the best results. Research indicates that brokerage recommendations often fall short in successfully guiding investors towards stocks with the highest potential for price increases.

Understanding the Limitations of Brokerage Recommendations

Why should investors be cautious? Brokerage firms often possess a vested interest in the stocks they analyze, leading their analysts to display a strong positive bias in their ratings. Research shows that for every “Strong Sell” recommendation, firms typically issue five “Strong Buy” ratings. This misalignment suggests that brokerage analysts do not always mirror the true interests of retail investors, making it risky to depend on these ratings alone for predicting stock price movements.

Investors can benefit more from employing their own analyses, complemented by insights from established tools like the Zacks Rank, which boasts a reliable track record in forecasting stock performance.

Differentiating Zacks Rank from ABR

While both the Zacks Rank and ABR utilize a 1-5 scale, they measure different factors. The ABR is derived from brokerage recommendations and is often seen in decimal form (such as 1.28). Conversely, the Zacks Rank is a quantitative model that focuses on earnings estimate revisions and is displayed in whole numbers—from 1 to 5.

Typically, analysts from brokerage firms remain overly optimistic in their assessments. They may provide ratings that do not adequately reflect the underlying research, which can mislead investors. In contrast, the Zacks Rank accurately correlates with trends in earnings estimate revisions, which are strongly tied to near-term price movements, as shown by empirical evidence.

Furthermore, the Zacks Rank is consistently updated based on brokerage analysts’ revisions of earnings estimates, allowing for timely signals regarding future stock price trends.

Evaluating Marvell Technology’s Investment Potential

For Marvell, the Zacks Consensus Estimate for the current year has risen by 0.6% over the past month to $2.76 per share. This growth in analysts’ earnings estimates, reflected by a strong collective agreement to adjust EPS forecasts upward, may indicate a promising future for the stock.

The increase in the consensus estimate, alongside other related earnings factors, has garnered Marvell a Zacks Rank #2 (Buy). Investors can find the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here>>>>

Consequently, while Marvell’s ABR suggests a favorable investment environment, utilizing it in conjunction with other analytical tools may enhance decision-making for investors.

Zacks Highlights Top Semiconductor Stock

This stock is merely 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation. While NVIDIA continues to perform well, this emerging chip stock possesses greater potential for expansion.

With robust earnings growth and an expanding customer base, it is well-positioned to address the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is expected to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Marvell Technology, Inc. (MRVL): Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.