“`html

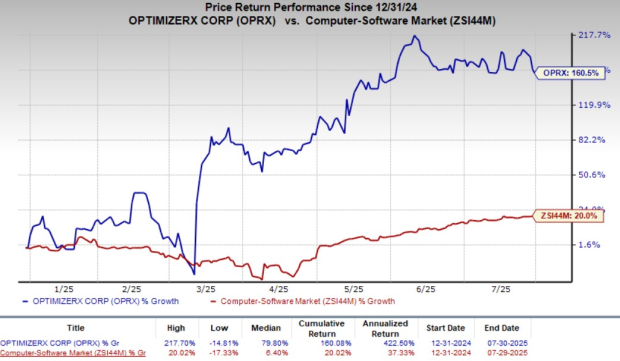

OptimizeRx Corp. (OPRX) has seen a significant 160.5% surge in its share price year-to-date, outpacing the industry growth of 20%. The company reported double-digit top-line growth over the last two quarters and is shifting from transactional to subscription-based revenues, which are projected to account for 5% of its revenues in 2025. As a part of its innovative strategy, OptimizeRx integrates point-of-care and direct-to-consumer marketing through its omnichannel platform, achieving a 25% average script lift for pharma clients and ROI exceeding 10:1 on 6-month campaigns.

For fiscal Q1 2025, OptimizeRx reported a gross margin of 60.9%, down from 68.2% in the previous quarter, influenced by increased direct-to-consumer managed services. Despite this margin volatility, its net revenue retention rose to 121% for fiscal 2024. The Zacks Consensus Estimate forecasts a 63.6% improvement in OPRX’s earnings per share for 2025 compared to 2024.

In comparison, Doximity (DOCS) reported a 20% year-over-year revenue growth, emphasizing the expansion of its user base, which now exceeds 2 million verified U.S. medical professionals. Veeva Systems Inc. (VEEV) also demonstrated strong performance with a 16.7% year-over-year revenue growth in Q1 of fiscal 2026, driven by its Vault CRM platform and crossix data unit, which experienced over 30% growth year-on-year.

“`