Roku, Inc. (ROKU) Sustains Growth and Expands Internationally

Roku’s ROKU shares have risen 5.8% in the past six months compared to the Zacks Consumer Discretionary sector’s growth of 5.3%. This performance highlights Roku’s competitive standing as a leading TV streaming platform across the United States, Canada, and Mexico, based on hours streamed. Strengthening advertising revenues, driven by increased video ad impressions, reveal the platform’s growing popularity.

The company is not only dominant in North America but is also systematically expanding into international markets. Notable recent developments include the launch of the National Women’s Soccer League Zone, a centralized hub for fans to watch live matches and highlights. Additionally, Roku acquired exclusive streaming rights to the documentary Just a Bit Outside, centered on the 1982 Milwaukee Brewers, which will be accessible on The Roku Channel.

ROKU’s 6-Month Performance

Image Source: Zacks Investment Research

How ROKU is Excelling in Advertising

Roku’s advertising segment has emerged as a key growth engine. In the fourth quarter of 2024, the company saw exceptional growth, even without political ad expenditures, which contributed about 6% to Platform revenues. Roku is diversifying its advertising clientele beyond traditional media and entertainment. Verticals such as retail and automotive continue to exhibit strong performance.

Through a new partnership with Yahoo DSP, Roku enhances advertisers’ targeted reach utilizing Roku Data Cloud and Roku Exchange. Innovative ad units such as Video Marquee ads on the home screen and interactive Brand Showcases, including a successful Neutrogena campaign, have resulted in improved viewer engagement.

Furthermore, Roku has expanded its self-service ad platform for small and medium-sized businesses (SMBs). The launch of the Roku Ads Manager in 2024 enables these businesses to access television streaming ads, broadening Roku’s advertiser base. Anticipating continued growth, Roku is well-positioned as a leader in CTV advertisement spending as it progresses into 2025.

Roku’s International Growth Strategy

Roku is making substantial advances in its international presence, particularly in North America, Central America, Latin America, and the U.K. This is crucial as they face streaming competitors like Netflix (NFLX), Disney (DIS)-owned Disney+, and Amazon (AMZN) Prime Video, which offer competitively priced content.

As the leading streaming platform in Canada, Mexico, and the U.S. (based on hours streamed), Roku is rapidly expanding in Latin America and the U.K. The company is enhancing its partnerships with TV manufacturers and retailers in Brazil, Colombia, Chile, Peru, and the U.K. To improve the user experience, Roku has introduced the OLED Philips Roku TV, which merges premium audio-visual performance with advanced streaming functionalities.

Additionally, Roku has focused on monetizing its presence in Mexico, having over 40% broadband penetration. Other markets in Latin America are still developing their ad capabilities, with monetization anticipated as digital advertising use increases. Roku aims to reach 100 million streaming households by 2026, suggesting that international markets will be vital revenue sources in the future.

Positive Outlook for 2025

Looking ahead to 2025, Roku projects total net revenue of $4.61 billion, reflecting a 12% increase year-over-year. Additionally, Platform revenues are expected to rise to $3.95 billion, also up 12% year over year. Excluding the impact of political ad spending, this forecast indicates a 15% growth, slightly exceeding the anticipated 2024 rate.

Roku is forecasting an Adjusted EBITDA of $350 million, signifying a 35% increase from 2024, demonstrating improved profitability as the company scales. The Zacks Consensus Estimate for 2025 revenues is $4.62 billion, implying a year-over-year growth of about 12.23%. The earnings consensus points to a loss of 27 cents per share, signaling a notable improvement of approximately 69.66% year over year compared to a loss of 89 cents a year prior.

Image Source: Zacks Investment Research

Consensus Estimate Trend for ROKU

Roku has consistently exceeded the Zacks Consensus Estimate over the past four quarters, achieving an average surprise of 55.07%.

Find the latest earnings estimates and surprises on Zacks earnings Calendar.

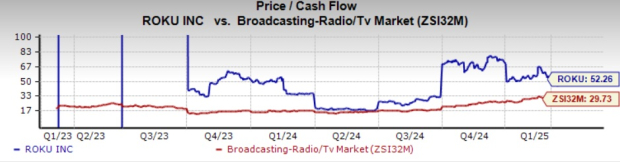

Despite Roku’s two-year price-to-cash flow ratio of 52.26X surpassing the Zacks Broadcast Radio and Television industry average of 29.73X, this premium valuation underscores investor confidence in the company’s future growth trajectory through 2025.

ROKU’s Price/Cash Flow Ratio

Image Source: Zacks Investment Research

Why ROKU Stock is a Strong Buy

Investors may find it appealing to purchase Roku stock in 2025 for numerous valid reasons, despite its premium valuation. Roku has solidified itself as the leader in household streaming, commanding the top spot in hours streamed across the United States, Canada, and Mexico. Its penetration of over half of U.S. broadband households lays a solid foundation for prospective growth, granting Roku considerable influence during negotiations with content providers and advertisers.

In addition to its market dominance, Roku is implementing strategic initiatives in advertising, partnering with content creators, and monetizing its platform to cultivate diverse revenue streams. International expansion also presents a significant growth opportunity outside the U.S. market.

Currently, Roku holds a Zacks Rank #2 (Buy) and boasts a Growth Score of A, making it an attractive investment opportunity. Those interested can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Recently released: Experts highlight 7 elite stocks from a list of 220 Zacks Rank #1 Strong Buys, identifying them as “Most Likely for Early Price Pops.”

Since 1988, this full list has significantly outperformed the market, with an average annual gain of +24.3%. Consider these hand-picked stocks immediately.

See them now >>

Want the latest from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days today. Click for this complimentary report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Netflix, Inc. (NFLX): Free Stock Analysis report

The Walt Disney Company (DIS): Free Stock Analysis report

Roku, Inc. (ROKU): Free Stock Analysis report

This article was initially published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.