Salesforce Stock Struggles But Long-Term Growth Outlook Remains Strong

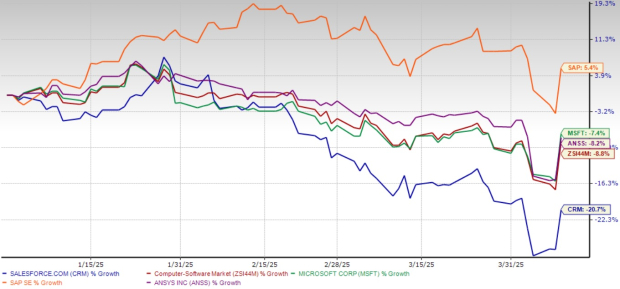

Salesforce, Inc. (CRM) has faced significant challenges this year, with its stock falling 20.7% year to date. This decline outpaces the broader Zacks Computer – Software industry, which is down 8.8% during the same timeframe. When compared to major competitors such as Microsoft Corporation (MSFT), SAP SE (SAP), and ANSYS, Inc. (ANSS), Salesforce’s struggles appear even more severe.

Recent Stock Performance of Salesforce

Image Source: Zacks Investment Research

This notable decline raises a pivotal question for investors: Should they cut their losses and move on, or is it prudent to hold their shares? Though the immediate challenges are substantial, Salesforce’s long-term growth prospects remain robust, bolstering the case for retention.

Reasons Behind Salesforce’s Underperformance

Salesforce’s struggles are part of a broader tech market retreat fueled by concerns over escalating tariff conflicts and a slowdown in economic growth. This downturn has been exacerbated by a disappointing fourth-quarter fiscal 2025 performance.

While revenues increased by 7.5% year over year to $9.99 billion, this result slightly missed the Zacks Consensus Estimate. Of particular concern is the guidance for revenue growth, which is projected to further decelerate to 6-8% for both the first quarter and the full fiscal 2026. This contrasts sharply with the double-digit growth rates that investors have come to expect in previous years.

Salesforce Stock Price, Consensus, and EPS Surprise

Salesforce Inc. price-consensus-eps-surprise-chart | Salesforce Inc. Quote

Additionally, enterprise customers are tightening their IT budgets due to economic uncertainties, which has stymied Salesforce’s momentum. Analysts predict that this cautious spending climate may continue, with the Zacks Consensus Estimate forecasting revenue growth of 7.6% in fiscal 2026 and 9.3% in fiscal 2027.

While this expected growth is slower than its historical trends, it is essential to note that Salesforce remains a dominant player in enterprise customer relationship management (“CRM”) software.

Salesforce’s Position in the CRM Market

Despite current growth worries, Salesforce holds its ground as the unequivocal leader in the CRM space. The company continues to outperform competitors like Microsoft, Oracle, and SAP, retaining the largest market share according to Gartner’s rankings. This leadership position is unlikely to diminish in the near future.

Salesforce is also expanding its ecosystem, seamlessly integrating with various enterprise applications. Recent acquisitions, including Slack and the Own Company, reflect a long-term strategy to branch out from CRM into areas such as enterprise collaboration, data security, and AI-driven automation.

AI stands out as a crucial growth component for Salesforce. Since introducing Einstein GPT in 2023, the company has integrated generative AI across its platform, enabling customers to automate workflows and enhance decision-making processes. As generative AI becomes more widely adopted, Salesforce is well-positioned to take advantage of this trend.

Further, global spending on generative AI is on the rise. Gartner predicts that worldwide spending will reach $644 billion by 2025, marking a 76.4% year-over-year increase. Within this, enterprise software, a vital segment for Salesforce, is anticipated to grow even more rapidly at 93.9%. Even if short-term economic conditions affect spending, digital transformation continues to be a priority, ensuring persistent demand for Salesforce’s offerings.

Salesforce’s Valuation Outlook

One bright side of the recent market sell-off is that Salesforce’s valuation is becoming more reasonable. The stock currently trades at a forward 12-month price-to-earnings (P/E) multiple of 23.31x, which is lower than the industry average of 27.82x. Although not exceptionally cheap, this valuation indicates that much of the prevailing pessimism is already reflected in the stock price.

Salesforce Forward 12-Month P/E Ratio

Image Source: Zacks Investment Research

Furthermore, Salesforce has a competitive P/E ratio compared to peers like Microsoft, ANSYS, and SAP, which currently sport P/E multiples of 27.25x, 25.93x, and 37.42x, respectively.

Conclusion: A Hold Recommendation for Salesforce Stock

Salesforce’s recent challenges are a result of broader market corrections and growth concerns. Nevertheless, considering its leading position in enterprise software, ongoing AI initiatives, and solid long-term growth potential, the recent stock pullback does not warrant selling.

Additionally, its valuation has become more appealing relative to historical norms. While short-term challenges persist, the company’s fundamentals remain robust, making it wise to maintain a holding position. Currently, Salesforce has a Zacks Rank of #3 (Hold). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Explore Top Stock Picks for the Next Month

Just released: Experts have selected seven premier stocks from the current roster of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.”

Since 1988, the exhaustive list has outperformed the market by more than double with an average annual gain of +23.9%. Don’t miss out on these meticulously chosen stocks.

Discover them now >>

For the latest insights from Zacks Investment Research, download 7 Best Stocks for the Next 30 Days. Click for your free report.

Microsoft Corporation (MSFT): Free Stock Analysis report.

Salesforce Inc. (CRM): Free Stock Analysis report.

SAP SE (SAP): Free Stock Analysis report.

ANSYS, Inc. (ANSS): Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.