Tesla’s Stock Decline Sparks Concerns Over Valuation and Future Growth

Tesla’s stock has declined almost 50% in the past three months, erasing significant gains and leading investors to question if Elon Musk’s ambitious electric vehicle (EV) phase is over. Historically, Tesla has defied market trends, yet its current valuation appears increasingly disconnected from its automotive performance. Much of its market value is based on future promises related to autonomous ride-hailing and robotaxi technologies, which have not yet been realized.

Concerns are intensifying regarding falling vehicle sales, particularly in critical markets such as Europe. Musk’s political engagements have also contributed to skepticism about Tesla’s future. While some analysts continue to predict remarkable growth fueled by new technology, others caution that the current premium appears unsustainable in a competitive market facing economic pressures.

Market Overview

- Tesla’s market capitalization has dropped 45% since its December peak, indicating rising investor hesitance.

- The bulk of Tesla’s valuation is dependent on unproven technologies like robotaxis and autonomous driving.

- Declining sales in Europe and heightened political distractions have led to further doubts about the sustainability of its premium valuation.

Key Points

- Analysts are divided; some maintain bullish price targets even amid deteriorating fundamentals.

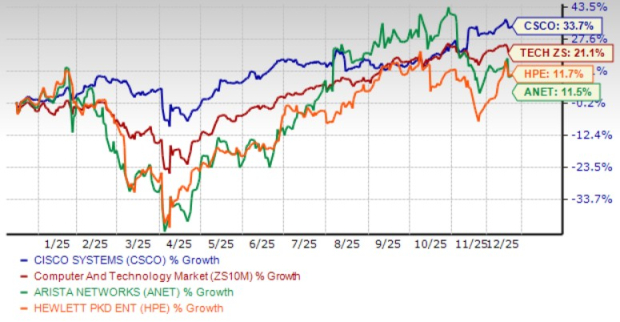

- Comparisons to traditional automakers such as GM and Ford reveal a stark difference in valuations relative to actual EV performance.

- The dependence on future technological breakthroughs presents a significant risk for Tesla’s stock.

Looking Ahead

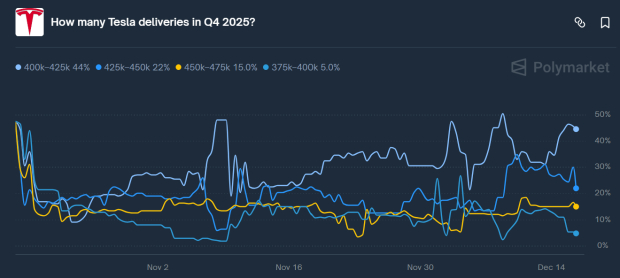

- Upcoming earnings reports and advancements in autonomous technology will be crucial for restoring investor confidence.

- Market volatility may necessitate a reassessment of Tesla’s stock based on more realistic performance metrics.

- Investors will be closely monitoring any progress Tesla makes toward delivering on its robotaxi and self-driving technology promises.

Bull Case

- Tesla continues to lead in the EV space and autonomous technology, backed by a strong brand and loyal customer base that could foster future growth.

- The company’s focus on AI and robotics may create substantial long-term value if developments like robotaxis are successful.

- Despite current setbacks, Tesla’s valuation could still indicate investor optimism regarding future technological advancements and market leadership.

- New models and technologies slated for release could rejuvenate sales and heighten investor confidence.

- Elon Musk’s leadership has historically pushed innovation and growth, potentially leading to forthcoming breakthroughs.

Bear Case

- Tesla’s stock has faced nearly a 50% decline lately, raising doubts about its valuation in relation to actual automotive performance.

- Decreasing vehicle sales, especially in Europe and China, signal weakening demand and escalating competition in the EV marketplace.

- Musk’s involvement in politics and multiple ventures may detract from his focus on core business operations, potentially affecting investor confidence.

- The reliance on unproven technologies such as robotaxis introduces substantial risks, given that these innovations have yet to be realized.

- Tesla’s inflated valuation relative to traditional automakers may be untenable if it does not fulfill its technological promises.

Despite these challenges, Tesla’s image as a pioneer in AI and robotics remains appealing to many investors, even as the gap between expectations and current performance grows. The debate surrounding the justification for its high valuation is ongoing, with the next few quarters likely to be crucial for determining if the company can reconcile its ambitious vision with tangible results.

Looking forward, Tesla’s capability to execute its ambitious autonomous vehicle plans will be pivotal in assessing whether the market’s optimism can persist or if a significant revaluation is on the horizon. As competition intensifies and regulatory demands increase, investors must carefully weigh the potential for groundbreaking innovations against the risks of investing in a stock that is priced substantially above conventional metrics.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.