“`html

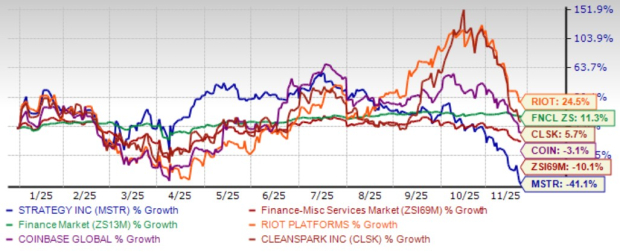

Strategy Inc. (MSTR) has seen its shares decline by 41.1% year-to-date (YTD), significantly underperforming the broader Finance sector, which has grown by 11.3%, and the Financial-Miscellaneous Services industry, which declined by 10.1%. The company’s valuation concerns are evident as it trades at a forward price-to-sales ratio of 99.25X, well above the industry average of 2.92X.

As of October 26, 2025, Strategy holds approximately 640,808 BTC, valued at nearly $71 billion, highlighting its significant Bitcoin position. The company has also generated a 26% BTC yield and reported nearly $12.9 billion in Bitcoin-related gains this year, despite recent challenges. In its third quarter of 2025, total software revenues increased by 10.9% year-over-year, with subscription services rising by 65.4%.

Strategy maintains a positive earnings outlook, projecting $80 per share for 2025, while the Zacks Consensus Estimate stands at $78.04 per share, up from a loss of $15.73 per share previously. The company’s ability to raise approximately $5.1 billion in net proceeds through equity-based financing programs also supports its long-term strategies.

“`