Oil Prices: Short-Term Struggles, but a Potential Rebound Ahead?

Expectations of $100-per-barrel oil are fading fast.

Recently, Saudi Arabia, the world’s leading crude oil producer, announced it will abandon its $100 price target while increasing crude production starting in December. This decision adds to an already plentiful supply that outstrips demand, especially as West Texas Intermediate Crude trades in the high-$60s range.

Is the oil industry doomed? Should investors just wait for a rebound? The answer could be more optimistic than it seems. The key question is timing: when will the turnaround occur, and when should investors act?

Evaluating Oil Demand’s Potential Shift

To understand oil’s outlook for the remainder of the year, we first examine its price trajectory.

After reaching nearly $94 a barrel last fall, oil prices have declined primarily due to oversupply compared to weak demand.

Source: StockCharts.com

As OPEC considers increasing supply further, significant price rises necessitate a substantial increase in demand. Will such an increase materialize before the year ends?

Recent declines in U.S. interest rates might boost economic activity, but the impact of these cuts is often delayed. Therefore, it is unlikely that U.S. oil demand will surge dramatically in the next few months.

The Role of China in Oil Demand

Looking to China, the country has recently announced extensive stimulus measures for its slowing economy. This assistance includes interest rate cuts and a reduction in reserve requirements for banks, the lowest level since at least 2018.

Latest reports indicate that China’s central bank is not only lowering rates but also injecting liquidity into the banking system to support economic growth towards the government’s target of approximately 5% for the year.

The crucial question remains: could this Chinese stimulus spark a resurgence in global oil demand?

Opinions differ between organizations such as OPEC and the International Energy Agency (IEA). Established about 50 years ago to balance OPEC’s power, the IEA and OPEC frequently offer conflicting forecasts, often skewed by their interests.

The disparity in current oil demand predictions is striking. According to a report from The Wall Street Journal, the IEA estimates that consumer demand for oil will grow by an extra 900,000 barrels per day in 2024, while OPEC’s outlook is significantly more optimistic, forecasting an increase of two million barrels per day.

This difference of 1.1 million barrels marks an unprecedented divergence, three times greater than typical variations seen, except during the pandemic when demand was highly unpredictable.

Which projection will prevail? The fate of Chinese demand remains uncertain. Will we witness a buoyant Chinese economy ignited by stimulus, or a continuing struggle against deflation?

OPEC anticipates that China will need an additional 650,000 barrels per day in 2024, while the IEA estimates a much lower figure—less than a third of that. In the first half of this year, China consumed 315,000 additional barrels daily, yet demand has been declining year-over-year for four months.

Given these trends, a major economic boom in China within the next few months seems unlikely for OPEC’s lofty projections to be met.

Thus, while China’s economic policies may help stabilize oil prices and perhaps create a mild increase, relying on these measures to lift oil back into the $80s by the end of the year appears overly optimistic.

On a broader scale, other potential triggers for oil price fluctuations remain. A disruption in supply due to geopolitical tensions in regions like the Middle East or disruptions in Ukraine could affect prices considerably. However, it would be imprudent to base investments solely on unpredictable geopolitical events.

Therefore, in the short term, the outlook for oil does not appear promising.

Could Current Sentiment Signal a Future Turnaround?

How are traders currently viewing the oil market?

The sentiment is largely bearish.

The data reveals the lowest levels of investor optimism seen in 13 years.

Oil Market Sentiment Shifts: Bearish Trends Suggest Future Price Increases

Market Survey Signals Caution on Crude Oil Investments

The latest Bloomberg Markets Live Pulse (BMLP) survey identified crude oil as the trade to “avoid for the rest of the year.” Despite this caution, it hints that prices may be poised to rise—though the timing remains uncertain.

Traders’ Sentiment May Bear Consequences

Interestingly, traders often display extreme bullishness or bearishness just before significant market shifts. When too many participants lean toward one outlook, it can signal potential reversals. A crowded trade often loses momentum when everyone anticipates the same outcome.

Last week, Brett Eversole, editor of Daily Wealth at Stansberry Research, discussed how extreme bearish sentiment frequently precedes bullish returns. He used the Commitment of Traders report to analyze how futures traders have positioned themselves financially, alongside measuring upcoming gains for the S&P 500.

According to Eversole:

Futures traders are nearing a level of bearishness not seen in the last 15 years. Take a look…

Source: Brett Eversole / Daily Wealth / Stansberry Research

Futures traders are more bearish on oil than they have been since June 2023, and a similar sentiment was last seen in 2010.

Evaluating oil price changes over the past 12 months, Eversole found that after low bearish readings, prices historically increased by an average of 62%.

He noted:

In the past, two rallies lasting over a year averaged gains of 96%, while three shorter rallies led to average increases of 39%.

This data indicates a potential opportunity for investors looking into oil.

Analyzing the Bullish Factors for Oil Investment

Ultimately, the balance of supply and demand plays a critical role in determining oil prices. Presently, excess supply is suppressing prices, but that won’t last indefinitely.

Earlier this year, CNBC reported that Vicki Hollub, CEO of Occidental, predicted a severe supply shortage by the end of 2025. She emphasized that 97% of current oil production stems from discoveries made during the 20th century, noting that less than half of the crude produced in the last decade has been replaced.

Hollub stated, “We’re in a situation now where in a couple of years’ time we’re going to be very short on supply.” Current oversupply is keeping prices low, even with ongoing geopolitical tensions in the Middle East. Record oil production in the U.S., Brazil, Canada, and Guyana, alongside decreasing demand from a struggling Chinese economy, contributes to this scenario.

What Lies Ahead for Oil Markets?

As for why the supply-demand imbalance will flip, consider previous insights shared by Reuters last year. Government initiatives aimed at combating climate change are discouraging oil companies from making significant investments, even as they record high profits. This could lead to a tightening supply and rising prices as alternative energy sources try to meet demand.

Exxon Mobil’s CEO Darren Woods warned that oil and gas reserves are depleting at rates of 5-7% annually. If companies don’t maintain investment to replace these reserves, output will diminish.

In summary, while the current market sentiment may appear bearish, underlying factors suggest that a shift toward price appreciation could be just around the corner.

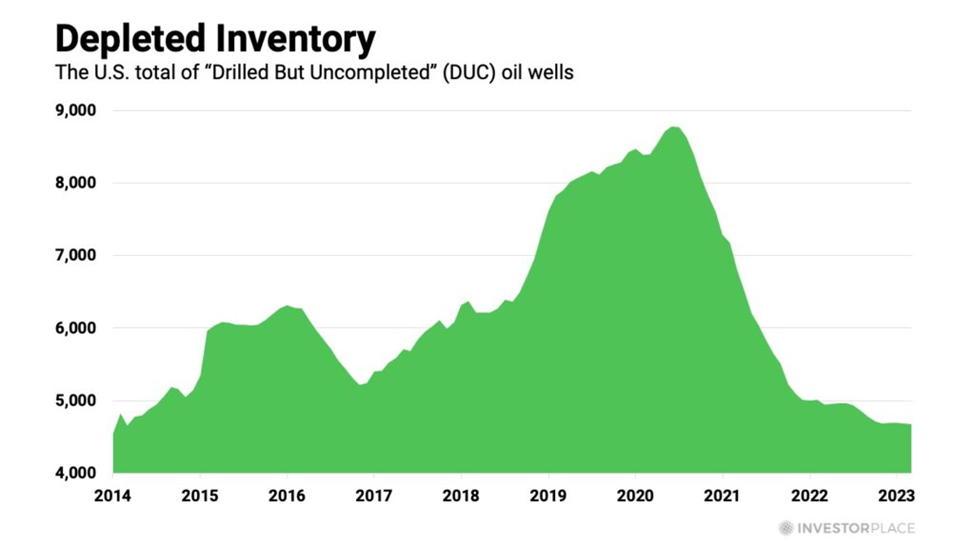

DUC Wells at Decade Low: Implications for the Oil Market

Oil companies face new challenges as Drilled But Uncompleted (DUC) wells hit a historic low, influencing future production strategies.

According to macro expert Eric Fry from Investment Report, the number of DUC wells has plummeted to the lowest point in over ten years. A DUC well is one that has been successfully drilled but not yet put into operation. Simply put, the process of completion remains pending.

These wells are crucial for oil companies because they can be quickly converted into production, allowing firms to take advantage of rising oil prices without large upfront investments. Over the past four years, companies have been capitalizing on this opportunity.

The current situation has led to a significant reduction in DUC inventories, now at a ten-year low. This decrease suggests U.S. oil firms have largely utilized the “easy money” they could earn from price surges. Moving forward, companies will need to invest more in drilling new wells, but this increase in spending is notably absent at the moment.

In fact, the number of active oil-drilling rigs in the U.S. has been declining for over a year and is now 26% below the 10-year average. This indicates that a considerable boost in U.S. oil supply is not anticipated anytime soon.

The takeaway is clear: the current supply/demand dynamic is likely to shift into a strong tailwind in about 15 months.

Exploring Big Oil’s Current Valuations

For context, the S&P 500 index currently boasts a price-to-earnings (PE) ratio of 29.9, alongside a dividend yield of merely 1.3%.

Now, consider these alternatives within the oil sector:

- Exxon: PE 13.9, dividend yield 3.4%

- Shell: PE 11.6, dividend yield 4.2%

- ConocoPhillips: PE 11.7, dividend yield 3.0%

- Diamondback Energy: PE 8.7, dividend yield 6.4%

- Equinor: PE 7.6, dividend yield 5.4%

It’s essential to recognize that these stocks may face downward pressures in the near term. However, trying to predict the absolute “bottom” can be unwise. Longer-term investors should focus on whether current prices can yield profits within the next 18 to 24 months.

The outlook looks promising.

Next Steps for Investors

The landscape for Big Oil seems to offer favorable long-term investment opportunities. Yet, what about immediate trading strategies?

Now is not the time to enter the market.

Current momentum points toward negative performance, as we may finish the third consecutive month of losses. It is crucial to respect this trend. Fighting against a strong market direction can lead to significant financial losses.

While a reversal could happen tomorrow—suggested by extreme COT readings—thinking strategically means we should wait for clearer indications of a market shift. Jumping in prematurely would likely be a gamble without a solid foundation.

Nonetheless, don’t lose sight of the wider picture. This imbalance in supply and demand is on track for a major turnaround, and present pessimism is setting the stage for future optimism.

Wishing you a productive evening,

Jeff Remsburg