The Ineffectiveness of Put Options for S&P 500 Investors

Long-term investors in the S&P 500 might consider purchasing out-of-the-money put options as a hedge against potential losses during a prolonged bearish market. However, is this approach historically effective? Are the protective benefits worth the associated costs?

Put Options: Costly and Misguided

With 15 years in options brokerage, I have firsthand experience purchasing put options for clients looking to protect portfolios with stocks like SPY. In many cases, these options failed to deliver the desired protective benefits. As Roni Israelov noted in his 2017 paper, using put options for long-term protection against S&P 500 investments often proves to be a waste of both time and money (Israelov, 2017).

For the purpose of this analysis, we will reference the SPDR S&P 500 ETF Trust (SPY) rather than SPX. Unlike SPX options, SPY provides a tradeable underlying asset and closely tracks the S&P 500, making it a preferred choice among investors.

Understanding SPY and Its Performance

The SPDR S&P 500 ETF Trust (SPY) ranks among the largest and most heavily traded exchange-traded funds, boasting assets under management (AUM) exceeding $600 billion. Its primary goal is to mirror the performance of the S&P 500 Index, offering extensive diversification across various industries and sectors.

SPY has historically produced strong long-term returns, closely aligning with the growth of the S&P 500. Over the last decade, it has recorded an impressive annualized return of 11%, surpassing many actively managed funds.

Challenges of Put Options

Strategic timing is key when considering put options. If you could predict exactly when a market downturn would occur, buying puts might be a sound tactic. However, without such foresight, maintaining continuous coverage typically requires purchasing new puts frequently—an inefficient, costly approach that burdens your investment account.

Moreover, buying puts after market volatility tends not to yield favorable outcomes. The premiums are usually significantly higher following spikes in volatility, similar to trying to secure car insurance while in the middle of an accident.

Puts Can Increase Portfolio Volatility

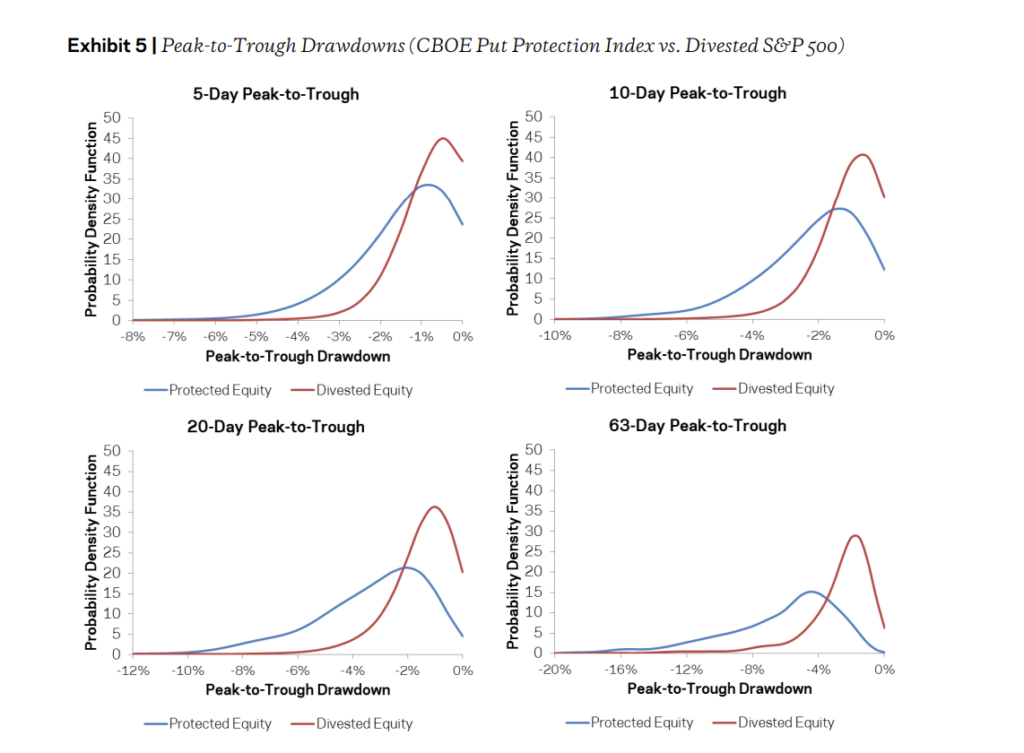

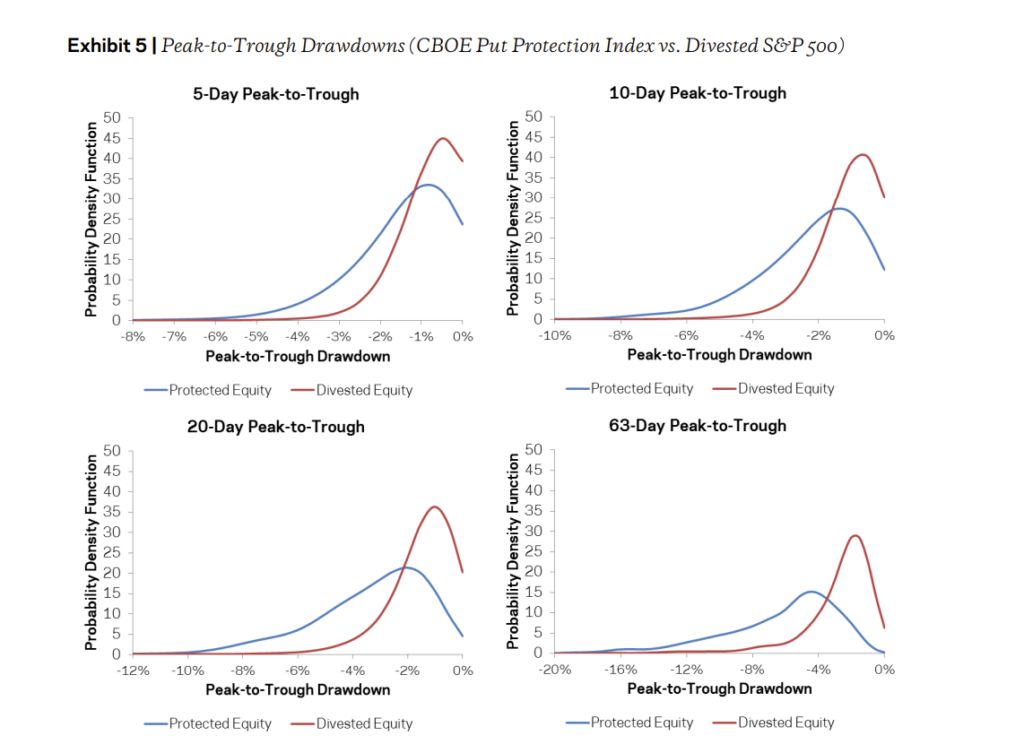

Many investors believe that purchasing protective puts will lessen portfolio volatility; however, these options can, in fact, introduce increased variability. The level of risk fluctuates based on whether the puts are in or out of the money. This variability can make a portfolio more volatile, potentially exacerbating peak-to-trough drawdowns instead of alleviating them.

Israelov’s research underscores this notion, revealing that simply reducing equity exposure during protracted bear markets yields better downside protection than relying on put options. His findings indicated that the CBOE S&P 500 5% Put Protection Index underperformed compared to a strategy of holding less stock and more cash, which maintained equivalent expected returns. As of 2025, with higher interest rates than in 2017, cash positions offer even greater advantages.

Insufficient Hedge Against Extended Bear Markets

Purchasing puts on SPY can offer temporary protection against sudden market crashes, such as the COVID selloff or recent volatility. However, most market downturns do not occur quickly—they gradually unfold over extended periods, rendering puts less effective as an ongoing hedge against bear markets characterized by moderate volatility.

Reflections for 2025

Since Israelov published Pathetic Protection: The Elusive Benefits of Protective Puts eight years ago, does his argument stand strong today?

Initially penned in a low-interest-rate climate, rates have since surged. Moreover, the VIX has experienced more pronounced spikes during significant events such as the COVID-19 crash (2020) and inflationary turmoil (2022). There is also a concern about the SPY’s evolving risk profile, which now features a massive weighting toward tech giants. Presently, three stocks alone account for nearly 20% of SPY’s exposure:

- Apple (AAPL): 7.05% weighting

- Microsoft (MSFT): 6.98% weighting

- Nvidia (NVDA): 5.64% weighting

This heavy concentration raises risk levels, especially given potential sector downturns. The options market has become increasingly dynamic, characterized by shorter expiration cycles and the popularity of zero-day-to-expiration (0DTE) options. While this enhances liquidity and tactical hedging options, it does little to alter Israelov’s primary assertions.

Ultimately, these changes in market dynamics further validate his conclusions:

- Options remain costly when the need is greatest.

- Puts do not effectively hedge against lengthy drawdowns.

- Reducing equity exposure continues to be a more effective strategy for downside protection, particularly amid higher interest rates.

In summary, investing in put options for portfolio protection is often an expensive and ineffective long-term strategy. While they might provide temporary respite during acute market events, their failure to consistently reduce drawdowns stems from poor timing, high costs, and path dependency.

Source

- Israelov suggests specific out-of-the-money levels for puts based on the time until expiration:

- 20-day options: 4.8% out of the money

- 63-day options: 9.2% out of the money

- 250-day options: 18.2% out of the money

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.