Apple (NASDAQ: AAPL) has experienced a 10% decline in its stock over the past year, while AI stocks have seen substantial gains. The company’s revenue growth has slowed, with significant missteps in virtual reality and AI services leading to concerns among investors.

In early 2024, Apple launched the Vision Pro, a $3,500 virtual reality headset, but it reportedly sold fewer than 1 million units by June 2025. This translates to potential revenue of $3.5 billion annually, a small fraction of Apple’s total revenue of approximately $400 billion. Additionally, delays in launching AI updates for Siri and Apple Intelligence have left Apple lagging behind competitors like Alphabet and OpenAI.

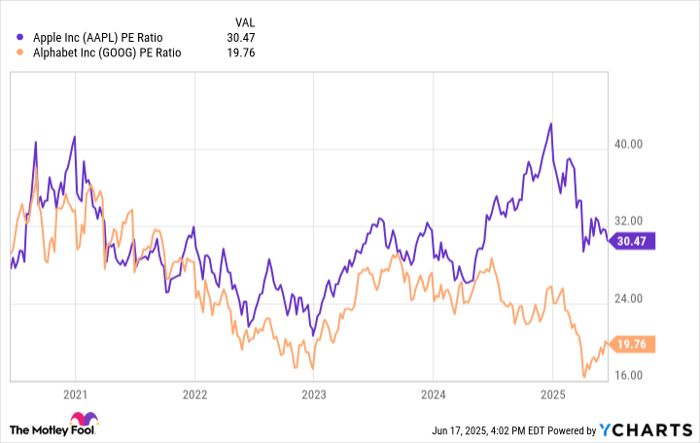

Apple’s price-to-earnings (P/E) ratio is currently 31, in contrast to Alphabet’s P/E of less than 20, raising concerns over valuation amid stagnant growth. Potential legal rulings could threaten over $20 billion in revenue from its search engine partnership with Google, compounding uncertainty regarding future earnings.