Broadcom reported $6.6 billion in infrastructure software revenues for Q2 of fiscal 2025, a 25% increase year-over-year, driven by its push of VMware Cloud Foundation (VCF) subscriptions. The company forecasts $6.7 billion for Q3, marking a 16% year-over-year rise. As of now, 87% of its top 10,000 customers have migrated to VCF, indicating strong confidence in the platform.

The introduction of VCF 9.0 on June 17 is expected to further enhance deployment efficiency and optimize costs, contributing to Broadcom’s ongoing annual recurring revenue (ARR) growth. However, it faces competition from NVIDIA and Marvell Technology, particularly in AI data centers and cloud infrastructure.

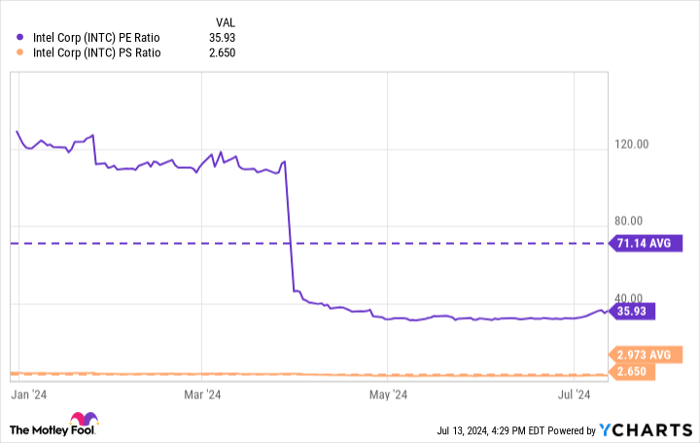

Broadcom’s shares have increased 9.2% year-to-date, surpassing the Zacks Electronics – Semiconductors industry’s growth of 5.1%. AVGO currently trades at a forward price-to-sales ratio of 16.85X, higher than the industry average of 8.18X.