Akamai Launches Cloud Inference to Enhance AI Capabilities

Akamai Technologies, Inc. (AKAM) recently unveiled its new distributed edge platform, Akamai Cloud Inference. This offering utilizes Akamai Cloud, its advanced cloud computing system, to foster faster and more efficient innovation by leveraging predictive models and large language models (LLMs).

In the rapidly evolving digital landscape, pushing AI (artificial intelligence) data nearer to end-users and devices is a considerable challenge for traditional cloud systems. While large-scale hyperscale data centers are capable of training LLMs, they frequently fall short when it comes to providing the performance necessary for inference tasks. Akamai Cloud Inference addresses this issue by allowing developers and engineers to operate AI applications and data-heavy workloads closer to end users. This improves performance, achieving up to 3x better throughput and reducing latency by as much as 2.5x.

Features of Akamai Cloud Inference

Akamai Cloud Inference is equipped with a wide array of tools designed to enhance AI inference across multiple facets of cloud computing. Its compute resources range from classic central processing units (CPUs) for detailed inference tasks to high-performance graphics processing units (GPUs) and application-specific integrated circuits (ASICs). This versatility ensures the platform can tackle a broad range of AI challenges effectively. Integration with NVIDIA Corporation’s NVDA AI Enterprise ecosystem further boosts its capability, optimizing performance for AI inference on NVIDIA GPUs.

In addition to these powerful computing resources, Akamai provides a sophisticated data management stack tailored for modern AI workloads. This solution includes scalable object storage for large, varied datasets and features integration with leading vector database services such as Aiven and Milvus to facilitate retrieval-augmented generation.

Akamai’s containerization capabilities also support demand-based autoscaling, enhance application resilience, and allow for hybrid and multi-cloud portability, optimizing performance in a cost-effective manner. By merging Akamai Cloud’s latest Kubernetes orchestration platform with the Akamai App Platform, the Cloud Inference solution enables organizations to quickly establish a flexible, open-source Kubernetes infrastructure. This ensures the seamless deployment of AI models for inference tasks.

Moreover, the introduction of WebAssembly capabilities in the Cloud Inference solution allows developers to execute inferencing for LLMs directly from serverless applications, empowering customers to run lightweight code at the edge. Together, these robust features create a platform ideally suited for low-latency, AI-powered applications that meet the growing demands for high-performance experiences from businesses.

Will AKAM Stock Benefit from This Launch?

Akamai’s cloud enhancement solutions are designed to help organizations optimize performance, boost application availability, and secure key web assets from data centers to end users. The company’s expansion in cloud computing through Akamai Connected Cloud has created a massive edge network with over 4,200 points of presence in more than 130 countries. This expansion enhances security and scalability, contributing to improved IT infrastructure for businesses.

These innovations are anticipated to drive increased demand for Akamai’s offerings, potentially leading to higher revenues. An uptrend in financial performance is expected to positively influence the Stock price.

Current AKAM Stock Price Performance

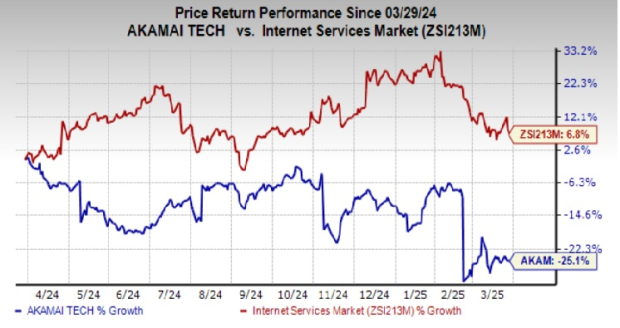

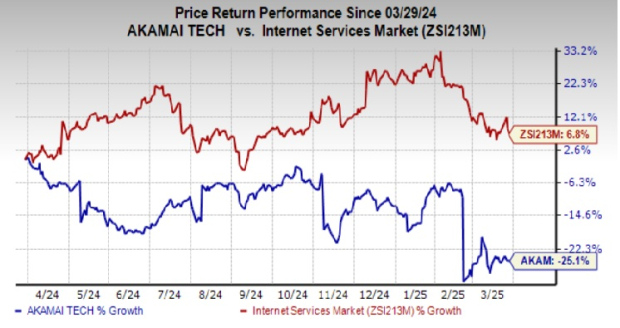

Over the past year, Akamai’s shares have experienced a decline of 25.1%, contrasted with a 6.8% growth in the industry.

Image Source: Zacks Investment Research

AKAM’s Zacks Rank and Alternative Stock Recommendations

Akamai currently holds a Zacks Rank of #4 (Sell).

However, several stocks within the broader industry are rated more favorably.

InterDigital (IDCC) is currently rated #1 (Strong Buy) by Zacks. It has delivered an impressive earnings surprise of 158.41% over the trailing four quarters, positioning itself as a leader in advanced mobile technologies that facilitate wireless communications.

Arista Networks, Inc. (ANET), holding a Zacks Rank of #2 (Buy), serves various prestigious customers, including Fortune 500 companies in sectors like cloud services, finance, and enterprise solutions. It has reported a trailing four-quarter average earnings surprise of 12.87% and expects long-term growth of 14.41%.

Zacks’ Research Chief Highlights Potential High-Growth Stock

Experts from our team have identified five stocks with a strong potential to gain +100% or more within the coming months. Among these, Director of Research Sheraz Mian emphasizes one stock expected to experience the highest growth.

This highlighted stock is recognized as one of the most innovative financial firms, boasting a rapidly expanding customer base of over 50 million and offering a diverse array of cutting-edge solutions poised for significant growth. While not all selections yield positive results, this particular stock could outperform former Zacks’ recommendations like Nano-X Imaging, which surged +129.6% in just over nine months.

For more insights, free reports on top stocks such as NVIDIA Corporation (NVDA), Akamai Technologies, Inc. (AKAM), InterDigital, Inc. (IDCC), and Arista Networks, Inc. (ANET) are available. This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.