“`html

Microsoft is undergoing a significant AI infrastructure expansion, with capital expenditures rising to $34.9 billion in Q1 fiscal 2026, a 74% year-over-year increase that surpassed the previously projected $30 billion. This surge reflects a strategic shift toward integrating flexible, global AI systems and linked AI superfactories to optimize efficiency. As of September 30, 2025, Microsoft reported approximately $102 billion in cash and investments against total debt of $97.6 billion.

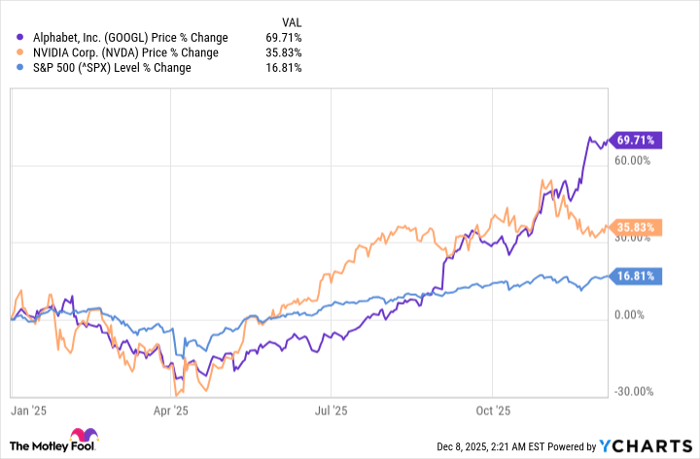

Simultaneously, rivals Amazon and Alphabet have made substantial AI infrastructure investments, with Amazon’s third-quarter capital expenditures at $34.2 billion and Alphabet raising its 2025 capex guidance to $91-$93 billion. Both companies are experiencing robust revenue growth in their cloud divisions, further emphasizing the imperative of AI infrastructure in a competitive landscape.

Microsoft’s stock has seen a 4.3% increase over the past six months, although its forward price/sales ratio stands at 10.55X, higher than the industry average of 7.69X. The Zacks Consensus Estimate anticipates fiscal 2026 earnings at $15.59 per share, indicating 14.3% annual growth.

“`