McDonald’s Faces Challenges: E. Coli Outbreak and Slow Growth Impact Stock

Shares of fast food giant McDonald’s (NYSE: MCD) have recently declined due to an E. coli outbreak linked to contaminated onions served on its burgers. This outbreak has led to at least 90 illnesses, including one fatality.

As McDonald’s works to resolve this crisis, investor confidence is waning. The stock is currently valued high, and concerns about future growth further complicate the situation, leading to a bearish outlook for this well-established brand.

So, is McDonald’s genuinely in trouble, or are these issues simply short-term bumps for investors? Below, we examine the seriousness of the situation regarding McDonald’s stock and whether this might be a good opportunity to invest in the famed golden arches.

Recent Quarterly Results Reveal Weak Performance

On Tuesday, McDonald’s announced its latest quarterly results, which were disappointing. Its revenue for the quarter ending on September 30 reached $6.9 billion, reflecting a mere 3% increase from the previous year. As costs rose faster than revenue, the company’s net income fell by 3% to $2.3 billion. U.S. comparable sales showed a slight increase of just 0.3%, while globally, they decreased by 1.5%.

These results follow a similar pattern from the previous quarter, where McDonald’s reported a 1% decline in global comparable sales, although the U.S. performance was slightly stronger with a 0.7% decrease.

With the E. coli outbreak threatening to further dampen sales, there is a growing concern that McDonald’s performance could decline even more in the near future.

High Premium for Modest Growth

The immediate outlook for McDonald’s appears bleak, particularly due to the E. coli incident. While value meals are attracting some customers back, this trend may not enhance gross margins significantly. As a result, even if sales pick up later, profits could grow at a slower pace.

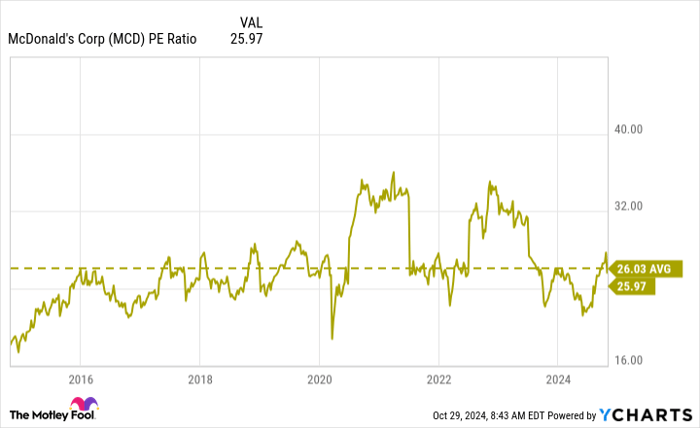

The issue is that McDonald’s stock trades at a price-to-earnings ratio of about 26, suggesting that the company should be performing better to justify this premium. In comparison, the average S&P 500 stock trades at a multiple of 25.

Although McDonald’s stock isn’t excessively overpriced, it’s not a bargain either. It trades in line with its 10-year average, yet, given the slower growth outlook, it may still seem overvalued.

MCD PE Ratio data by YCharts

Is Now the Right Time to Buy McDonald’s Stock?

The E. coli outbreak has resulted in McDonald’s stock returning to where it started in early 2024. However, this situation could still present a good long-term investment opportunity. As economic conditions improve, there’s potential for increased demand, leading to better sales figures in the future.

Furthermore, McDonald’s consistently increasing dividend offers a solid yield of 2.4%, which is higher than the S&P 500 average of 1.3%. This could entice long-term investors to consider buying and holding the stock despite recent fluctuations.

Though not a standout growth stock, McDonald’s may be a reliable income investment. The challenges posed by the E. coli outbreak and other economic factors might burden its performance in the short term, but these shouldn’t deter long-term investment.

It’s crucial to approach this investment with realistic expectations, understanding that recovery might take time given the current challenges. For those willing to wait, investing in this restaurant chain could still prove beneficial.

Evaluating Investment in McDonald’s: A Worthy $1,000 Bet?

Before making a move on McDonald’s stock, here’s something to ponder:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks for investors right now, and McDonald’s is not among them. The selected stocks are expected to yield significant returns in the years to come.

For instance, consider when Nvidia appeared on this list on April 15, 2005. If you had invested $1,000 then, it would now be valued at an astonishing $829,746!*

Stock Advisor provides an easy-to-follow investment strategy offering guidance on portfolio building, regular analyst updates, and two new stock suggestions every month. Since its inception in 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

David Jagielski has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.