Invesco S&P 100 Equal Weight ETF Shows Promising Upside Potential

Analyzing the ETFs within our coverage at ETF Channel, we’ve evaluated the trading prices of individual holdings compared to their average 12-month analyst target prices. This has led us to determine the weighted average implied target price for the Invesco S&P 100 Equal Weight ETF (Symbol: EQWL), which stands at $118.11 per unit.

Substantial Upside Opportunities for Investors

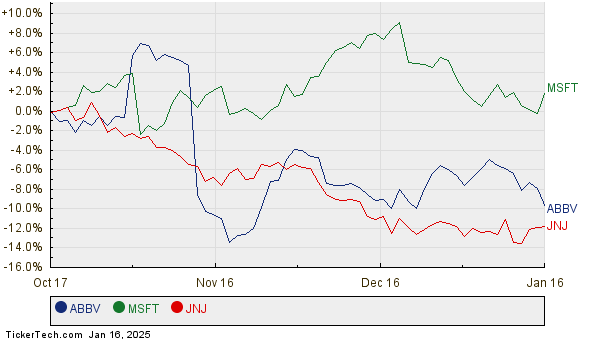

Currently priced at approximately $103.21 per unit, EQWL is viewed by analysts as having a potential upside of 14.43%. This projection is based on the anticipated performance of its underlying holdings. Noteworthy stocks contributing to this optimism include AbbVie Inc (Symbol: ABBV), Microsoft Corporation (Symbol: MSFT), and Johnson & Johnson (Symbol: JNJ). AbbVie has a recent trading price of $171.35; however, the average analyst target price is significantly higher at $205.48 per share, indicating a 19.92% upside. Likewise, Microsoft shares are trading at $426.31, and analysts project a target of $510.26, suggesting a potential increase of 19.69%. Johnson & Johnson’s stock, recently priced at $144.97, also has a target of $173.27, yielding an upside of 19.52%. Below, you can view a chart depicting the 12-month price history for ABBV, MSFT, and JNJ:

Current Analyst Target Prices at a Glance

Below is a summary table outlining the latest analyst target prices for the mentioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P 100 Equal Weight ETF | EQWL | $103.21 | $118.11 | 14.43% |

| AbbVie Inc | ABBV | $171.35 | $205.48 | 19.92% |

| Microsoft Corporation | MSFT | $426.31 | $510.26 | 19.69% |

| Johnson & Johnson | JNJ | $144.97 | $173.27 | 19.52% |

Investor Considerations Ahead

Investors may wonder if analysts are justified in their target prices or if expectations are overly optimistic. Are these targets based on solid fundamentals or merely an echo of past performance? A high target price can signal positive market sentiment but may also foreshadow potential downgrades if analysts fail to adjust to new developments within the companies or their industries. These are pertinent questions that demand careful investor research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Explore More:

• High-Yield Canadian Real Estate Stocks

• Institutional Holders of LTRE

• Institutional Holders of EZT

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.