Wall Street Analysts Recommend Buy for Grab Holdings Limited

Wall Street analysts significantly influence investor decisions about stocks like Grab Holdings Limited (GRAB). Changes in their ratings can impact stock prices, but their reliability is often debated.

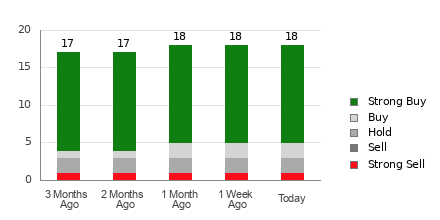

Currently, Grab Holdings has an average brokerage recommendation (ABR) of 1.53, on a scale from 1 (Strong Buy) to 5 (Strong Sell). This ABR is derived from the recommendations of 18 brokerage firms, suggesting a rating between Strong Buy and Buy.

Among the 18 recommendations, 13 are Strong Buy and two are Buy, representing 72.2% and 11.1% of all recommendations, respectively.

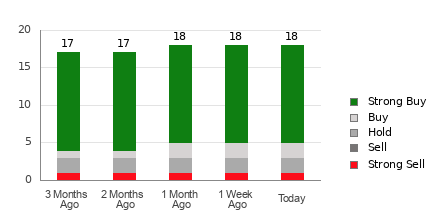

Brokerage Recommendation Trends for GRAB

Check price target & stock forecast for Grab here>>>

While the ABR suggests a Buy for Grab, relying solely on this information is not advisable. Studies show brokerage recommendations often lack effectiveness in identifying stocks with high potential for price appreciation.

The bias in recommendations often stems from brokerage firms’ vested interests. Research indicates that firms assign five “Strong Buy” ratings for every “Strong Sell,” misaligning their interests with those of retail investors. Thus, the best approach to using this information is to complement your own research.

Zacks Rank is an independent stock rating tool that categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). Its solid track record relies on earnings estimate revisions, proving to be a reliable indicator of a stock’s near-term price performance. Validating ABR against Zacks Rank can enhance investment strategy.

Zacks Rank vs. ABR

The ABR and Zacks Rank may appear similar, but they measure different factors. The ABR, calculated from brokerage recommendations, often features decimals (e.g., 1.28). Conversely, the Zacks Rank operates on a quantitative model based on earnings revisions and uses whole numbers—1 to 5.

Brokerage firms tend to issue overly optimistic ratings, leading to misleading recommendations. In contrast, Zacks Rank focuses on earnings revisions that have been empirically linked to stock price movements.

Zacks Rank grades apply evenly to stocks receiving current-year earnings estimates from analysts. This system maintains balance across its five categories, unlike ABR indicators, which may lag in timeliness.

Investment Outlook for GRAB

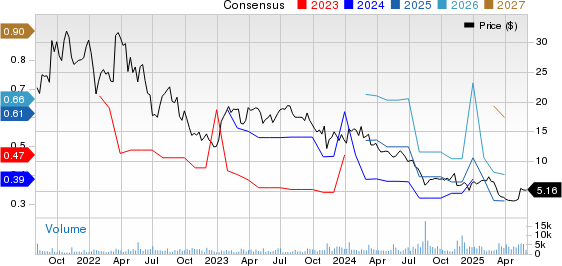

The Zacks Consensus Estimate for Grab remains unchanged at $0.05 for the current year. Analysts’ stable outlook on earnings could lead to the stock performing in line with broader market trends.

The Zacks Rank #3 (Hold) for Grab arises from recent changes in the consensus estimate along with other earnings factors. Caution is advised given the Buy equivalent ABR.

Zacks Highlights Top Semiconductor Stock

A small semiconductor stock has gained attention, with strong earnings growth and an expanding customer base. The global semiconductor market is expected to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Grab Holdings Limited (GRAB): Free Stock Analysis Report

This article originally published on Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.