Analyzing Wall Street’s Take on Teekay Tankers: A Cautious Approach Needed

Wall Street analysts’ recommendations can influence investors’ decisions on stocks. When these analysts adjust their ratings, the stock price often responds. So how credible are their insights?

Let’s delve into the views of analysts regarding Teekay Tankers (TNK).

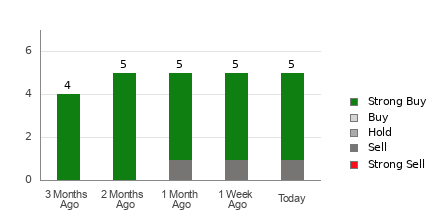

Teekay Tankers has an average brokerage recommendation (ABR) of 1.60, rated on a scale from 1 to 5 (where 1 is a Strong Buy and 5 is a Strong Sell). This score is calculated from the recommendations made by five brokerage firms and suggests a leaning towards Strong Buy.

Out of the five recommendations contributing to this ABR, a significant four are categorized as Strong Buy, indicating that 80% recommend purchasing the stock.

Trends in TNK Brokerage Recommendations

View Teekay Tankers’ price target and stock forecast here>>>

While the ABR suggests a buying opportunity, it’s essential not to make investment decisions based solely on this information. Research indicates that brokerage recommendations often fail to help investors effectively identify stocks with significant price potential.

What accounts for this discrepancy? Brokerage firms typically have vested interests in the stocks they cover, leading to an optimistic bias in their analysts’ ratings. Research shows a ratio of five “Strong Buy” recommendations for every “Strong Sell.” This misalignment means their recommendations rarely accurately signal a stock’s potential price trajectory.

The most effective use of these recommendations is perhaps to reinforce your own research or indicators that have historically performed well in forecasting stock movements.

One such effective tool is the Zacks Rank, which is based on a proven model categorizing stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It has a strong track record in predicting stock performance in the near future. Thus, correlating the ABR with the Zacks Rank may provide valuable insights into investment decisions.

Distinguishing Zacks Rank from ABR

Although both the Zacks Rank and ABR use a 1-5 scale, they serve different purposes.

The ABR is derived solely from analyst recommendations, often displayed as decimal values (like 1.28). In contrast, the Zacks Rank relies on quantitative earnings estimate revisions and is represented by whole numbers from 1 to 5.

Analysts in brokerage firms tend to show optimistic tendencies in their recommendations. The ratings they provide often do not fully align with their underlying research due to their employers’ interests, leading them to misguide investors more often than help.

On the flip side, the Zacks Rank is rooted in earnings estimates, reflecting a strong correlation between price movements and earnings estimate revisions, according to numerous studies.

Additionally, Zacks Rank applies its grades consistently across all stocks for which analysts have provided earnings estimates for the current year, maintaining balance among its rankings.

A significant difference also exists in the recency of these ratings. The ABR may not always be current, while Zacks Rank reflects timely changes in analysts’ earnings estimates based on shifting business trends, making it a more reliable predictor of future stock prices.

Should You Invest in TNK?

Recent earnings estimate revisions for Teekay Tankers show a decline of 2.2% in the Zacks Consensus Estimate for the current year, now at $11.21.

This shift indicates rising concerns among analysts regarding the company’s earnings outlook, potentially suggesting a risk of further decline for the stock.

The adjustment in the consensus estimate, along with other earnings-related factors, has led to a Zacks Rank of #5 (Strong Sell) for Teekay Tankers. To view a list of stocks ranked #1 (Strong Buy), click here>>>>.

In conclusion, it’s advisable to approach the ABR suggesting a Buy for Teekay Tankers with caution.

Explore Potential in Clean Energy Stocks

The energy sector remains a vital part of the global economy, generating trillions in revenue with numerous successful companies.

Innovative technologies are leading the charge for clean energy sources to surpass traditional fossil fuels, with significant investments flowing into sustainable energy initiatives, including solar energy and hydrogen fuel solutions.

Stocks in this emerging sector could represent some of the most promising investments in your portfolio.

Download “Nuclear to Solar: 5 Stocks Powering the Future” to see Zacks’ top picks for free today.

For a free stock analysis report on Teekay Tankers Ltd. (TNK), click here.

To read the full article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.