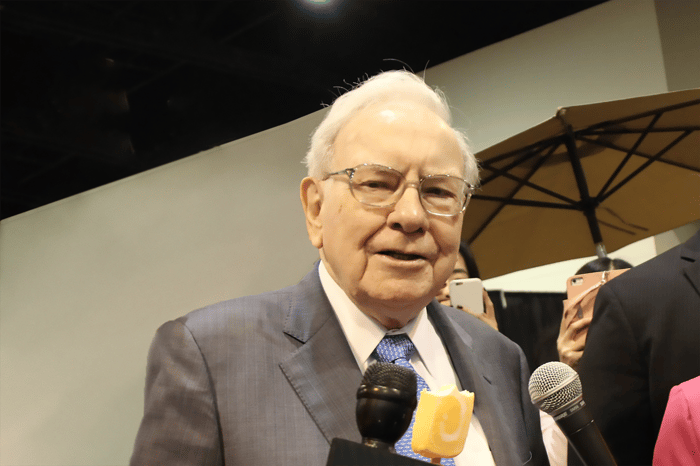

Warren Buffett Credits Tim Cook for Apple’s Value to Berkshire Hathaway

Warren Buffett stepped outside his usual role at Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) during the latest annual shareholder meeting. This time, he acknowledged Apple (NASDAQ: AAPL) CEO Tim Cook, stating, “I’m somewhat embarrassed to say that Tim Cook has made Berkshire a lot more money than I’ve ever made for Berkshire Hathaway.”

While it’s clear that Cook and Apple have significantly benefited Berkshire’s portfolio, the accuracy of Buffett’s assertion raises questions.

Image source: Getty Images.

Buffett’s Admiration for Tim Cook

Buffett briefly knew Apple co-founder Steve Jobs and acknowledged his unique contributions to the company. Under Jobs, Apple introduced groundbreaking products like the Mac, iPod, iPhone, and iPad. Buffett believes that Jobs made an excellent choice in selecting Cook as his successor. He stated, “Steve picked Tim to succeed him, and he really made the right decision,” adding, “Steve died young, as you know, and nobody but Steve could have created Apple, but nobody but Tim could have developed it as he has.”

Interestingly, Buffett’s investment in Apple began after Jobs’ passing. Berkshire first took a stake in the company in early 2016, when Cook had been at the helm for over four years. Buffett has expressed similar sentiments in past communications, including his 2021 letter to shareholders where he described Cook as a “brilliant CEO.”

Financial Impact of Cook and Apple on Berkshire

Determining how much Apple has contributed to Berkshire under Cook’s leadership is complex, due to frequent trading activities. Berkshire amassed a substantial position in the company between early 2016 and late 2018, but has sold some shares since then. Notably, the conglomerate began to reduce its stake significantly in late 2023 and throughout 2024.

Berkshire’s cost basis for Apple was approximately $34 per share by 2022. Sales done in 2023 and 2024 likely resulted in total gains nearing $97 billion, although the precise figure is uncertain due to unknown sale prices. In addition, with Berkshire owning 300 million Apple shares as of December 31, 2024, and Apple trading around $209 per share, the unrealized gain stands at about $52.5 billion. This brings the total estimated value created by Cook and Apple to nearly $150 billion.

Including dividends, Apple has generated between $5 billion and $6 billion for Berkshire, elevating the total contribution to around $155 billion.

Evaluating Buffett’s Statement

Buffett’s comment about Cook’s impact does not hold up against the total success he has achieved for Berkshire. Buffett initially purchased shares in Berkshire at a price per share between $7.50 and $11.375, while today, Class A shares are valued at about $767,000. The vast majority of Berkshire’s current market capitalization of approximately $1.1 trillion has been realized under Buffett’s leadership.

Though Cook and Apple have indeed created substantial wealth for Berkshire, it is clear that Buffett has made more. His statement may reflect gratitude rather than a factual comparison.

Future Considerations for Investors

As Buffett prepares to pass leadership to Greg Abel and Cook continues to steer Apple, it raises the question of whether Cook could one day surpass Buffett in generating value for Berkshire shareholders.

Should You Invest $1,000 in Apple Now?

Before making any investment decisions regarding Apple, consider this:

The Motley Fool Stock Advisor analyst team recently identified the 10 best stocks for current investment, and Apple was not included. The stocks on this exclusive list could potentially yield outstanding returns in the years to come.

For example, if you invested $1,000 in Netflix when it was recommended on December 17, 2004, you would have $598,613 today!

Similarly, a $1,000 investment in Nvidia since April 15, 2005, would now be worth $753,878!

The Stock Advisor has averaged a return of 922%, outperforming the S&P 500’s 169%. To view the latest top 10 list, join Stock Advisor.

*Stock Advisor returns as of May 12, 2025.

Keith Speights has positions in Apple and Berkshire Hathaway. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.