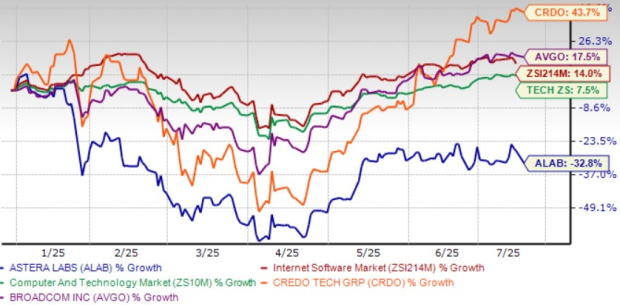

Astera Labs (ALAB) has seen its shares decline by 32.8% year to date (YTD), significantly underperforming the Zacks Internet Software industry’s 14.1% gain and the Computer and Technology sector’s 7.5% rise. In contrast, peers such as Broadcom (AVGO) and Credo Technology (CRDO) registered YTD increases of 17.5% and 43.7%, respectively.

Astera faces competition and tariff uncertainties impacting performance. However, the company’s expanding portfolio is projected to support recovery into 2025, with second-quarter 2025 revenues expected between $170 million and $175 million, representing a year-over-year increase of 7% to 10%. The Zacks Consensus Estimate for Q2 revenues stands at $172.71 million, indicating a growth rate of 124.74% year over year.

Looking ahead, Astera Labs has guided for earnings per share between 32 and 33 cents, with the consensus set at 33 cents, reflecting a 153.85% year-over-year growth. Furthermore, the revenue forecast for all of 2025 is approximately $702.43 million, indicating a 77.25% increase over 2024.